AT&T, EchoStar Fire Back at Spectrum Deal Opponents

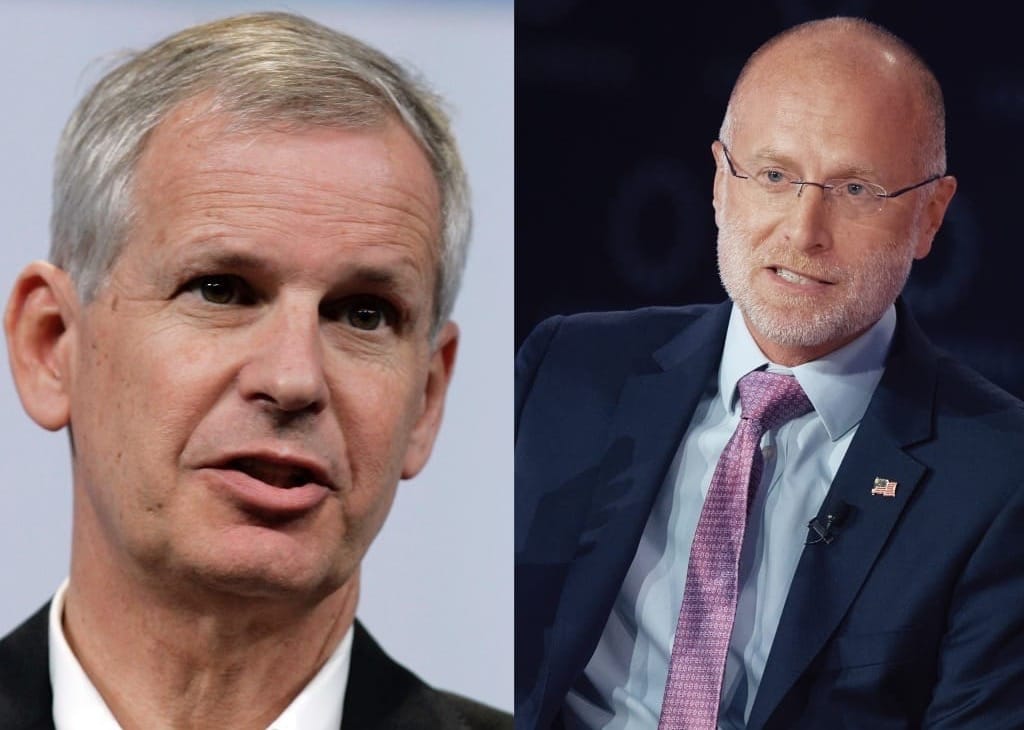

EchoStar’s Charlie Ergen reiterated the company's ‘force majeure’ argument to FCC Chairman Brendan Carr.

Jake Neenan

WASHINGTON, Dec. 5, 2025 – T-Mobile is asking the federal regulators only to approve AT&T’s $23 billion spectrum purchase from EchoStar with conditions attached to ensure rural deployment. The companies involved in the deal don’t want that.

“Perhaps the most compelling evidence of the Transaction’s pro-competitive effects is the disingenuous embrace of rural consumers by T-Mobile… to prevent AT&T from acquiring spectrum that would allow AT&T to compete more effectively with T-Mobile nationwide,” AT&T and EchoStar wrote in a Wednesday filing with the Federal Communications Commission.

As part of the deal, AT&T would grab about 30 megahertz of nationwide 3.45 GigaHertz (GHz) spectrum, which it’s already deploying through a lease agreement, and about 20 megahertz of nationwide 600 MHz spectrum. EchoStar would transition to operating its Boost Mobile service largely on AT&T infrastructure while maintaining a separate core.

T-Mobile said last month that the FCC should impose more stringent buildout requirements on the 600 MHz licenses, and revoke and re-auction EchoStar’s 600 MHz licenses that hadn’t been built out yet. T-Mobile uses 600 MHz licenses for its network.

The carrier pushed for geographic area benchmarks, rather than the population benchmarks AT&T committed to, which T-Mobile also wanted verified with a drive test. The company said that would ensure rural areas excluded from EchoStar’s existing deployment would see benefits from the spectrum sale.

“T-Mobile’s proposed buildout requirements are simply not reasonable given the work required to integrate a new frequency band into a nationwide mobile network,” AT&T and EchoStar argued. “The Commission has previously rejected similar calls for additional buildout conditions where, as here, the applicant has demonstrated a credible deployment plan and strong incentives to use the spectrum intensively.”

AT&T doesn’t currently use 600 MHz, and said it would have to spend up to two years developing and procuring new radios, and another nine months hammering out new lease agreements and permits, before even beginning to turn the spectrum online.

The company’s current commitment under the deal is to reach 40 percent of the nationwide population – not area – covered by the 600 MHz licenses within three years of closing and 75 percent of the nationwide population covered by the licenses within five years. The company said it would hit 40 percent of the population covered by each individual license by the same five-year mark.

The Rural Wireless Association had asked the agency to require AT&T to hand some of the licenses over to rural carriers, and consumer advocacy groups Public Knowledge and New America’s Open Technology Institute had asked for a raft of conditions including device unlocking and net neutrality rules.

AT&T and EchoStar opposed all of those.

“It is well established that transaction reviews are not the proper forum to resolve industry-wide complaints unrelated to the transaction at hand,” the companies wrote Wednesday. “There is no valid basis for adopting any of the proposed conditions.”

In previous filings with the FCC and a white paper to the Justice Department – the agency is, unlike the FCC, concerned about spectrum consolidation among the three national carriers – the companies argued the deal would make AT&T and EchoStar more competitive.

AT&T’s mobile and fixed wireless services would be improved, and EchoStar’s wireless service would also be more competitive because of a lower cost structure, they argued.

Ergen, Carr meet

EchoStar Chairman and CEO Charlie Ergen met with FCC Chairman Brendan Carr on Monday and “urged the expeditious approval” of both the AT&T deal and another spectrum sale to SpaceX worth a total of $19.6 billion.

EchoStar entered into the sales in the first place because of pressure from Carr, who said the company wasn’t effectively using its valuable airwaves and had opened probes into the company’s licenses.

According to the ex parte filing from the meeting, Ergen and other EchoStar representatives took the chance to emphasize to Carr that the company was effectively forced by the agency to make the sales, and wouldn’t have sold its spectrum otherwise.

That’s what EchoStar subsidiary Dish, which actually operates the network and which Ergen insisted on EchoStar’s third quarter earnings call was technically a separate company, has been telling tower companies and contractors as it looks to exit contracts early: The FCC forced its parent company to sell its spectrum, and thus Dish is unable to meet its long-term contractual obligations.

Two major tower companies, American Tower and Crown Castle, have already sued Dish over the issue. The tower companies argue EchoStar wasn’t legally forced to do anything but simply took the easiest path to get the FCC off its back, and stands to gain more than $40 billion in the process.

That, the tower companies argued, doesn’t come close to making their long-term leases null and void.

EchoStar is planning to decommission its radios as part of the deals, transitioning to largely operating its Boost Mobile service on AT&T infrastructure.

“Due to severe uncertainty as to whether EchoStar could recoup its multibillion-dollar investments following potential Commission investigations and forfeitures, EchoStar had to abandon its plans to grow its facilities-based MNO operations,” the company wrote in the ex parte.

Ergen didn’t comment during the earnings call on whether EchoStar would actually stop paying contractors and tower owners.

“EchoStar has not-so-subtly threatened to bankrupt its own subsidiary, Dish Wireless LLC, in order to shelter the parent company’s cash from the liabilities incurred in EchoStar’s erstwhile effort to build a wireless network,” MoffettNathanson founder Craig Moffett wrote in a recent investor note. “Dish’s creditors will be left to fight over issues of asset conveyance. Creditor on creditor violence.”

Member discussion