Liberty Broadband CEO Says Fixed Wireless ‘Noise’ Will Subside

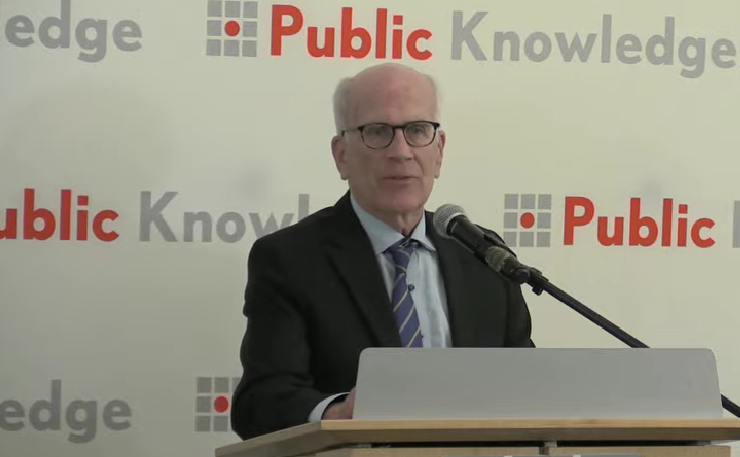

Fixed wireless added nearly one million subs in Q4, but their growth capacity is limited, Liberty CEO Greg Maffei said Friday.

WASHINGTON, February 18, 2024 – Fixed Wireless Access providers, led by T-Mobile and Verizon, added nearly one million Internet subscribers in the fourth quarter last year while many wireline rivals moved in the opposite direction by losing thousands of customers.

Nevertheless, Gregory B. Maffei, President & Chief Executive Officer of Liberty Broadband Corp., believes that FWA providers can’t sustain their growth curve because their networks do not have sufficient spectrum capacity.

“There's been a consistent trend in 2023 of increased competition from fixed wireless, but we do believe the competitive noise will lessen over time,” Maffei told Wall Street analysts on Friday. “Fixed wireless assets will have capacity issues over the long term and the operators have been clear on their limitations. And we do believe that bandwidth demands will continue to increase among consumers, which will favor higher speeds.”

Liberty Broadband owns GCI in Alaska and 26% of Charter Communications, which lost 61,000 broadband customers in last year’s fourth quarter. Maffei serves on Charter’s Board of Directors.

“We are long-term shareholders. We are confident that strategic investments that Charter is making will generate excellent returns and accelerate growth over the next few periods,” Maffei said.

Maffei’s view of FWA is shared by top officials at Comcast Corp. and Frontier Communications. Comcast President Michael Cavanagh has said his company is focused more on competition from fiber network overbuilders than FWA providers, agreeing wireless networks will struggle as consumers ramp up their monthly data usage, especially to watch sporting events like NFL games.

“Fixed wireless has to date had very limited effect or impact on our overall operating results,” Frontier Executive Chairman John Stratton said two months ago. “We’ve seen virtually no sense for fixed wireless access in our fiber footprint. Period.”

Consumers, especially those on a tight budget, have gravitated to FWA based on several factors, including affordability and ease of setup. No annual contracts or additional fees seem to be winning over the masses, too.

The four major FWA provides serve about 8 million subscribers combined, led by T-Mobile with 4.7 million subscribers after adding 541,000 in the fourth quarter last year. On Friday, FWA newcomer UScellular said it ended 2023 with 114,000 subscribers, up 46% year over year.

Verizon EVP and CFO Tony Skiadas has said in response to FWA critics that his company’s engineers are “in front of the demand curve” to ensure a positive consumer experience

“There are lots of ways to design a network,” Skiadas said. “If we have more demand for fixed wireless access, that is a good problem.” Verizon has 2.7 million FWA subscribers and 6.9 million Fios wireline broadband customers.

Verizon’s FWA product starts at $24.99 with discounts, a price that includes the router, a two-year price guarantee, and download speeds up to 300 Megabits per second (Mbps).

Maffei claimed that FWA consumers will eventually migrate to wireline Internet service provided by Charter and others to connect to robust speeds.

“I would say that there are certainly customers for whom fixed wireless is the answer that they believe they need. I think that customer set will be reduced over time as broadband demands grow,” Maffei said.

A few weeks, ago Charter CEO Christopher Winfrey called FWA an “inferior product with limited capacity and geographic coverage.” On another occasion, he referred to FWA as “another former of DSL” – a reference to phone companies’ low-bandwidth copper networks that cable’s higher-capacity networks steadily marginalized over the past 20 years.

In January, FWA leader T-Mobile raised its monthly fee $10 to $60 for new customers who do not have a mobile wireless plan. T-Mobile’s FWA download speeds range between 72 – 245 Mbps.

Maffei suggested that T-Mobile is using pricing mechanisms to ensure demand does not overwhelm the FWA network.

“They are recognizing that there's not an unlimited amount of capacity for FWA,” Maffei said.

Ted Hearn is the Editor of Policyband, a new website dedicated to comprehensive coverage of the broadband communications market. A version of this piece was published on Policyband on February 18, 2024, and is reprinted with permission.