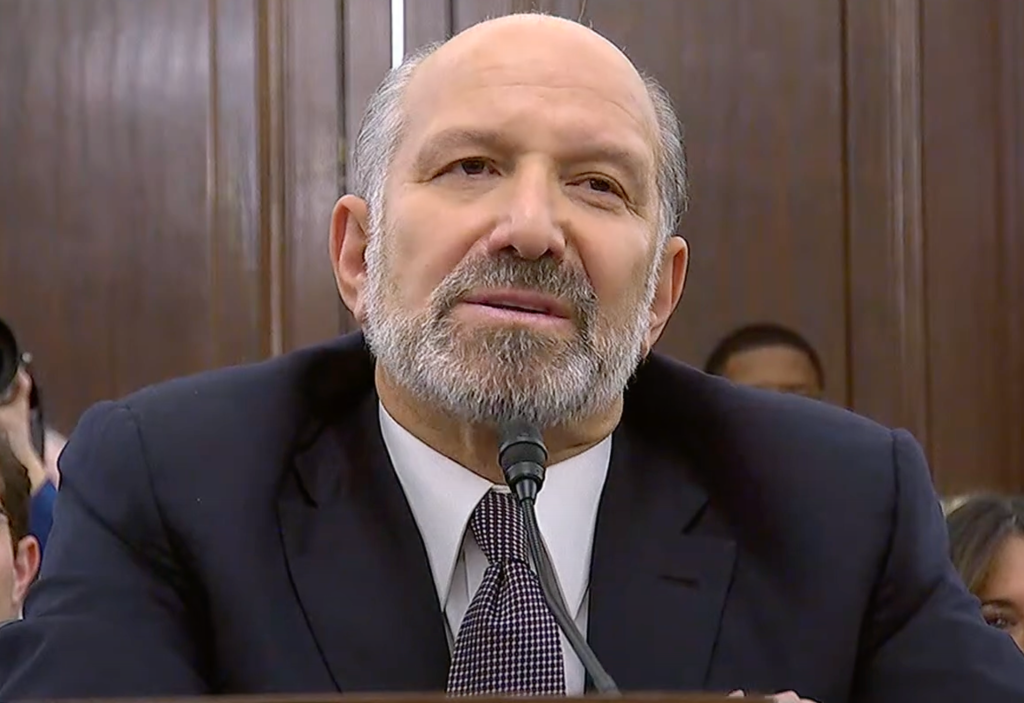

Commerce Nominee Lutnick Leans Toward 5G Carriers on Spectrum

The GOP is looking to get spectrum auction authority into a budget reconciliation bill this year.

Jake Neenan

WASHINGTON, Jan. 30, 2025 – The spectrum dispute between the big wireless carriers and the Defense Department continued at Howard Lutnick’s confirmation hearing Wednesday. President Donald Trump’s pick to run the Commerce Department hewed toward the 5G industry’s side.

The 5G industry is eager for more licensed mid-band spectrum for its mobile networks, but DoD, which holds some of that spectrum, is not interested in moving its military systems to other airwaves – particularly the lower 3 GigaHertz band. The issue created an impasse that resulted in the Federal Communications Commission losing its ability to auction off spectrum in March 2023.

“We’ve got to make sure to protect ourselves. But, with all due respect, if I’m going to be your Secretary of Commerce, I kind of lean toward commerce,” Lutnick said. “I’d like to help us drive some of that spectrum toward our businesses.”

Now, the GOP is planning to restore auction authority as part of a budget reconciliation bill sometime this year, using the revenue to pay for extending tax cuts. Experts have said Senate Commerce Committee Chair Ted Cruz, R-Texas, likely wants any reauthorization legislation to resemble a bill he and Senate Majority Leader John Thune, R-N.D., introduced last year.

The bill had the support of the wireless carriers and would mandate that Commerce find at least 1,250 megahertz of federal spectrum for exclusive commercial licenses – the kind the 5G industry uses.

But senators aligned with Defense have made clear they still aren’t on board with widespread clearing of government bands. The Pentagon has endorsed a Democratic auction authority bill last year that wouldn’t have required a certain quantity of spectrum be sold off for licensed use.

“At the onset, I want to make it clear to you that DoD airwaves are not lying dormant, and that proposals to clear them would jeopardize our national security,” Deb Fischer, R-Neb., a member of the Armed Services Committee, told Lutnick.

The issue also came up briefly at Defense Secretary Pete Hegseth’s confirmation hearing earlier this month. Sen. Mike Rounds, R-S.D., asked Hegseth if he would be willing to “literally go to the mat” to protect DoD access to lower 3 GHz spectrum, citing huge projected costs to move Navy radars. Hegseth said it would be his job to do so if necessary.

Brad Gillen, executive vice president of CTIA, the 5G industry’s main trade group, said at a separate House hearing on Jan. 23 that the industry still wants to see something more than a so-called “clean” auction reauthorization. The group wants lawmakers to direct the FCC to auction off either certain bands or a certain amount of spectrum, he said.

The DoD said in a 2023 report that the lower 3 GHz band couldn’t be vacated, and that even sharing wouldn’t be possible in the near future. Defense and Commerce’s National Telecommunications and Information Administration are currently studying the band, as well as the government’s 7/8 GHz band, as part of a Biden administration effort to potentially institute dynamic sharing systems with commercial users.

The cable industry has generally pushed for unlicensed spectrum or sharing plans – some big cable providers use CBRS or Wi-Fi to offload traffic for the mobile service they provide through deals with Verizon. The wireless carriers are also scooping up more and more home broadband customers with excess capacity, which they would have more of if additional full-power licenses were sold off.

Member discussion