Can Elon Musk Gain a Global Starlink Monopoly? Likely Not, Says Analyst Moffett

'Irrespective of the underlying economics, there will be multiple operators. And that, in turn, means lower returns. For everyone,' Moffett said yesterday in a deep-dive look at LEOs

Ted Hearn

LEOs: Elon Musk has a shot at monopolizing satellite broadband, but such an outcome is unlikely based on steep economic and political challenges. Craig Moffett, senior managing director at MoffettNathanson, said the low-Earth orbit (LEO) satellite broadband sector has the hallmarks of a natural monopoly, though the market is unlikely to play out that way. “Geopolitics argue for a different outcome, however. Irrespective of the underlying economics, there will be multiple operators. And that, in turn, means lower returns. For everyone,” Moffett said yesterday in a deep-dive look at the global LEO sector led by Elon Musk’s Starlink, a division of his SpaceX rocket company.

Broadband BreakfastBroadband Breakfast

Broadband BreakfastBroadband Breakfast

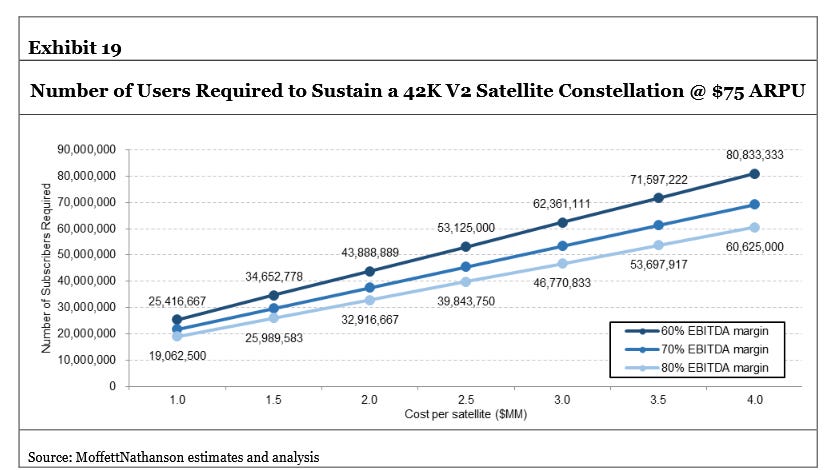

“To be sure, that alone doesn’t mean that building and operating a satellite constellation like SpaceX’s Starlink can’t be a good business. But it certainly makes it more difficult.” In one forecast, Moffett said Starlink would need about 80 million subscribers globally to sustain the operations of a 42,000-LEO constellation. Starlink today serves more than 7 million subscribers across approximately 150 countries and territories. Starlink has 8,344 operational LEOs today, according to Jonathan’s Space Report statistics kept by British-American astronomer and astrophysicist Jonathan McDowell. “To earn a return on the stupendous upfront and maintenance costs of a LEO satellite constellation, a LEO constellation needs to serve a huge customer base. Inherent capacity limitations, not just based on constellation size but also on limits of clustering within a given spot beam, make that challenging. That there will be multiple operators vying for the same opportunity makes it worse,” Moffett said. (More after paywall.)

Member discussion