BEAD Tax Bill Costs $2.5 Billion in First Six Years, Analysis Shows

Joint Committee on Taxation in 2023 Put 11-Year Cost at $578 million

Jericho Casper

WASHINGTON, March 18, 2025 – A proposal to exempt federal broadband grants from taxation could cost the federal government $2.5 billion in lost revenue over the first six years, according to a 2023 analysis by the Joint Committee on Taxation.

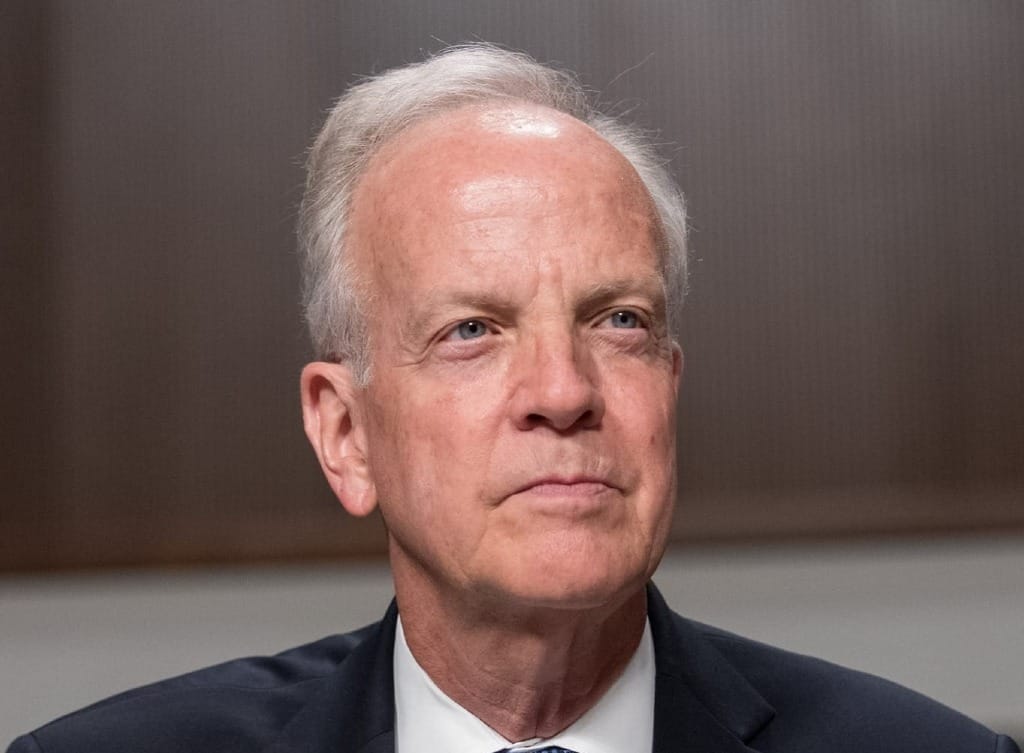

Sen. Jerry Moran, R-Kan., previously estimated his Broadband Grant Tax Treatment Act would cost around $400 million in lost revenue. However, the JCT report projected a much larger fiscal impact, estimating that exempting broadband grants from taxation would result in a revenue loss of $573 million in 2026 alone, with similar losses in 2025 and 2027.

The report predicted federal revenue would begin to recover in 2029, with gains of $291 million that year and increasing through 2033, leading to a net revenue loss of $578 million over the full 11-year period (2023-2033).

The discrepancy between Moran’s estimate and the JCT analysis remains unexplained, and his office has not responded to multiple requests for clarification on how his figure was calculated.

“[This is] another way to make certain that the dollars that we're spending on broadband deployment are spent in a way that is efficient and effective,” Moran said last week at the INCOMPAS Policy Summit, where he proposed including his bill in the upcoming reconciliation package.

While grant funds would be excluded from taxable income, Moran’s proposal includes guardrails to prevent broadband providers and state agencies from receiving a double tax benefit: Recipients would be barred from deducting expenses paid with those tax-free funds.

The JCT report confirmed that the proposed tax exemption would also apply to a range of federal, state, and tribal broadband grants, including:

- Middle-mile grants (IIJA, Section 60401);

- State Digital Equity Capacity Grant Program (IIJA, Section 60304);

- Digital Equity Competitive Grant Program grants (IIJA, Section 60305);

- Broadband Loan and Grant Pilot Program (Rural Electrification Act, Section 779);

- Distance Learning, Telemedicine, and Broadband Program (USDA’s Rural Utility Service);

- Grants provided by states, territories, and tribal governments using federal funds from the Social Security Act (Sections 602-604); and,

- Broadband grants under the Consolidated Appropriations Act, 2021.

Member discussion