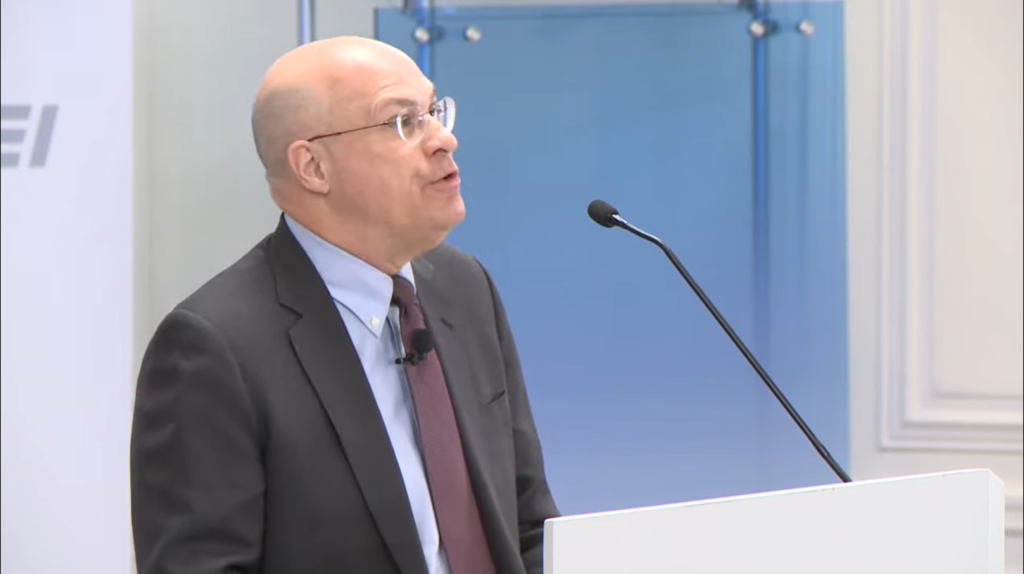

U.S. Needs to Modernize with Blockchain and Cryptocurrencies, Said Former Trading Commission Chairman

Christopher Giancarlo said U.S. falling behind China on new wave of innovation, driven by blockchain and cryptocurrencies.

WASHINGTON, January 4, 2022 – A former chairman of the U.S. Commodity Futures Trading Commission said the federal government needs to catch up and modernize the currency system to include cryptocurrencies, lest the U.S. fall behind competitors in the global arena.

Christopher Giancarlo, staunch supporter of cryptocurrencies and adjacent technologies, said during a panel hosted by the American Enterprise Institute Tuesday that, while some entities in the private sector are blazing ahead on cryptocurrencies and the decentralized ledger system called the blockchain — exploring the possibilities and limits to these technologies — western governments and societies at large are lagging.

“Money is changing right before our eyes,” the former chairman said. “Like text messages and photographs, money is becoming digital, decentralized, tokenized and borderless.”

Antiquated methods of transferring and ordering money are still mainstream, and not suitable for the fast-paced transactions that take place in the 21st century, said Giancarlo. He argued that these methods put the U.S. “at a competitive disadvantage to the likes of China, that are building new financial infrastructure from scratch with 21st century digital technology.

“It typically takes days in the United States to settle and clear retail bank transfers, while in many other countries it takes mere minutes if not seconds. And it takes days to settle securities transactions, and it’s ridiculously expensive to remit money overseas,” said Giancarlo. “It is often faster to move money around the globe by stuffing cash in a suitcase and hopping on a plane than it is to send a wire transfer.

“I just rode the Acela from Newark to Washington and the state of our dilapidated American infrastructure is on full display right outside the train window,” he said. “But sadly, the same is true about much of our financial infrastructure, both in the United States and in developed western economies.”

Innovation on the internet comes in waves, said Giancarlo. The first wave was the “Internet of Information,” which gave rise to digitally accessible and nearly instantaneously shareable libraries, such as Wikipedia. The second wave is what is commonly referred to as the “Internet of Things,” where nearly every device one can engage with can be accessed via the internet.

The ‘Internet of Value’

In Giancarlo’s view, a third wave is now in the midst of crashing down: the “Internet of Value” has begun to wash across the internet, where property titles, contracts, stock certificates, and other fungible and non-fungible assets can be shared and exchanged.

“Thanks to stablecoins, value is now transferable around the world in nanoseconds – 24/7/365 – the way that is increasingly decoupled from the traditional bank account-based system and corresponding correspondent banking service,” he said. “And it is the private sector, not the official sector that is leading the way to the future of money.”

Giancarlo condemned the U.S. government’s inability to “declare any national imperative to harness digital asset innovation to upgrade our creaky exclusive financial system to expand inclusiveness and lower costs for new generations of Americans.”

“I believe we can harness this wave of innovation this internet of value for greater financial inclusion, capital and operational efficiency and economic growth for generations to come. But if we do not act, this coming wave of the internet will lay bare in the shortcomings of our aged, analog financial systems with potentially disruptive impact on our western economies.”

Giancarlo stated that 80 percent of the world’s central banks are currently considering a central bank for digital currency. Bearing that in mind, he provided seven core reasons why they are doing so:

- access to citizens economic data

- financial infrastructure modernization

- financial inclusion solution monetary policy execution

- rising success of stable coins

- geopolitical influence

He said that over the coming decades, there will be myriad stakeholders attempting to advance digital currencies – ranging from national governments, to legacy fintech institutions, to Big Tech – but that “citizens for a free society” need to be one of the key players.

“Looking back on the carnage of World War One, French premier George Clemenceau is said to have remarked, ‘war is too important to be left to the generals,’” Giancarlo said. “I adapt Clemenceau’s famous quote: money, especially the digital money of the future, is too important to be left to central bankers.”

Giancarlo stated that it is important for both non-sovereign and sovereign currencies to coexist in the same financial ecosystem. “The best protection against impermissible government surveillance of economic activity or restrictions on otherwise lawful transactions may be robust competition from well-constructed stable coins, and other non-sovereign digital money.

“On the other hand, privately held operators of stable coins are not bound by the Fourth Amendment to respect individual privacy. They can easily be brought under political pressure to surveil or restrict politically incorrect transactions.

“Perhaps the best approach is what I call a ‘jigsaw’ approach to privacy, where no entity or provider of the digital currency has all the information about a transaction.”

He argued that such a system would be “the most effective guarantor of economic liberty and individual privacy.”