Because of Power Availability, Fiber Providers Racing to Connect Remote Data Centers

Power availability is now dictating location decisions, forcing fiber providers to adapt with unprecedented long-haul infrastructure builds.

Drew Clark

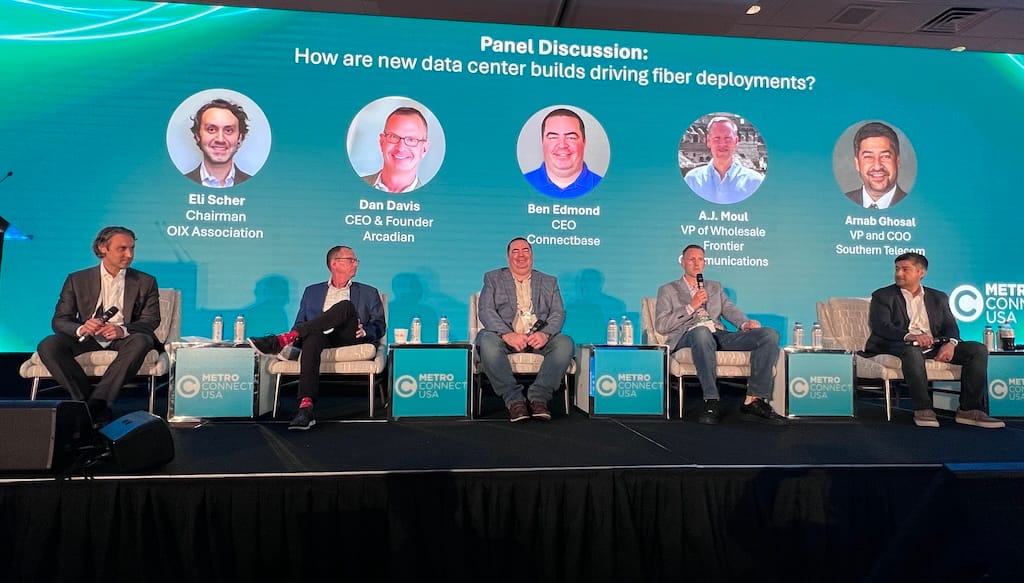

FORT LAUDERDALE, Fla., March 24, 2025 — The data center landscape is undergoing a fundamental shift with power availability now dictating location decisions, forcing fiber providers to adapt with unprecedented long-haul infrastructure builds, industry leaders said Feb. 25 at the MetroConnect conference here.

"It used to be the decision was made, 'Hey, I need to be somewhat near a fiber footprint.' Now it's 'Where's the power?' And then everyone else has to figure out how to get to me from there," said A.J. Moul, vice president of wholesale for Frontier Communications.

Arnab Ghosal, vice president and chief operating officer of Southern Telecom, highlighted the scale of power demand fueling this transformation. His parent company, Southern Company, currently has 50,000 megawatts in its connection queue, with about 10,000 megawatts of "legit load" expected in the next five years.

The panel, moderated by Eli Scher, Chairman of OIX Association, a self-regulating community formed to foster data center and internet exchange point technical and operating standards, described how data centers were previously built at intersections of existing fiber networks in major metropolitan areas.

However, those locations have now exhausted available power capacity, pushing new developments into more remote areas where electricity is available but fiber infrastructure is lacking.

"We've been dropping data centers in the metros where the long-haul fibers crisscrossed," said Dan Davis of Arcadian. "Well, we've sucked up all the power where the fiber crossroads are."

This shift has extended project timelines dramatically. While building fiber to a data center within metropolitan areas might have taken 2 to 2.5 years, rural connections spanning hundreds of miles can now take 3 to 5 years to complete.

The complexity comes not just from distance but from permitting challenges. Davis described a 693-mile project from Salt Lake City to Phoenix requiring 74 different permit processes across "two states, an independent sovereign Native American nation, five municipalities, six counties, BIA, BLM, DOD, National Park, National Forest — it just goes on and on."

When asked about what drives customer decisions in selecting providers for these massive builds, panelists unanimously pointed to speed and certainty of delivery over cost considerations.

"Speed, 100% speed," Ghosal said. "How quickly can you get infrastructure? How quickly can you get them going? And then money will follow that speed and certainty of delivery."

Ben Edmond, CEO of ConnectBase, a platform for service providers to buy and sell connectivity globally, noted that this infrastructure shift is likely to create lasting changes to America's digital backbone, opening new connectivity options beyond the traditional data center hubs that have dominated for the past two decades.

"We're building new networks. We're going to new places with new fiber that hasn't ever existed before," Edmond said. "I think we're going to see a massive shift in what the data center map in the United States looks like, and it's going to be a positive thing."

The fiber being deployed is also changing dramatically in scale. Panelists noted that while 12 fibers was once considered high-count, new builds now routinely include 1,728 fibers, with some hyperscale customers requesting entire conduits with 432 or 864 fibers each.

The industry faces challenges in financing these massive projects, with panelists describing different approaches to de-risking investments, including government funding, private capital structures, and customer-anchored funding models.

Despite the frenzied building pace, panelists expressed confidence that current investments don't represent another fiber bubble like the early 2000s. They pointed to the legitimacy and financial strength of today's customers — primarily major technology companies with substantial balance sheets — compared to the speculative builds of the dot-com era.

As AI workloads continue to evolve, hyperscalers are requiring not just more fiber routes but higher capacity and greater diversity, with data centers typically needing at least four unique entrances and diverse paths to the nearest metropolitan areas, further complicating the planning and execution of these critical infrastructure projects.

Member discussion