Verizon's Fixed Wireless Plateau a 'Riddle': Analyst

The company said it's still on track to hit 8 million fixed wireless subscribers by 2028.

The company said it's still on track to hit 8 million fixed wireless subscribers by 2028.

WASHINGTON, Jan. 24, 2025 – Verizon added another 373,000 fixed wireless broadband customers in the fourth quarter of 2024, for a total of nearly 4.6 million. It was slightly more than analysts had expected but similar to the same time one year ago.

“Verizon’s fourth quarter FWA results continue a trend of skewing more towards Business than Residential, where net additions continue to moderate,” MoffettNathanson analyst Craig Moffett wrote in an investor note after the company’s earnings call Friday.

The company saw 216,000 residential additions and 157,000 business additions to the service, a similar breakdown to what it reported over the last year. Moffett called the flattening residential growth “a riddle,” since the company is still rolling out the C-band spectrum it bought in 2021 and, in doing so, expanding the areas in which it can offer fixed wireless.

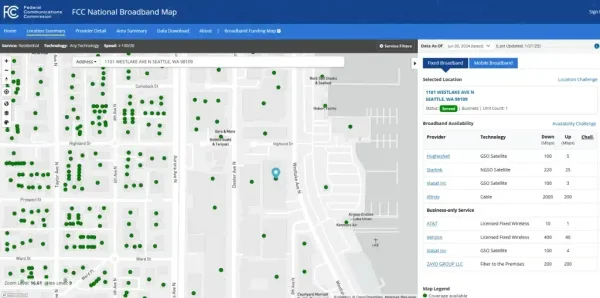

States, ISPs still struggling to challenge its accuracy

The city will continue managing customer service and billing until Charter assumes full control

The App Store Accountability Act requires app stores to verify users’ ages and obtain parental consent for minors

The deadline for submissions is May 9.