Providers Increasingly Vocal in Raising Concerns About Rural Digital Opportunity Fund Auction

February 11, 2021—Broadband providers are becoming increasingly vocal in their concerns over some of the winning bidders in the first phase of the Rural Digital Opportunity Fund that was completed last year. In late 2019, the Federal Communications Commission announced that it would put more than $2

Benjamin Kahn

February 11, 2021—Broadband providers are becoming increasingly vocal in their concerns over some of the winning bidders in the first phase of the Rural Digital Opportunity Fund that was completed last year.

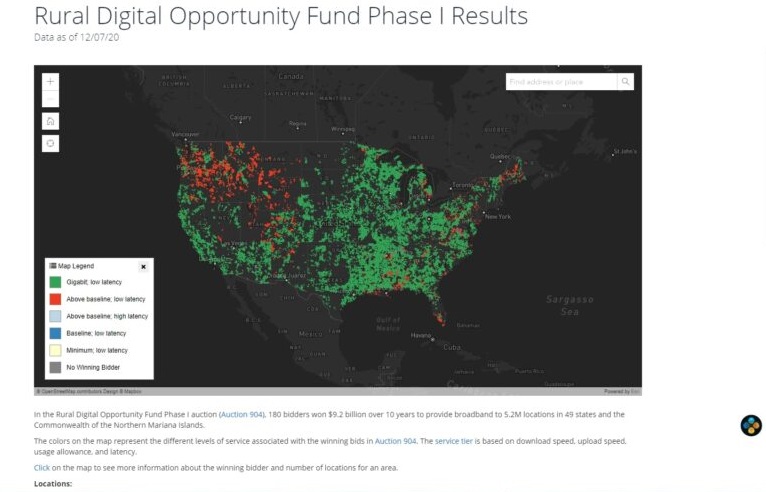

In late 2019, the Federal Communications Commission announced that it would put more than $20 billion towards the expansion of broadband service in rural areas over the next ten years. Phase I of the program began in October of 2020, when the FCC began a reverse auction of the regions in need of coverage to broadband providers.

A reverse auction is the process by which the FCC opens with an initial bid for a region or locality and prospective broadband providers provide bids for what they would charge to provide broadband access to that area. Results from these auctions were made public in December of 2020.

Mammoth Networks CEO Brian Worthen said that his company participated in a few bids, principally in the Rocky Mountain region across three states. Mammoth Networks is a broadband provider based out of Wyoming. The company says it prides itself on covering hard to reach regions that other providers “shy away from.” He indicated that while he felt that the FCC’s auction process was well run and Mammoth Networks was the recipient of a contract, he was left somewhat confused by some of the contracts awarded.

Worthen’s chief concern was that many of the small broadband providers that were awarded contracts would not actually be able to fulfill them, and as a result would just end up “squatting” on the regions they were meant to serve.

Daniel Friesen, managing member and innovation officer with Ideatek Telcom, echoed Worthen’s confusion. “We were scratching our heads through the process,” Friesen said. Ideatek Telcom operates exclusively within Kansas, and as such expected to secure a contract in the state. Friesen indicated that the company was bewildered with the contract they received. “We really weren’t a major awardee,” Friesen stated. “Obviously it was disappointing for us.”

Friesen observed bidding that took place at the gigabit level was somewhat presumptuous. “I think one of the biggest elephants in the room here is the gig level with fixed wireless providers.”

The FCC seemed to just assume that these small providers possessed the technology and scale to fulfill their obligations, he said. It was shocking to see how low the bidding got in the midwest, and he added, “At [the level they were bidding] you might as well just do it for free.”

The impact of broadband mapping on the Rural Digital Opportunity Fund

Worthen commented that as the size of the broadband provider decreases often times the quality of their mapping does as well. He stated that he had come across small providers who did not file Form 477s with the FCC. Form 477 is a mandatory report that broadband providers must provide the FCC that outlines the extent of their coverage operations. Without accurate data, the FCC is working with outdated information. “The real dichotomy here is the FCC is operating on these [broadband] maps that aren’t encompassing what’s happening in rural America.”

Others were more optimistic about the awards. Brian Regan of Starry Inc. stated that Starry’s contract had him excited. As a business, Regan said that Starry aims to provide robust broadband coverage for those living in affordable housing. He explained that Starry received a contract that covered over 100,000 locations across nine states.

Regan emphasized that this endeavor needs to be viewed overall as a success. “The result of this [program] is that millions of locations across the country are going to get service that weren’t going to get it before,” even if there were some instances of failed broadband implementation on the peripheries. Regan stated that even if some broadband providers defaulted on their contracts or failed to perform, the initiative should still be considered a success.

Even with the issues surrounding the allocation of funds and the potential inaccuracy of mapping, most of the panel agreed that going through the first phase of the program was the right decision.

Member discussion