Altice Down 58,000 Broadband Subs, Rebrands as Optimum

CEO said on quarterly earnings call that competition from fixed wireless and fiber providers was fierce.

CEO said on quarterly earnings call that competition from fixed wireless and fiber providers was fierce.

WASHINGTON, Nov. 6, 2025 – Altice USA reported 58,000 lost broadband subscribers in the third quarter, worse than analysts had been expecting.

Can't see the Earnings Chart? Get access to the Breakfast Club for $590/year.

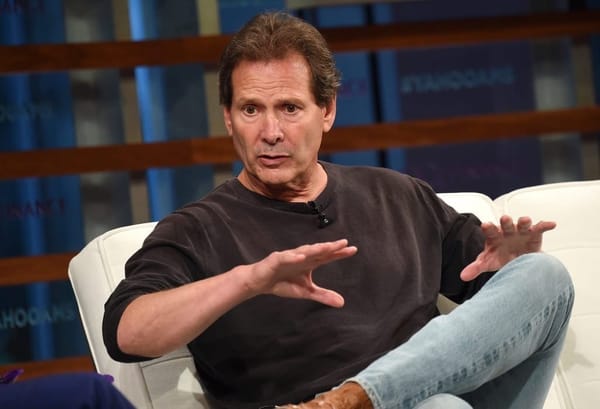

CEO Dennis Mathew said on the company’s earnings call that competition from fixed wireless and fiber providers was fierce in the quarter, something fellow cable operators Charter and Comcast have also said.

“We had, since I’ve been sitting in the seat, the most aggressive offers I’ve ever seen in the marketplace,” he said of ISP efforts to scoop up subscribers.

Connected Nation said differences in advertised broadband prices point to gaps in national pricing data.

Bipartisan support backs having tech companies install power generation and pay for infrastructure upgrades to cover their needs.

Dennis Mathew urges FCC leader to require 'divestiture of Big-4 triopolies in a local market'

‘Convergence can be either fixed wireless or fiber,’ Verizon CEO Dan Schulman said.

Member discussion