How NTIA is Asking States to Revise BEAD Plans

States could have to rebid certain areas, people familiar with the process said.

Jake Neenan

WASHINGTON, Sept. 12, 2025 – States may have to rebid their most expensive areas under the Broadband Equity, Access, and Deployment program, according to two people familiar with the matter.

For a PDF of the full document, join the Breakfast Club

As part of the process to get their final spending plans approved by the Commerce Department, these officials said, the Commerce Department’s National Telecommunications and Information Administration will compare a state’s tentatively approved projects under the $42.45 billion program to a broadband deployment cost model.

States will need to negotiate downward or potentially award to another provider areas where costs are above certain thresholds, the people said.

At least 33 states have submitted their final spending plans to NTIA.

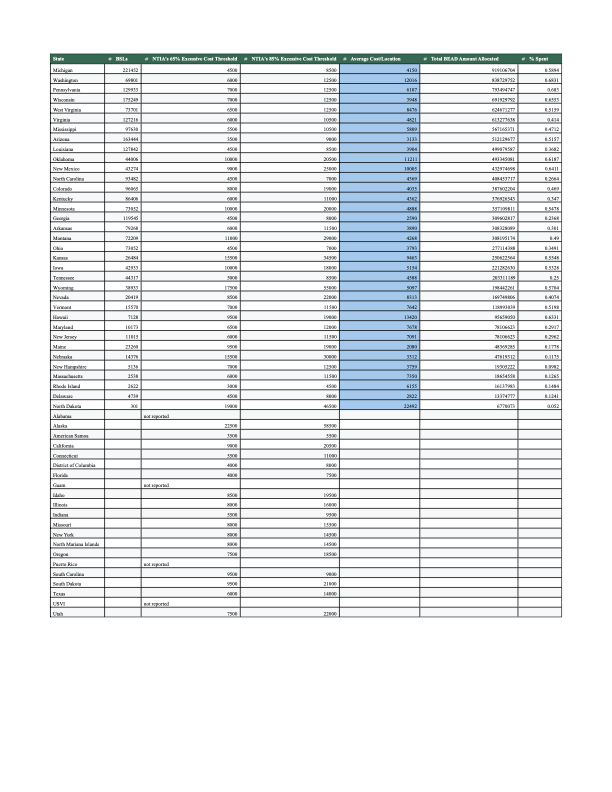

The rebidding and cost analysis was first reported on Thursday, Sept. 11, by Doug Adams, head of broadband marketing firm Broadband Marketers. He obtained a spreadsheet of cost thresholds caps in each state that Adams said was being used by NTIA.

‘Secret Cost Cap’ from NTIA

Christopher Mitchell, director of the Institute for Self-Reliance’s Community Broadband Networks Initiative, also raised concerns about a “secret cost cap” in a blog post on Tuesday, Sept. 9, which was republished by Broadband Breakfast on Wednesday.

Broadband BreakfastChristopher Mitchell

Broadband BreakfastChristopher Mitchell

“There is no official announcement to date about the new ‘Best and Final Offer’ part of the BEAD saga, but it apparently involves new price caps that are based on secret Costquest (the company the FCC pays to maintain the deeply-flawed national broadband map) models,” Mitchell wrote.

“If a project exceeds the secret cost cap, the state has 3 days to work with the ISP bidder to reduce costs still further. If the bidder cannot meet that secret cost cap, then the state must reopen negotiations with all the applicants.”

An NTIA spokesperson did not respond to a request for confirmation and for comment.

The CostQuest cost model

The project areas a state tentatively approved for funding are compared to a model of how much broadband should cost to build in a state on average, according to the people. Project areas are geographic units ISPs could bid to serve with BEAD money, and they differ in each state. A tentatively approved project can encompass several project areas.

Project areas above the 65th percentile – that is, more expensive on a per-location basis than 65 percent of projects predicted by the model – have to be justified in writing, the people said. Projects above the 85th percentile have to be renegotiated with the provider close to the 85th percentile price.

Project areas that came in above a third, higher per-location cost are effectively doomed, according to the people. They said those projects will have to be rebid and awarded to the lowest bidder.

One person said that the third threshold would be 1.15 times the 85th percentile price, the other said it wasn’t clear.

‘Priority broadband projects’ would not be in place for this rebidding

The usual BEAD rules, where “priority broadband projects” get preference, would not be in place for that rebidding, according to the people. The criteria would be BEAD support requested by the applicants.

The people said states were asked to justify or renegotiate some projects when reviewing drafts of their final spending plans with NTIA, a necessary step before posting them for public comment. But the post-submission process and potential rebidding in certain areas was new.

The guidance is not yet official from NTIA, and could potentially end up changing. How much rebidding could happen in a given state would be dependent on how their tentative awards stack up to NTIA’s model, and could be more significant in some states and less significant in others.

Although the NTIA did not respond to a request for comment from Broadband Breakfast, the agency reportedly released a rebuttal memo entitled “Debunking Lies,” also posted Thursday by Adams. The memo was not shared directly by the NTIA with Broadband Breakfast.

Apparent NTIA memo rebuts that there are changes beyond June 6 rules

The apparent NTIA memo said the agency was not imposing arbitrary price caps or reversing course from its updated June 6 guidance. That guidance eliminated an explicit preference for fiber and made it easier for other, cheaper to deploy technologies to compete on the basis of cost.

“Consistent with its decision to decline to adopt a national excessive cost threshold, NTIA is using tailored, state-by-state data to identify outlier, unreasonably expensive projects. Press reports identifying a price cap are inaccurate,” the memo read. “NTIA looks at each state individually, given their unique topography, geography, density, and local needs.”

The memo also disputed that the process amounted to an additional bidding round.

“In cases where proposed costs are unreasonable (using state-by-state cost data), states will ask existing bidders in that project area to provide their best and final offer. In these limited cases, providers have already submitted bids and have the information they need to quickly submit a new bid or stand on their current one,” the agency wrote. “This allows all providers, regardless of technology, another chance to compete for BEAD funding, rather than awarding all excessively high cost areas to one particular technology.”

Tentative awards still skew toward fiber

Satellite broadband providers like Elon Musk’s SpaceX and Amazon’s Kuiper Systems bid aggressively in many states, submitting bids for many of their eligible locations. SpaceX has challenged the proposals of many states, saying it should have been awarded more locations because of its inexpensive bids.

Among states that have posted their draft BEAD awards for public comment, most locations are still tentatively slated to be served with fiber – about 67 percent to satellite’s 19 percent, according to the most recent analysis from New Street Research.

State broadband offices “were hard at work and near the finish line with the ‘original’ BEAD. They were asked to redo their numbers in three months with the June 6 Benefit of the Bargain guidelines,” Adams wrote. “And now, with news of a possible ‘Best and Final Offer’ requirement to revisit awards, states are being asked to conduct a rather sizable task three times.”

The cost models were compiled using data from CostQuest, the firm handling the federal government’s map of nationwide broadband-serviceable locations. Adams and one of the people who spoke to Broadband Breakfast expressed concern the model was based on an outdated version of that location fabric.

When the Trump administration handed down new rules for the program in June, NTIA declined to set a national per-location cost threshold as some had anticipated. The agency has said it’s aiming to approve most state plans by the end of the year.

Member discussion