With Universal Service Fund Contributions at 32 Percent, Experts Debate Its Sustainability

January 29, 2021 – With contributions into a program intended to extend basic telecommunications services to all Americans now adding an additional 32 cents on top of every dollar of telecommunications service, experts on January 15 debated whether, and how, the Universal Service Fund can be sustain

Ahmad Hathout

January 29, 2021 – With contributions into a program intended to extend basic telecommunications services to all Americans now adding an additional 32 cents on top of every dollar of telecommunications service, experts on January 15 debated whether, and how, the Universal Service Fund can be sustained.

There seem to be two proposed solutions to what all agreed was an untenable status quo: First, Congress could appropriate USF out of general revenues. Alternatively, mandatory contributions into the USF could be broadened beyond voice telecommunications services and begin to level fees on broadband internet.

Either way, change seems to be coming, said the four panelists mulling the program at a forum convened by the Federal Communications Bar Association.

Currently, the USF program only requires telecommunications and voice-over-internet protocol providers to collect a percentage of revenues. That percentage amount is set quarterly by the Universal Service Administration Company, a non-profit entity that has been delegated this task by the Federal Communications Commission.

The USF fund administered by USAC pays for programs that expand telecommunications and broadband to rural areas, and also to lower-income Americans, schools and libraries, and rural healthcare.

Now there is a 31.8 percent fee added to all voice telecom bills

In December, the FCC released a public notice that the January through March 2021 contribution was 31.8 per cent of user revenues, a new record. Companies can decide whether to pay it from their own reserves or pass it on to subscribers.

Many agree the program, which is runs about $10 billion per year, is unsustainable. That’s particularly so with voice service revenues declining.

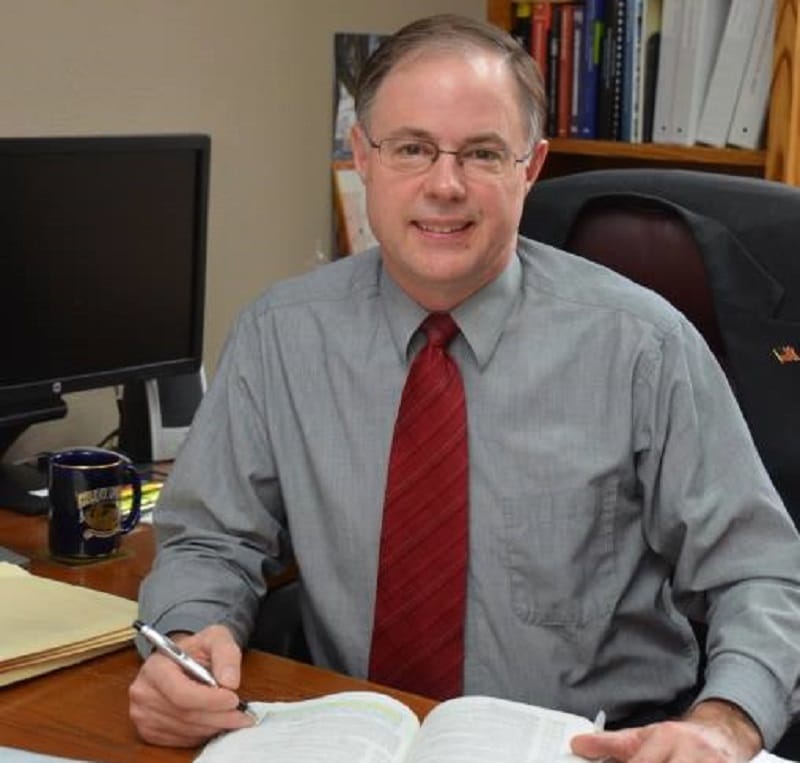

Chris Nelson, vice chairman of the South Dakota Public Utilities Commission, said taxing broadband service would be acceptable because “we tax everything else.” He alluded to the taboo call for taxing the internet and said that he struggled to make sense of it. He argued that a higher number of landline telephone users are elderly. It doesn’t make sense to charge them more, he said.

Nelson, who is part of a bipartisan organization that has been pressing for USF reform for years, said a hybrid model would work best. That is, half of the contribution can come from residential connections (at a cost to the customer about 55 to 60 cents) and the other half can come from enterprise, at about 8 percent of revenues.

Part of the reason for the increase is what some see as the inverse relationship between telecom revenues and the contribution — as telecom revenues decline, the relative contribution amount increases. John Windhausen, executive director of the Schools, Health and Libraries Broadband Coalition, said telecom revenues have declined from $67 billion at one point to $34 billion, pointing primarily to the decrease in wireless revenues over the years. Windhausen estimated that expanding the USF base to include broadband revenues would push the contribution down to 2.5 per cent. That won’t affect broadband adoption, he said.

“Including the broadband revenues into the base provides a more stable funding base, so the base of broadband revenues and telecom revenues together is increasing, and there’s even the possibility that the contribution factor would come down in the future as the base of broadband revenues continues to increase,” Windhausen said.

Windhausen added that Congress can supplement this proposed model with appropriations, but said that an appropriation model shouldn’t wholly replace the current fund.

Some say that the revolving Universal Service Fund should be replaced by congressional appropriation

On the flip side, some are clamoring for congressional appropriations, which proponents argue would allow for more stability from broad taxation and would open up the fund to more legislative oversight. AT&T and former FCC chairman Ajit Pai have pushed for this model.

Earlier in January, Pai suggested $50 billion from the record-setting windfall of the ongoing C-Band spectrum auction should be put into the USF for the next five years.

Mary Henze, assistant vice president of federal regulatory affairs at AT&T, doubled-down on this model as a panelist. She said the USF should move to have a congressional budget line item. That was a position also supported by Daniel Lyons, professor at the Boston College Law School who teaches telecom law. He has historically pushed that position, he said.

Lyons said the program would be subject to direct congressional oversight, which would address any fraud or abuse issues in the existing system through inquiries and hearings. He also said direct appropriations would avoid the “market distortions” of trying to tax some goods and not others to fund the program, such as a surcharge on connections or broadband service.

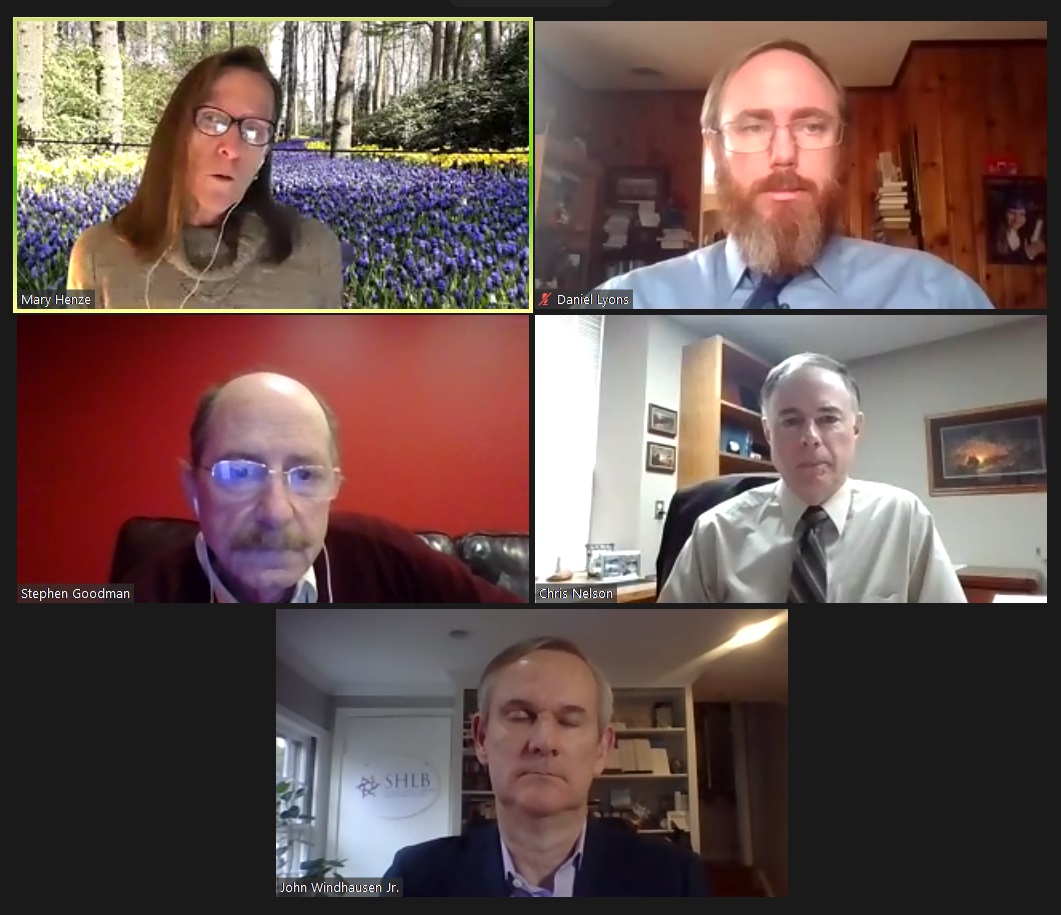

Screenshot from the FCBA event

“They encourage strategic behavior by consumers,” said Lyons, referring to efforts to make communications services fall outside the jurisdiction of the FCC.

Henze said part of solving the market distortion problem is to bring technology companies into the base to spread the contribution out further so it is ultimately less harmful to individual companies or consumers.

The timeline for taxing broadband would also be a problem, Henze argued. Whereas she said it could take companies another year to make that adjustment, Congress, which is now be controlled by Democrats, can quickly put appropriations on budget. Windhausen suggested potentially asking Congress to give the FCC a deadline to come up with a new contribution mechanism in 18 months.

Opponents of making it a congressional budget item included Nelson. He conceded that his opposition come down to politics: Turnover of members of Congress could mean radically different views on appropriations from year to year.

If your company has any questions regarding the steep hike in USF contribution factor or would like to engage in a Communications Taxes & Fees “Optimization” to potentially minimize the economic impact of the ever-skyrocketing Federal USF contribution costs and end user pass-through surcharges, please contact Jonathan S. Marashlian of The CommLaw Group at jsm@commlawgroup.com or 703-714-1313.

Member discussion