CCIA Raises Alarm Over T-Mobile, UScellular Merger

Trade group concerned about market consolidation, higher consumer bills.

Trade group concerned about market consolidation, higher consumer bills.

WASHINGTON, Dec. 10, 2024 – Another influential voice has raised concerns over T-Mobile’s proposed $4.4 billion acquisition of UScellular.

The Computer & Communications Industry Association urged the Federal Communications Commission on Monday to carefully evaluate the deal, warning that the deal could lead to higher consumer prices — a sign that the merger does not serve the public interest.

CCIA’s comments noted that since T-Mobile acquired Sprint in 2020, wireless prices have risen despite promises to the contrary. “Earlier this year T-Mobile notified its users of significant rate increases for a number of legacy calling plans,” wrote Stephanie Joyce, CCIA’s senior vice president, in the filing.

The FCC suspended commissioner travel with no public explanation.

House Bill 6 bars state agencies in Kentucky from issuing new regulations that would cost more than $500,000

The agency's next meeting is on April 28.

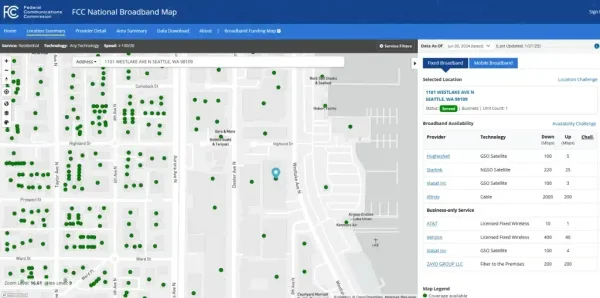

States, ISPs still struggling to challenge its accuracy