AT&T Expects Fixed-Wireless, Itself To Be Competitive in BEAD Applications

AT&T expects fixed-wireless to be key player in BEAD funding.

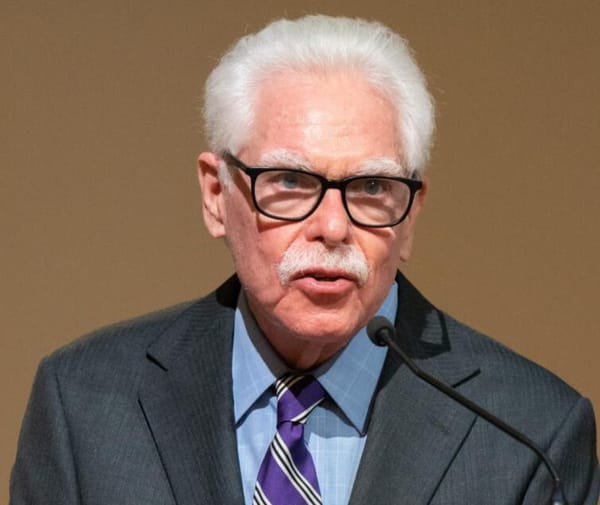

WASHINGTON, July 26, 2023 – AT&T is set to be competitive in the $42.5 billion Broadband Equity Access and Deployment subgrant process, said CEO John Stankey during the company’s second-quarter earnings call Wednesday, adding fixed-wireless technology will be key to connecting hard-to-reach areas using the subsidies.

The company is working to be informed on what underserved markets have the best business propositions, the chief said. AT&T will be an informed bidder and put forward a compelling case in the state grant process, said Stankey. States are responsible to allocate BEAD funds according to federal guidance in order to connect every unserved or underserved area in their jurisdiction.

Stankey said that he expects AT&T to be very competitive due to its quality product offerings and competitive framework. He told investors that he expects the money will be unfolded in 2024 and will impact business operations in 2025. He refused to provide an estimate of awards before states conduct their subgrant process.

Stankey estimated that fixed-wireless services will be in demand following the allocation of BEAD funds despite the program’s preference for fiber connection, saying that fixed-wireless is the only way to connect every address in hard-to-reach geographies. He expects that AT&T’s fixed-wireless offerings will be a competitive offer in broadband builds for decades to come.

In response to investor concern regarding lead-clad cables that have the potential to harm employees and residents in surrounding areas, Stankey and Pascal Desroches, chief financial officer, said that the issue will not affect dividends.

The company will work with the Environmental Protection Agency to investigate the potential harms that lead-clad cables present to communities and employees. Stankey said that doing so is “the responsible way” to evaluate the issue.

AT&T is currently in litigation with California Sportfishing Protection Alliance, which sued AT&T in 2021 to remove the cables. AT&T released a court filing last week claiming that it is in the public interest that the cables remain in place as they “pose no danger to those who work and play” in surrounding areas.

According to Stankey, no state or municipal regulator raised concerns with the company regarding the lead-clad cables prior to the litigation beyond the normal discussion surrounding regulated materials.

Fiber subscribers increased from 6.6 million in Q2 2022 to 7.7 million this quarter, representing 251,000 net additions, with total locations passed to over 25 million. Fiber revenue increased by $3 million year over year to a total of $1.5 billion, representing a 28 percent change. 5G subscriptions increased by 464,000 from Q2 2022 to 2023.

Total revenue increased from $29.6 billion in Q2 2022 to $29.9 billion in Q2 2023, primarily driven by mobility service and broadband revenues. Wireline revenue decreased by 6 percent year over year. The company expects the majority of cash after dividends to go to debt reduction, aiming for a net debt reduction by $4 billion by the end of 2023.