NTIA Approves Nevada’s $416 Million in BEAD Money

New Street's Levin doesn't expect the Trump administration to put the program on hold.

New Street's Levin doesn't expect the Trump administration to put the program on hold.

WASHINGTON, Jan. 17, 2025 – It’s now three for three. Nevada’s final proposal for deploying broadband throughout the state received federal approval Thursday evening, meaning every state that released the document has been greenlit.

“Nevada’s plan shows how we can economically bring the best possible Internet service to people using a variety of technologies,” National Telecommunications and Information Administration Administrator Alan Davidson said in a statement. “Today it can put that plan into action and bring high-speed Internet service to everyone in the state.”

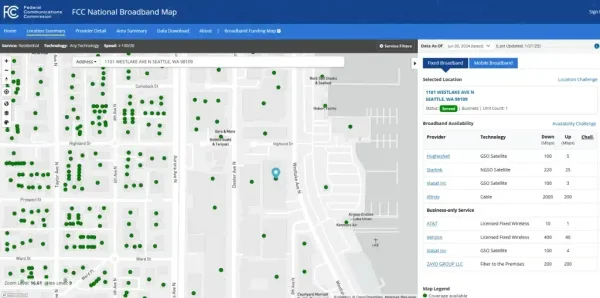

The state was allocated $416 million through the Broadband Equity, Access, and Deployment program to get broadband to each unconnected home and business in the state. Nevada, with lots of remote and hard-to-reach locations, brought in an additional $137 million from other federal funding sources to the table to make the math more workable for ISPs.

States, ISPs still struggling to challenge its accuracy

The city will continue managing customer service and billing until Charter assumes full control

The App Store Accountability Act requires app stores to verify users’ ages and obtain parental consent for minors

The deadline for submissions is May 9.