Verizon Doubles Fixed Wireless Targets, Plans More Than 35M Fiber Passings

The company should have 30 million passings by 2028, by virtue of buying Frontier and continuing Verizon expansion.

Jake Neenan

WASHINGTON, Oct. 22, 2024 – Verizon plans to double its fixed wireless customer base to 8-9 million by 2028, the company announced Tuesday.

“We’re going to double the fixed wireless access targets by 2028, to 8-9 million subscribers,” Verizon CEO Hans Vestberg said at the company’s analyst day.

That’s more than some analysts had initially been estimating based on the company’s spectrum holdings and the capacity estimates T-Mobile submitted as part of its Sprint merger. New Street Research said in a note yesterday that after T-Mobile put its fixed wireless target at a higher-than-expected 12 million in September, the group expected Verizon to set its sights on about 9.5 million today.

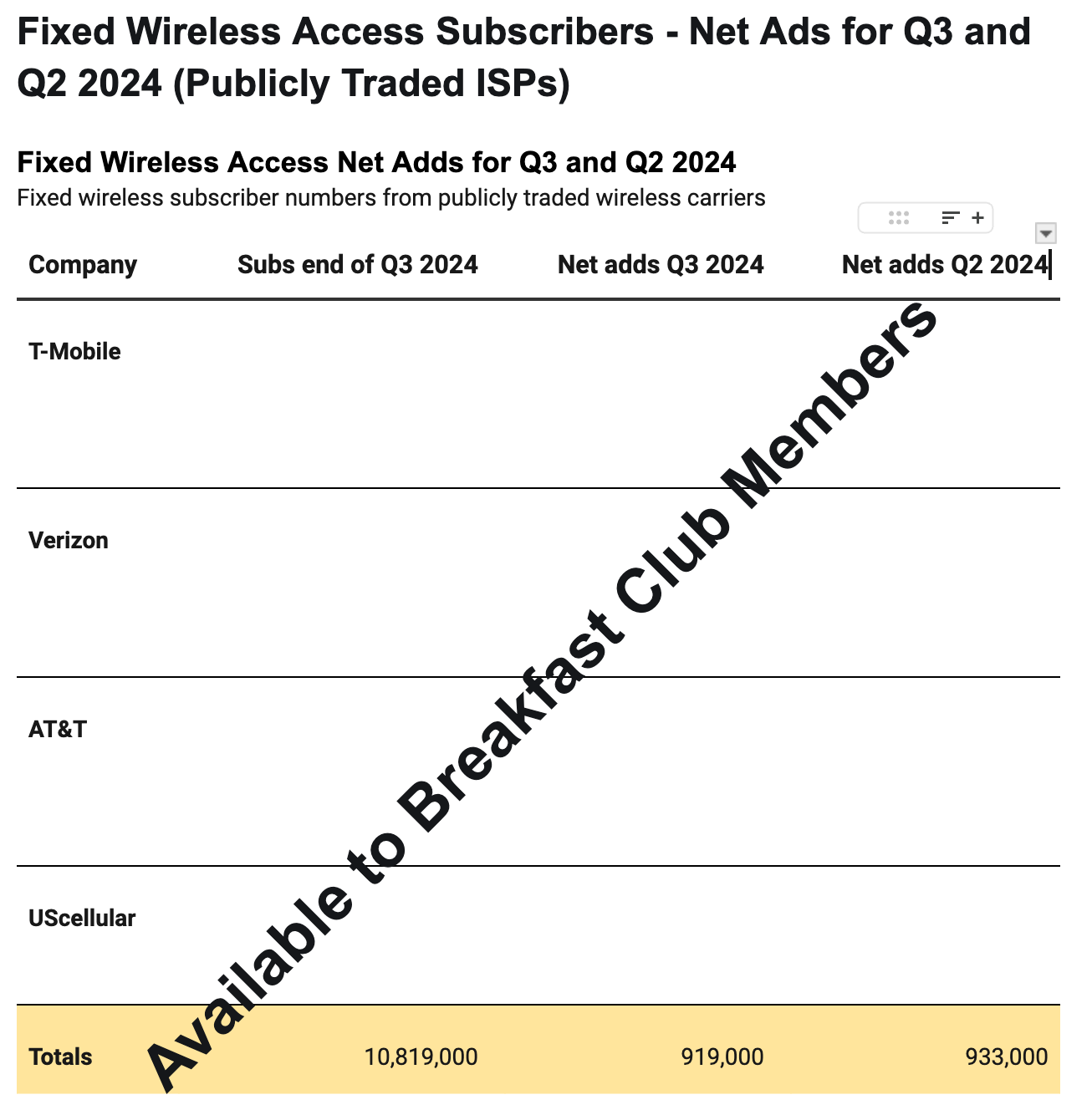

The new target comes after Verizon hit its previous target of 4 million fixed wireless subscribers. The company added 363,000 subscribers to the service in the third quarter, down from 384,000 in Q3 of last year, for a total of 4.2 million.

Joe Russo, the company’s president of global networks and technology, said the next wave of fixed wireless additions would be driven by continued deployment of C-band spectrum – the company plans to have 70 percent of its sites deployed by the end of the year and up to 90 percent by the end of 2025 – and a new millimeter wave product aimed at apartment buildings and offices.

Russo said Verizon has been testing the product, which he said provides speeds of up to 1 gigabit per second, and is planning to put it into commercial use next year. Millimeter wave spectrum is capable of those fast speeds, but doesn’t punch through obstacles or travel long distances like other 5G spectrum.

Fiber plans

Russo said Verizon plans to pass 35-40 million homes and businesses with fiber “over time.” He said the company should have about 30 million passings by 2028, by virtue of buying up Frontier and continuing its own expansion.

Frontier has about 7 million passings, with existing plans to reach 10 million locations by 2026. Verizon has nearly 18 million passings. Russo said the company was on track to pass 500,000 new locations in 2024, and is aiming for 650,000 next year. After the Frontier deal, he said the pace could surpass 1 million new locations per year.

Verizon added 43,000 fiber subscribers in the third quarter, down from 72,000 in Q3 2023, for a total of nearly 7.5 million.

The Frontier purchase and ramped up broadband plans generally are part of an industry-wide bet on ‘convergence’ – retaining customers by offering both mobile and fixed broadband. MoffettNathanson analyst Craig Moffet said in an investor note after the event that he’s still skeptical of Verizon’s plan.

Even getting fiber to about 25 percent of the US is “still not enough to support a meaningful national convergence strategy,” he wrote.

Executives said the company plans to participate in the BEAD program, but those builds make up a small percentage of their 35-40 million target.

Frontier deal

Some Frontier shareholders have been voicing concerns about its deal with Verizon, saying the company is worth more than Verizon is set to pay. The deal is up for a shareholder vote on Nov. 13.

“We were asked for the best and final [offer], we gave the best and final,” Vestberg said when asked about the discontent. “Now it’s up to Frontier’s shareholders to make the vote.”

“We’ll see what’s going to happen, but we feel really confident that this is fair and good for all stakeholders,” he said.

Member discussion