T-Mobile Plans 6 Million New Customers in 2025

T-Mobile accelerates growth with major mergers, fiber expansion, and satellite connectivity push.

T-Mobile accelerates growth with major mergers, fiber expansion, and satellite connectivity push.

Jan. 29, 2025 – This year, T-Mobile is gearing to add up to 6 million postpaid subscribers, expand satellite connectivity, and push into fiber and digital advertising — all under new leadership.

CEO Mike Sievert announced that Srini Gopalan will step in as T-Mobile’s new CEO on March 1, 2025. "I decided now is the time to… focus even more of my time on our longer-term opportunities and strategies. Srini is the right guy,” Sievert said of the transition.

The city will continue managing customer service and billing until Charter assumes full control

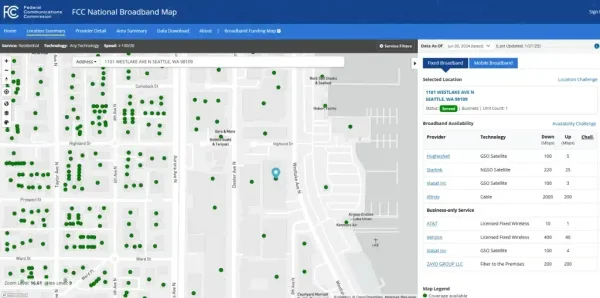

States, ISPs still struggling to challenge its accuracy

The App Store Accountability Act requires app stores to verify users’ ages and obtain parental consent for minors

The deadline for submissions is May 9.