Analyst: So far, Two-Thirds of BEAD Locations Getting Fiber

Current sample shows western states adopting a mix of technologies, including satellite.

Jake Neenan

WASHINGTON, August 27, 2025 – Eight more states are taking public comment on their final spending plans under the Broadband Equity, Access, and Deployment program, bringing the total to at least nineteen.

New Hampshire, New Mexico, Delaware, and New Jersey posted drafts of their final proposals on Tuesday. Oklahoma, Georgia, and Maryland posted their draft plans on Monday and Montana posted its plan on Friday.

After taking public comments for one week each, states will submit their plans to the National Telecommunications and Information Administration for approval, the final step before state broadband offices can start funding projects under the $42.45 billion program. States have until Sept. 4, 2025 to make their submissions, aside from California and Texas, which were granted extensions.

Like other western states to publish drafts of their plans, New Mexico and Montana leaned on fixed wireless and satellite awardees in their effort to secure a connection for each eligible home and business.

Of New Mexico’s more than 43,000 eligible locations, about 16 percent will get low-earth orbit satellite, largely from Amazon’s nascent Kuiper Systems, about 40 percent would be served with fixed wireless, and about 44 percent would receive fiber.

In Montana, about 65 percent of the state’s 72,200 locations would receive satellite, roughly split between Kuiper and SpaceX’s Starlink, with about 20 percent getting fiber and the rest receiving fixed wireless.

Colorado, Kansas, and Washington also awarded less than half of their eligible locations to a fiber bidder. Meanwhile, denser eastern states have tended to be over 70 percent, with some like Maine and West Virginia reaching above 80 percent. Maryland and New Jersey posted tentative awards that would get fiber to less than half of their eligible locations, but the states would still be mostly wireline, with cable taking a healthy share.

The states would each spend less than they were allocated under the program. The Trump administration nixed Biden-era green lights for spending remaining BEAD money on things like broadband adoption and workforce development efforts, and has said more guidance is forthcoming.

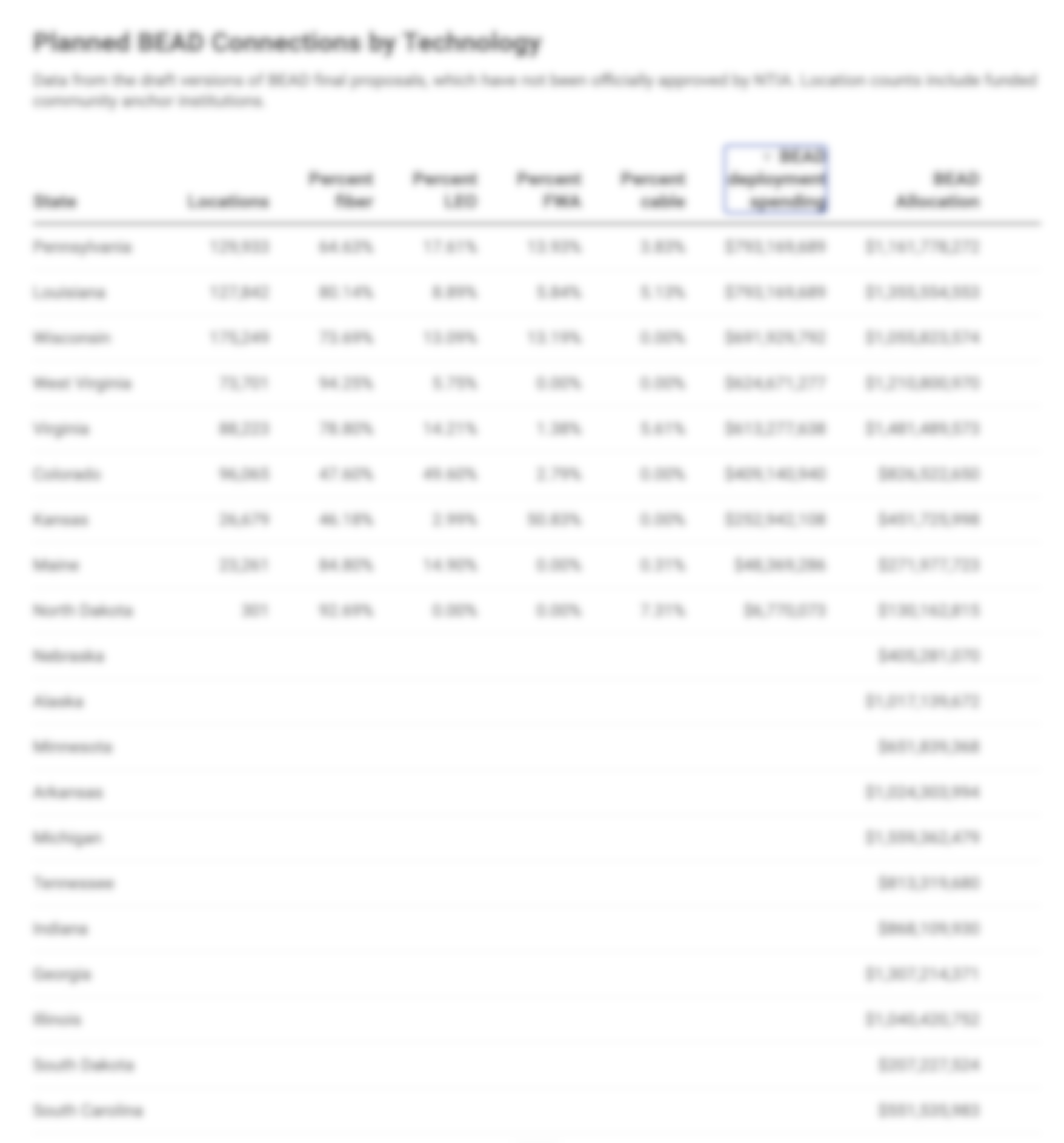

New Street Research Analyst Vikash Harlalka noted that among 13 of the states whose data the group analyzed, 67 percent of all eligible locations had gone to fiber. He also noted fixed wireless, underrepresented in early plans, was now at “13 percent of locations, up from 8 percent in our last report yesterday.”

“Fiber is still the preferred technology, but its share is declining” as more states publish their plans, he wrote in an investor note Wednesday. “Each state has their own way of evaluating applications and we could end up with very different results across all the states (as is already evident from the results declared so far). As such, we can’t extrapolate the results of any one state to the entire nation.”

Still, western states can generally be expected to rely less on fiber because of their more remote geography, according to NSR policy advisor Blair Levin. States had been expecting as much even before the Trump administration instituted new rules that emphasized cost savings and removed a formal Biden-era preference for fiber.

“As a result, the mountain states will simply have to rely more on satellites, even if they had a sufficient budget for wireline in more places,” Levin wrote in a note last week.

SpaceX has challenged the proposals from Louisiana and Virginia, arguing its applications were not treated as ‘priority broadband projects’ often enough. That designation gives an applicant preference over non-priority applicants for a given BEAD project area. Priority applicants compete with each other on the basis of deployment cost, where satellite applicants are at an advantage.

The law standing up BEAD defines priority projects as those that, in addition to meeting minimum requirements, can scale easily over time to meet future needs. That was previously limited to fiber, but states are making the call on an application-by-application basis under the Trump administration

In New Mexico and Montana, neither SpaceX nor Amazon secured priority designation even in their large and successful applications, implying fiber providers considered the areas too expensive to make a build out profitable or to pass muster with the Trump Commerce Department.

Member discussion