White Paper

Orbiting the Divide: How LEO Satellites Are Transforming State Broadband

White Paper Provided by Ookla

Executive Summary

Satellite broadband has entered a pivotal new phase, evolving from a niche technology into a strategic component of state broadband portfolios. Historically constrained by high latency and limited capacity, modern low Earth orbit (LEO) satellite networks have made significant performance gains, particularly in latency and peak download speeds. While performance can vary and may not match fiber’s peak speeds, LEO satellite’s primary strength lies in delivering broadly consistent broadband coverage and service availability in locations where terrestrial networks cannot be economically or practically deployed. However, real-world performance does not uniformly meet federal broadband performance standards across all users or locations, underscoring the importance of independent measurement and ongoing oversight.

According to Ookla Speedtest Intelligence, as of Q1 2025, 17.4% of Starlink Speedtest users in the U.S. recorded speeds consistent with the FCC’s minimum requirement for broadband of 100 Mbps download speeds and 20 Mbps upload speeds. This figure serves as an important baseline, capturing end-user performance during an earlier stage of LEO network scale-up and highlighting both the progress achieved to date and the variability policymakers must account for when integrating satellite into publicly funded broadband programs.

By Q4 2025, Starlink’s consistency against the same 100/20 Mbps minimum requirement improved to 44.7%, reflecting ongoing constellation expansion, software optimization and ground structure investment. At the same time, these gains have not been uniform across all users or locations, reinforcing the need for detailed, location specific evaluation as satellite becomes a more prominent component of state broadband strategies.

As state broadband offices and federal officials have confronted the cost and timeline constraints of universal fiber deployment, where construction costs can exceed $100,000 per address in some very remote locations, satellite is increasingly being used where terrestrial infrastructure is cost‐prohibitive, geographically complex, or unlikely to be delivered within required timelines. Revised BEAD allocations reflect this shift, with satellite solutions capturing a modest but intentional share of funding aimed at the most difficult‐to‐serve locations.

This expanded role brings new responsibility. The success of satellite constellations in becoming a part of the BEAD program depends on more than just being a lower cost and fast deployment option. State broadband offices must move beyond a deployment‐focused mindset toward long‐term compliance, sustainability, and accountability.

That shift requires clear policy guardrails, competitive diversity among providers, and most critically, ongoing, independent performance monitoring. Without third‐party verification of real‐world speeds, latency, and reliability, states lack the evidence needed to confirm that funded networks continue to meet required standards as adoption and demand increase.

This white paper examines what has changed in satellite broadband performance and deployment, how leading LEO systems are reshaping the market, how states are strategically integrating satellite into broadband plans, and why independent and continuous data is essential to ensuring these investments deliver durable, equitable, and accountable connectivity.

From Legacy Satellites to LEO Networks

For decades, satellite broadband played a limited role in broadband policy. Legacy geostationary (GEO) systems, orbiting roughly 22,000 miles above Earth, faced inherent latency constraints that challenged real-time, interactive applications. As a result, satellite constellations were typically positioned as an option to be used only when terrestrial networks were deemed impractical.

Modern LEO constellations represent a fundamental shift. Orbiting just a few hundred miles above the Earth’s surface, LEO satellites dramatically reduce latency and improve download performance compared to legacy geostationary systems. These gains are driven by a combination of satellites operating closer to Earth, advanced and widely distributed infrastructure, adaptive software and network optimization, and innovations such as spot-beam frequency reuse, which multiplies capacity across smaller coverage areas.

Satellite broadband has also become a continuously evolving system rather than a static product. Performance improves as new satellites are launched, software is updated, and ground infrastructure expands. For policymakers, this means satellite broadband services cannot be evaluated through one‐time modeling or initial acceptance testing alone. Performance must be assessed over time.

Starlink has set a new benchmark for satellite broadband, deploying the largest LEO constellation and serving millions of users worldwide, including in BEAD- eligible areas. At the same time, new entrants such as Amazon LEO (formerly Project Kuiper) are preparing to launch services with differentiated architectures that emphasize cloud integration and enterprise-grade service tiers. For state broadband offices, the emergence of multiple LEO providers reduces reliance on a single vendor and underscores the importance of technology-neutral oversight focused on outcomes rather than system design.

Measuring Real-World Satellite Performance

The case for modern satellite broadband must be grounded in measured, real-world performance rather than projections or modeled assumptions. Independent, large-scale testing provides visibility into how satellite networks perform under actual usage conditions, across geographies, and over time. Ookla Speedtest data captures millions of consumer-initiated tests, offering a neutral view of satellite performance at national, state, and local levels.

This analysis focuses on Starlink, currently the largest LEO satellite network at a national consumer scale, which provides the bulk of available Speedtest data in the U.S. Other LEO networks, including Amazon LEO, are still in early deployment and do not yet have enough commercial usage to support comparable large-scale measurement.

Over the past several years, measured performance on the leading LEO network in the United States has improved substantially. Between Q3 2022 and Q1 2025, median download speeds for U.S. Starlink users nearly doubled, rising from 53.95 Mbps to 104.71 Mbps, while median upload speeds increased from 7.50 Mbps to 14.84 Mbps. Over the same period, median latency declined from 76 milliseconds to approximately 45 milliseconds, well below levels historically associated with geostationary satellite systems and within BEAD program latency requirements. These trends reflect the combined effects of constellation expansion, software optimization, and continued investment in ground infrastructure.

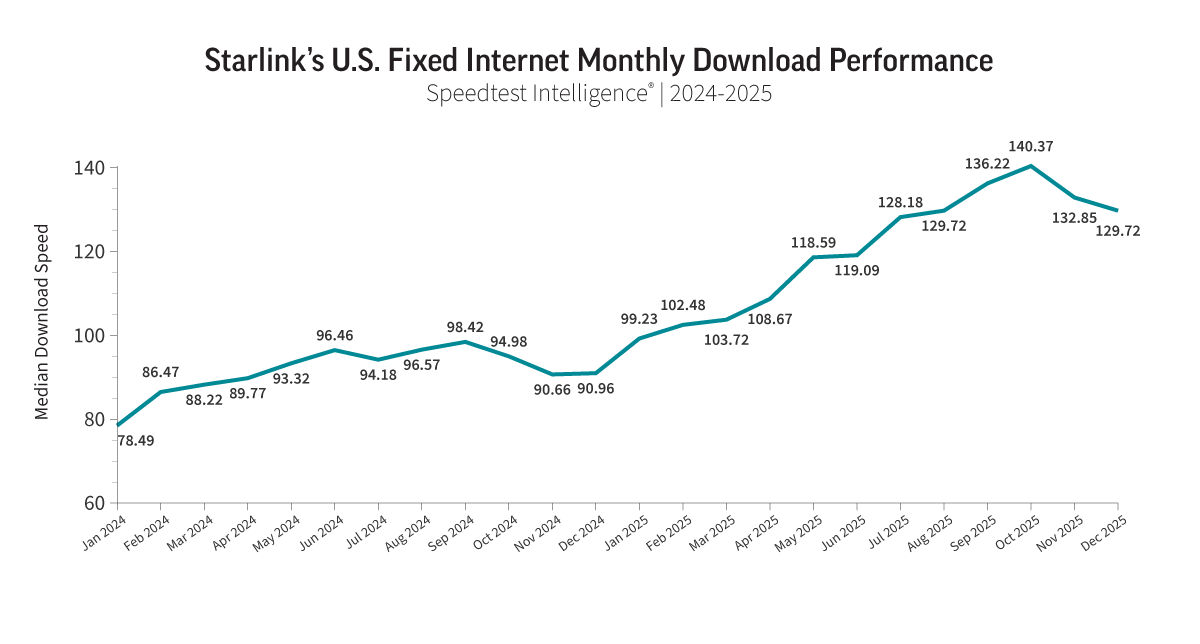

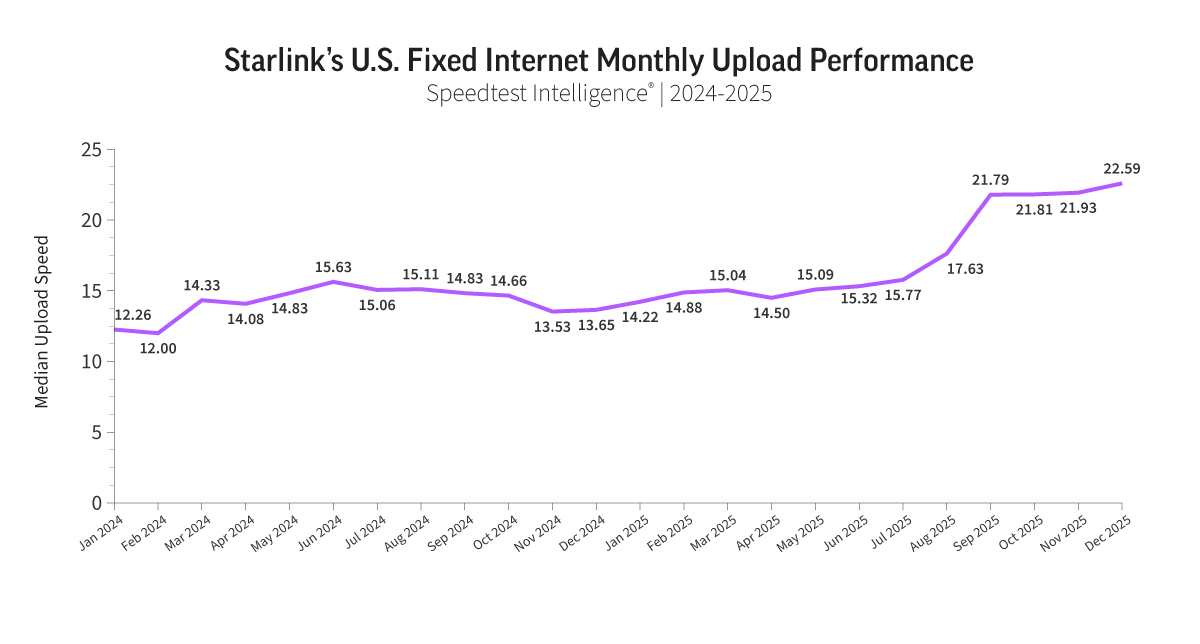

More recent data indicates that these gains have continued as LEO networks scale. Speedtest Intelligence data shows that Starlink’s median U.S. fixed download speeds increased from approximately 78 Mbps in early 2024 to 128 Mbps by December 2025. Over the same period, median U.S. fixed upload speeds rose from about 12 Mbps to 22 Mbps.

While median performance metrics show clear improvement over time, national and regional averages alone do not capture the full performance distribution experienced by users. As of Q1 2025, only 17.4% of U.S. Starlink Speedtest users met the FCC’s minimum broadband requirement of 100/20 Mbps, with upload performance remaining a limiting factor in many locations at that time.

By Q4 2025, Starlink’s consistency against the same 100/20 Mbps benchmark improved to 44.7%, reflecting continued constellation expansion, software optimization, and investment in ground structure, with gains driven primarily by improvements in median upload performance. This improvement highlights the pace at which LEO networks are maturing as they scale. At the same time, performance outcomes still vary widely by state, geography, network load, and environmental conditions. This variability reinforces the need to evaluate satellite broadband continually at a granular, location-specific level rather than relying solely on aggregate metrics.

Performance improvements are also evident internationally. In Latin America, Starlink’s median download speeds reached 82.54 Mbps in Q3 2025, while median satellite download speeds across all consumer-oriented providers in the region more than doubled from 29.12 Mbps in Q1 2023 to 72.01 Mbps in Q3 2025, highlighting the broader maturation of LEO-based satellite services beyond the U.S. market.

Capacity, Congestion, and Variability

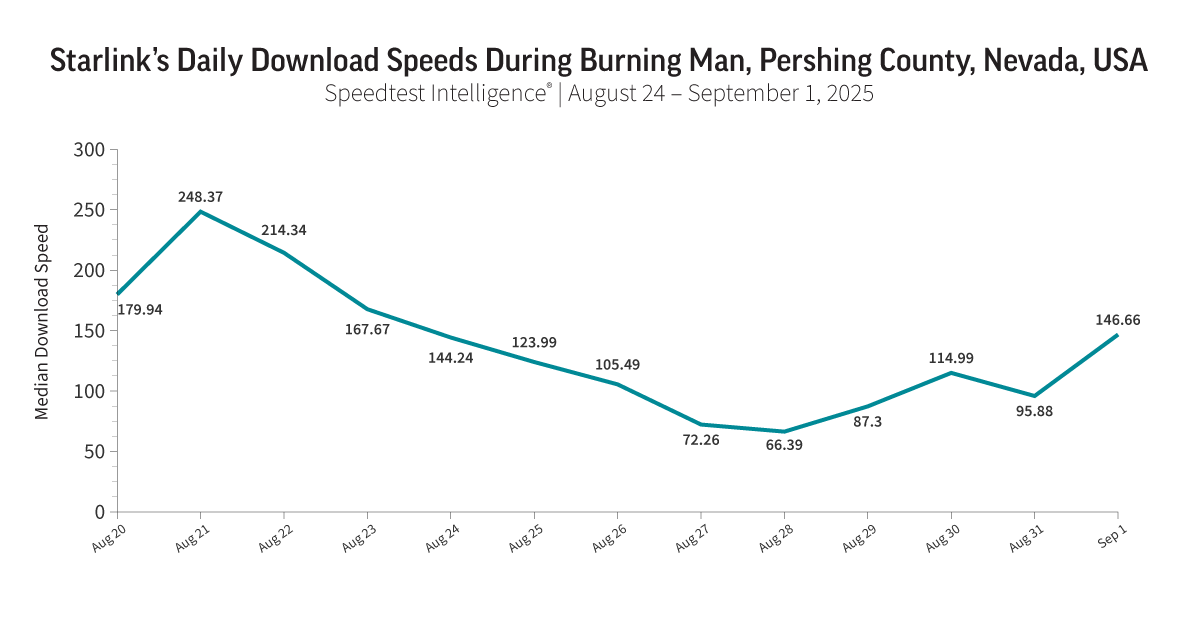

Like all shared networks, satellite broadband systems operate within finite capacity limits. When many users connect in the same place at the same time, localized congestion can occur, resulting in temporary performance declines. These conditions provide useful insight into how satellite networks perform under peak demand.

A clear example occurred during the annual Burning Man festival in Nevada’s Pershing County, where the population temporarily increased more than tenfold. Speedtest Intelligence data shows that Starlink download speeds exceeded 200 Mbps in the days leading up to the event, dipped to a low of 66 Mbps during peak festival activity, and then recovered as demand subsided. The slowdown was localized and temporary, affecting the immediate area but not Starlink’s nationwide performance.

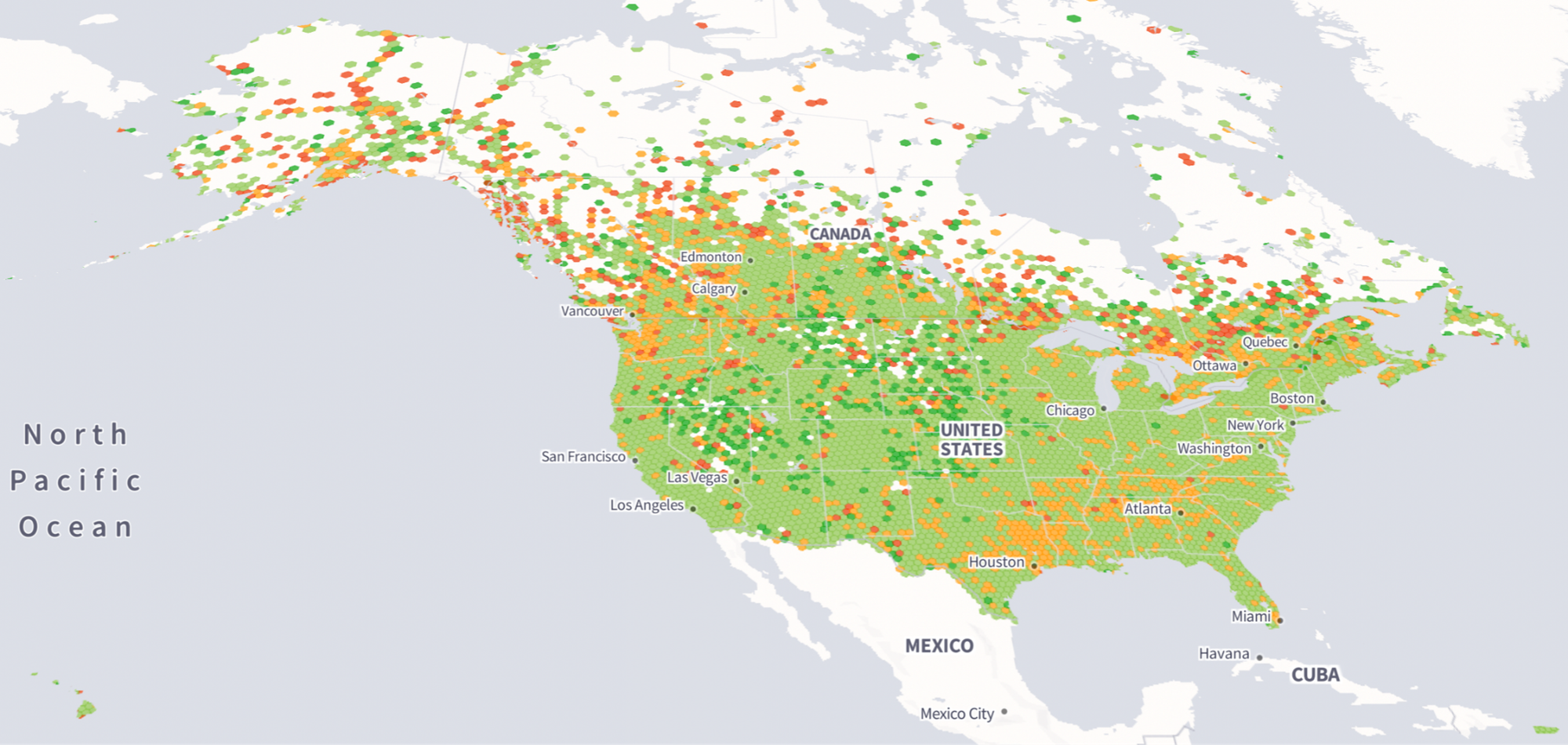

Performance variability also reflects underlying geographic patterns. As shown in the Speedtest Insights map below, median speeds have increased nationwide, though regional differences persist. Lower-density areas from Nevada through the Dakotas often experience higher median speeds, while other regions, such as parts of East Texas through Tennessee, report relatively lower speeds.

In higher-demand markets, including Seattle, Portland, and parts of Florida, Starlink uses activation fees as one way to balance network growth and maintain service quality. This demonstrates how satellite providers use a combination of technical planning and economic mechanisms, including regional pricing, to help ensure consistent service and align network capacity with local demand.

For state broadband offices, the key takeaway is not that satellite performance varies, but that oversight cannot rely on one-time tests or installation checks alone. Temporary congestion events, like those at Burning Man, may seem like outliers but they highlight the importance of ongoing, independent performance monitoring as service subscriptions expand. This helps distinguish short-term demand spikes from persistent capacity constraints and ensures that publicly funded networks continue to meet performance obligations over time.

Strategic Policy: Where Satellite Fits in State Broadband Plans

State broadband offices have faced difficult tradeoffs as they pursue universal coverage. Fiber remains the preferred long‐term solution in most cases, accounting for roughly 63% of awarded BEAD funds. As 2025 ushered in new national leadership looking to reduce the cost of the program via the “Benefit of the Bargain” initiative, satellite broadband emerged as a strategic option within a layered connectivity framework, representing roughly 22% of BEAD award funds.

In practice, states have been using satellite services in two main ways. In some cases, the technology served as a primary solution where construction costs are extreme due to terrain, remoteness, or environmental constraints. In others, satellite served as bridge connectivity, providing meaningful service to unserved locations while permanent infrastructure is planned and built. Some of these areas may be served in the future with a different broadband solution while others may remain on satellite as defined by a state’s approved BEAD award plan.

Hawaii: Managing Extreme Construction Constraints

In Hawaii, satellite is deployed as a primary solution within defined exclusion zones, rather than as a default alternative to fiber. State and tribal broadband programs have established cost thresholds at the individual-location level, shifting to satellite where serving a single household would consume the budget required to connect multiple homes.

This approach reflects Hawaii’s unique geography, where trenching through lava rock, crossing rugged terrain, or extending service across islands can dramatically increase deployment time and cost. In these areas, LEO satellite enables faster service delivery while allowing fiber investments to remain focused on locations where long-term terrestrial infrastructure is feasible.

Maine: Addressing Infrastructure Gaps and Time-to-Service

In Maine, satellite has been used to rapidly connect households in regions where basic infrastructure such as utility poles does not yet exist. Even where fiber routes pass through nearby towns, long driveways, forest density, and extreme remoteness can push per-location costs to impractical levels.

Programs such as Working Internet ASAP have leveraged satellite internet solutions to provide immediate service to unserved residents while long- term networks are planned and built. This approach prioritizes time-to- service without abandoning future fiber deployment, ensuring households are not left offline during multi-year construction timelines.

Together, these examples illustrate how states are using satellite not as a substitute for fiber, but as a targeted policy instrument to address extreme cost, geography, and time-to-service constraints within a broader, layered connectivity strategy.

Ensuring Performance After Deployment

As broadband programs mature, state broadband offices are transitioning from awarding grants to enforcing performance commitments. This shift elevates the importance of network performance monitoring mechanisms that extend well beyond construction milestones.

For satellite-funded projects, traditional oversight approaches such as construction verification, installation checks, and one-time acceptance testing are insufficient. These methods confirm that a connection exists, but they do not show whether it consistently delivers required speeds and latency as conditions change and usage scales. Environmental factors such as foliage, weather, terrain, and line of-sight obstructions can materially affect satellite performance over time, particularly in rural and heavily forested regions.

LEO satellite networks are also dynamic. Individual satellites have an estimated operational lifespan of roughly five to seven years, requiring operators such as SpaceX to continually launch replacement satellites to sustain coverage, capacity, and performance. As constellations evolve, network behavior can change due to shifting orbital density, traffic routing, and ground-infrastructure upgrades. For states, this means performance oversight must continue throughout the life of the funded service.

Independent, third-party data is essential to meet this challenge. Crowdsourced performance datasets capture actual user experience at scale, revealing trends and variability that provider-reported or one-time measurements may miss. When analyzed over time, this data allows states to establish baselines, monitor trends, and identify early signs of congestion or degradation.

Best practices for state broadband oversight include:

Establishing baseline performance metrics at project launch and tracking them over time

- Conducting regular monitoring to detect persistent underperformance or emerging capacity constraints

- Using independent data to validate that networks deliver promised speeds consistently

- Ensuring regulatory authority and enforcement mechanisms are in place to address non-compliance

- Integrating satellite and terrestrial performance into state broadband maps and dashboards for transparency

As Jaren Tengan, Broadband Coordinator at the Department of Hawaiian Home Lands, explains, independent datasets are key to gaining a neutral, third‐party view into how satellite connections are performing in the real world.

“By pushing a crowdsourcing speed test and seeing what devices that they’re connected to and their speeds, it really helps us drive decision making on buildouts, whether it be LEO or terrestrial. With the Speedtest data, we can help go back to the companies and ask why and help troubleshoot what’s really going on with some of the systems or the connectivity that’s going on Hawaiian Homelands.” - Jaren Tengan, Broadband Coordinator at Department of Hawaiian Home Lands

Conclusion

Satellite broadband is no longer a niche solution. Modern LEO networks are now a critical part of state broadband strategies, especially in the hardest-to-reach communities. But deployment alone isn’t enough— states need real-world insight to ensure networks deliver consistent speeds, low latency, and reliable service over time.

That’s where Ookla comes in. By providing independent, crowdsourced performance data, Ookla helps states validate compliance, identify issues early, and protect public investment. With Ookla’s data, states can pair strategic satellite deployment with proactive and actionable oversight, ensuring every broadband dollar delivers measurable, equitable connectivity outcomes.

Ultimately, independent performance monitoring isn’t optional; it’s the foundation for durable, high-performing broadband that supports progress toward closing the digital divide.

Check out other resources from Ookla: