Bell Canada: Ziply Counts 375,000 Fiber Subs

The Northwest ISP is expected to hit 2 million fiber passings by 2028.

Jake Neenan

WASHINGTON, August 11, 2025 – As a private company, Ziply Fiber’s subscriber numbers weren’t publicly disclosed. But publicly held Bell Canada recently closed is acquisition of the company and reported those figures on its Thursday earnings call.

Can't see the Earnings Chart? Know you need Breakfast Club? Get access for $590/year.

The Northwest ISP counts about 375,000 fiber subscribers and 60,000 broadband customers on its legacy copper infrastructure.

Ziply had about 1.3 million fiber passings when the companies asked for FCC approval of the merger in December 2024, and Bell Canada said Thursday it expects Ziply to hit 1.5 million by the end of the year. The companies had previously expected Ziply to already be at 1.5 million by the time the transaction closed.

Ziply is expected to hit 2 million fiber passings by the end of 2028. The company, the product of Searchlight Capital purchasing Frontier assets in 2020, also has a legacy copper footprint of roughly 700,000 homes and businesses, which the company is overbuilding with fiber.

Bell Canada, Canada’s largest telecom provider, closed its $3.5 billion acquisition of Ziply on August 1.

Bell Canada also reported a low deployment cost as Ziply overbuilds its legacy footprint: about $1,000 USD per new fiber passing.

The Canadian firm told investors it was expecting “a higher level of wireline pricing competition” in the U.S. broadband market, and increased demand for datacenter connectivity.

In May, Bell Canada announced a joint venture with private equity firm PSP Investments that aims to take Ziply to 8 million total fiber passings at some point in the future. PSP agreed to potentially put down more than $1.5 billion toward the goal.

Bell Canada has a roughly 8 million-location fiber footprint in Canada, and Ziply would be its first foray into the United States. With Ziply expected to hit 2 million and the extra 6 million locations potentially added from the JV, executives said when announcing the JV they see the possibility for 16 million North American fiber passings.

That would put the company on par with major American wireless carriers, which are also working to expand their fiber footprints as fast as possible. AT&T has more than 30 million such passings, while Verizon now has about 25 million after closing its merger with Frontier.

T-Mobile is aiming for a more modest goal of up to 15 million fiber passings through two joint ventures of its own, which took over regional fiber providers Metronet and Lumos.

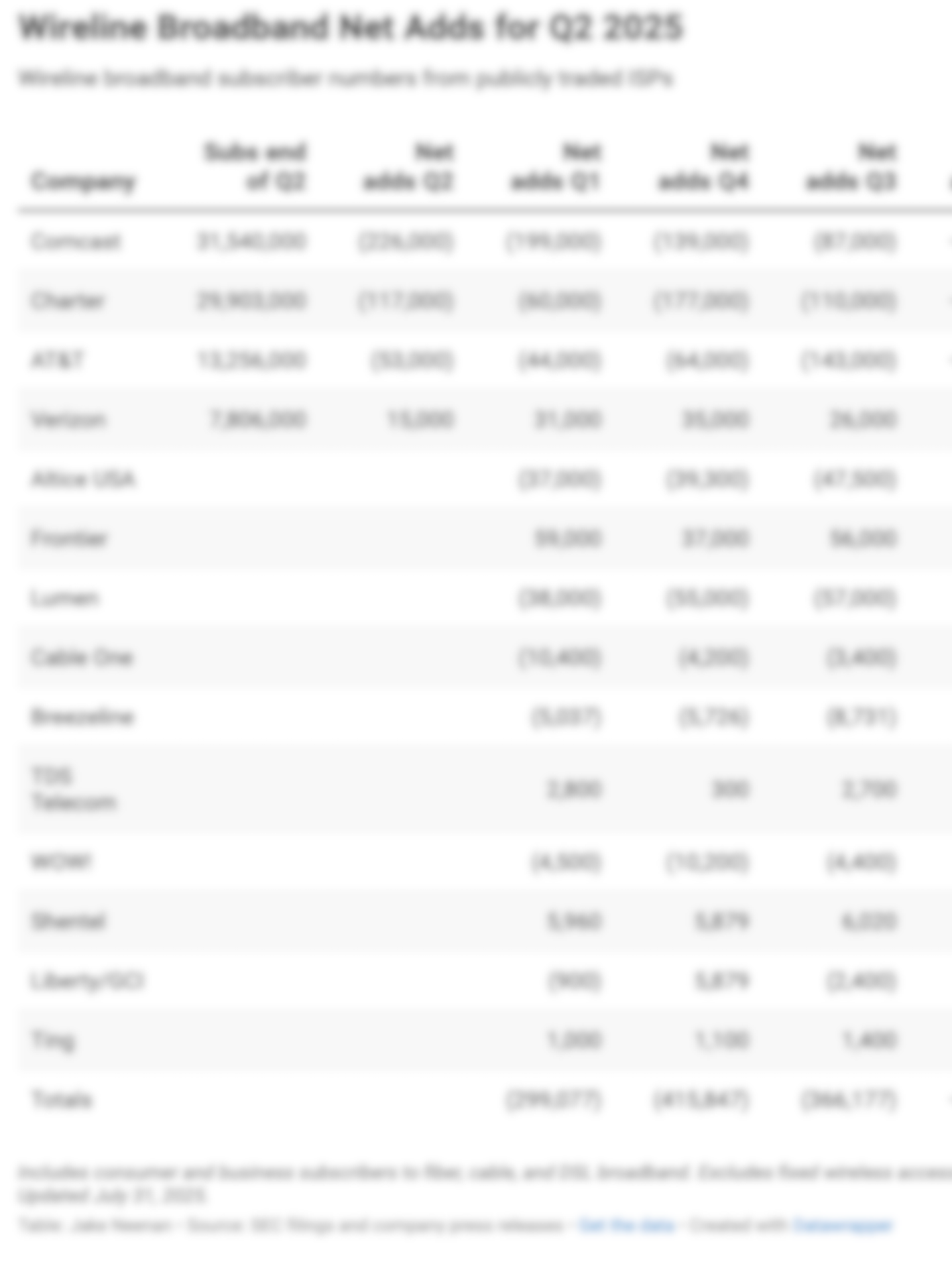

Fiber, along with fixed wireless also offered by the carriers, continued to take share in the American market in the second quarter, while cable continued to lose subscribers.

The cable giants and the major 5G providers are racing to offer bundled fixed and mobile broadband across their wireline footprints, which keeps customers around longer and produces better margins. Bell Canada doesn’t offer its own wireless service in the United States.

Member discussion