Analysis: LEO Bids Average $886 Per Location in Tennessee BEAD Round

Fixed wireless requested $1,289 per location, fiber averaged $4,903

Jericho Casper

July 30, 2025 – New cost-per-location data confirms just how aggressively Amazon and SpaceX undercut fiber and cable competitors in Tennessee’s most recent broadband grant round.

An analysis of 541 applications submitted during the state’s Benefit of the Bargain phase revealed that low-Earth orbit (LEO) satellite providers requested an average of just $886 per location, a more than fivefold gap compared to fiber applicants.

The figures, compiled by broadband analyst J. Randolph Luening, founder of BroadbandToolkit.com, offer a detailed breakdown of cost-per-location funding requests by technology type. Beyond satellite, fixed wireless applicants requested $1,289 per location, followed by fiber providers averaging $4,903 per location, and cable-hybrid networks at $6,305 per location. Luening discussed his analysis on Broadband Breakfast Live Online on Wednesday, July 30, 2025:

Broadband BreakfastMichael Santorelli

Broadband BreakfastMichael Santorelli

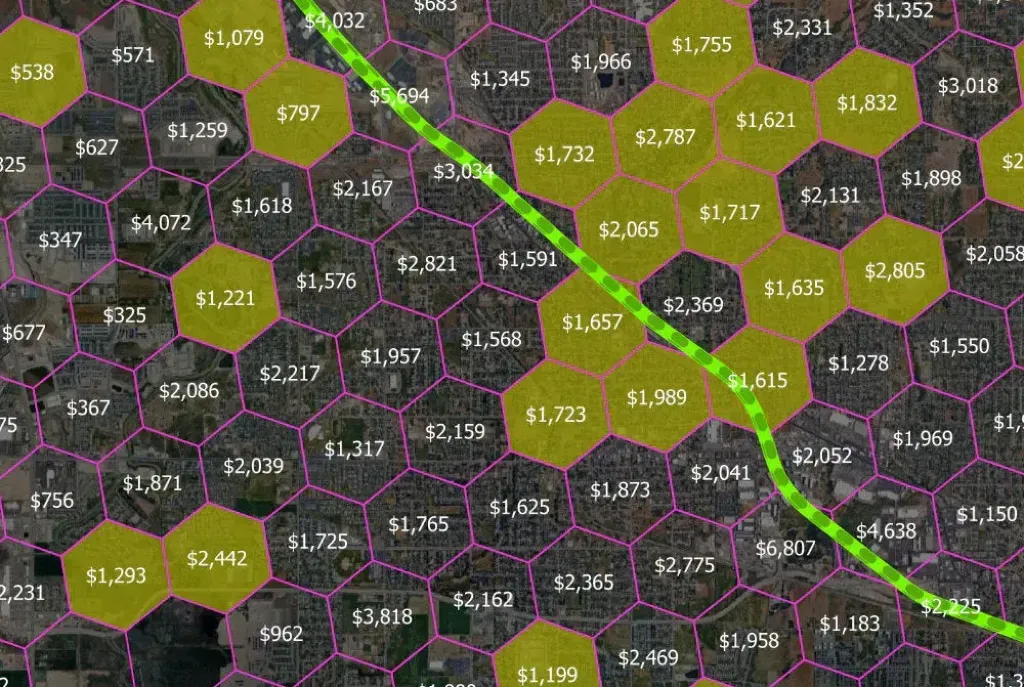

Can't see the charts? Join the Breakfast Club to see

To estimate the location counts, Luening relied on a state-issued spreadsheet listing eligible unserved and underserved addresses by project area. Luening then calculated the average cost per location, dividing total funding requested by total locations in a project area.

Luening emphasized that while the analysis offers strong directional insights, it does not account for locations that individual applicants may have dropped from their proposals, in light of Trump administration rule changes that allow applicants to exclude hard-to-serve addresses from their bids.

A separate chart from Luening’s analysis showed just how closely Starlink and Kuiper were competing against one another, and how far below the rest of the field their bids land. Starlink submitted an average bid of $836 per location, while Kuiper came in only slightly higher at $852.

“They were competing head-to-head,” Luening told Broadband Breakfast in an interview Monday, “but sometimes one would be a decisive winner in one location versus another.”

In a recent expert opinion published in Broadband Breakfast, Luening explored how BEAD’s June 6 policy shift may impact deployment outcomes. He argued then that fiber remains the most viable and scalable solution under a truly performance-based, technology-neutral framework.

When asked Monday which providers were likely to win funding in Tennessee’s Benefit of the Bargain round, Luening said it was too early for predictions. He noted that the program's overseer, the National Telecommunications and Information Administration, retains the authority to override states final award selections.

Luening also cautioned, “One of the weaknesses of most state BEAD programs, especially those with large project areas, is that they are designed to produce a single award per project area… In many geographic areas the optimal solution – from an engineering and financial perspective – is a hybrid solution, with fiber in denser areas and satellite [or fixed wireless] in remote areas. Such a thoughtfully blended outcome is unlikely or impossible in most subgrantee selection processes.”

Tennessee was one of several states to release raw data following the Benefit of the Bargain round of the Broadband Equity, Access, and Deployment program. Similar dynamics surfaced in Texas, with SpaceX bidding on nearly every eligible location in the state.

Member discussion