Cable One Testing Mobile Service

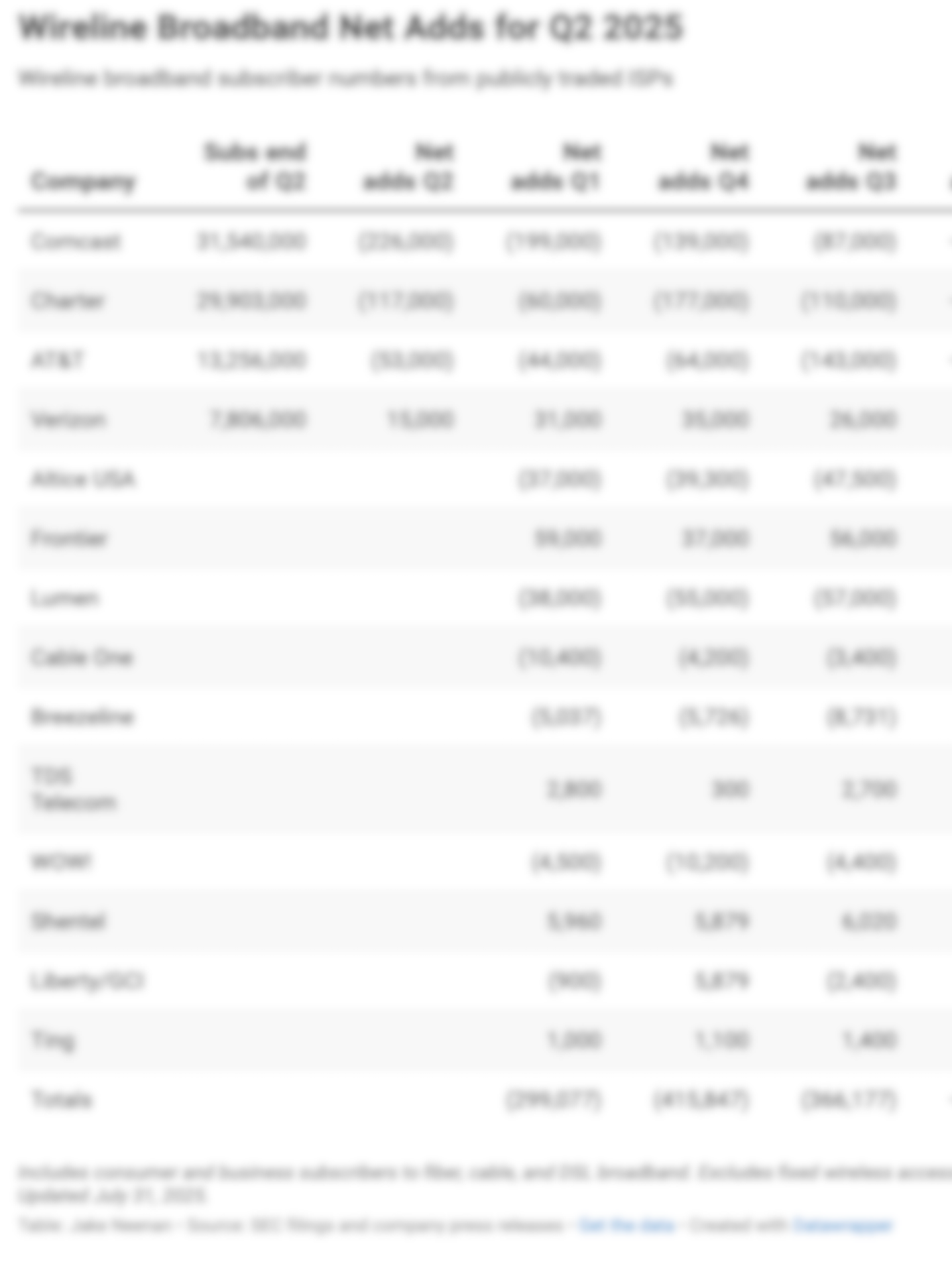

The cable operator lost 13,500 broadband subscribers in the second quarter.

Jake Neenan

August 1, 2025 – Cable One reported 13,500 lost broadband subscribers in the second quarter of 2025, more than analysts had expected.

Can't see the Earnings Chart? Know you need Breakfast Club? Get access for $590/year.

Executives said on the company’s earnings call Thursday that the loss was driven in part by promotional prices ending, the completed rollout of a new billing system, and seasonal churn.

Cable One CEO Julia Laulis said that despite the heavy losses, the company was “encouraged” that this quarter was better than the last. She noted in June specifically the ISP had better subscriber numbers than in June 2024, a first for this year.

The Phoenix-based cable operator now counts 1,031,300 residential and business broadband subscribers.

The company also announced it was piloting a mobile service, something cable giants Charter and Comcast have already been leaning into in an attempt to stave off losses of their own. Competition from fiber and fixed wireless as well as the absence of the Affordable Connectivity Program subsidy have been hitting cable companies hard over the last year.

Laulis said Cable One, like Charter and Comcast, would be looking to keep customers around and improve margins by offering bundled fixed and mobile broadband.

“We are encouraged by Cable One’s long overdue announcement that it has reached an agreement to pilot mobile service in several of its markets,” MoffettNathanson Senior Managing Director Craig Moffett wrote in an investor note. “We continue to believe that Charter’s, and now Comcast’s, wireless-first strategy offers the best available solution for fixing broadband pricing. By packing more value, Cable operators can fix its broadband relationship with customers while increasing stickiness in the bundle.”

He said that Cable One in particular would likely need to continue lowering prices too, though. While the company has introduced promotions to make its pricing more competitive, its average revenue per user – which increased again in the second quarter to $81.23 – still outpaces the cable giants and major fiber providers.

The company did not strike a deal with a wireless carrier directly to pilot its service, instead going through an unspecified third party. Charter and Comcast offer consumer wireless with Verizon infrastructure and, as of last month, mid-size business wireless plan through T-Mobile.

The cable giants together count 19.3 million mobile lines between them, with Charter leading at 10.8 million.

Laulis said she was retiring at the end of the year, or sooner if the company found a replacement before that.

Member discussion