Charter Down 117,000 Broadband Subs

That's more losses than Wall Street had expected.

Jake Neenan

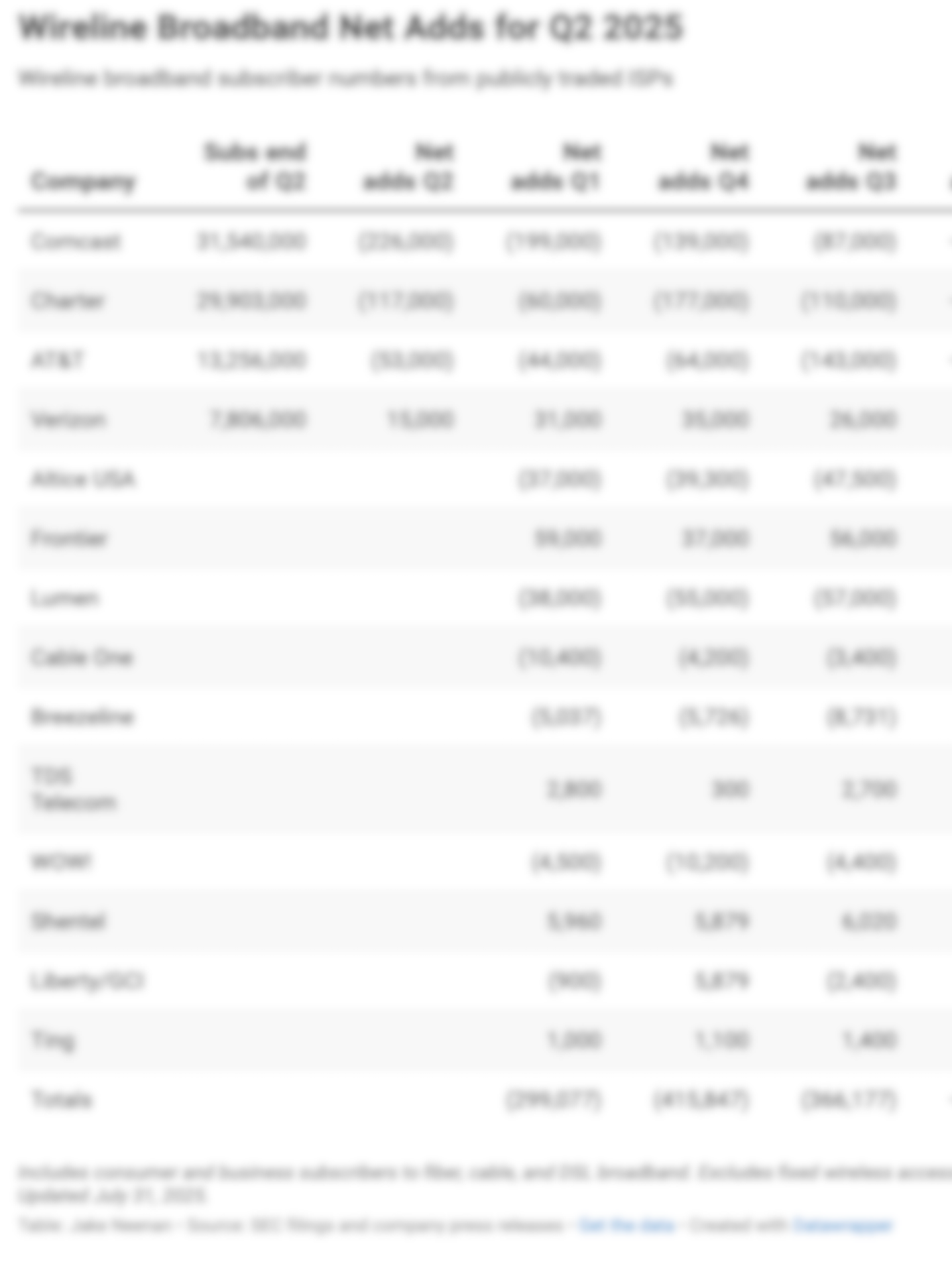

WASHINGTON, July 25, 2025 – Charter Communications reported 117,000 lost broadband subscribers in the second quarter of 2025, worse than the 74,000 Wall Street had been expecting but better than the same period last year.

Can't see the Earnings Chart? Know you need Breakfast Club? Get access for $590/year.

Charter CEO Chris Winfrey said on the company’s earnings call the drop was the result of continued competition from fixed wireless and fiber, plus higher levels of non-pay churn – people disconnecting after failing to pay their internet bill – in the wake of the Affordable Connectivity Program’s cancellation last year.

That’s both from customers who used to receive the subsidy and now have difficulty making payments and from new customers who would have qualified not receiving the subsidy and also struggling to make payments consistently, Winfrey said.

He said the broadband market generally was plagued by slow builds and customers reverting back to mobile-only subscriptions after the end of the ACP.

“You put all of those market movements, or in this case lack of market movements, together with a new competitor, even if it’s inferior, and it puts pressure,” he said, referring to the fixed wireless from the 5G carriers he has often bashed. “It’s not ideal.”

Still, with the ACP shut down in the rear view, Charter’s broadband numbers should improve year-over-year, MoffettNathanson Senior Managing Director Craig Moffett wrote in an investor note. He pointed to fixed wireless net additions remaining relatively stable in recent quarters.

“It’s too early to say what happened in the quarter for [fiber] – only Verizon and AT&T have reported thus far – but the results from fixed wireless access (FWA) certainly fit this pattern,” he wrote. “That fact pattern continues to suggest that the change in the market over the past year has not been heightened competitive intensity but instead has been the end of the ACP program.”

Charter added 123,000 subsidized rural passings in the quarter, which accounted for 47,000 new broadband subscribers. Executives said the company was still expecting a total of 450,000 new rural passings in 2025. The company has a total of more than 1 million such passings.

The cable operator added 500,000 new mobile lines, fewer than analysts had expected and fewer than the second quarter of last year. That brings the company to 10.8 million wireless customers, a number Charter will be looking to expand after its planned acquisition of Cox, which has a much smaller mobile service in its footprint.

Winfrey added the company was deploying its CBRS spectrum in 23 markets and had completed its first round of network upgrades in eight markets, allowing Charter to offer 2 * 1 gigabit per second plans in about 15 percent of its footprint. He said an upgrade to 5 * 1 Gbps was underway in another 50 percent of the footprint.

Along with Comcast, Charter recently inked a deal with T-Mobile to offer wireless service to mid-size business customers, which is limited under their consumer mobile virtual network operator (MVNO) deals with Verizon. Winfrey said the ability to offer bundled mobile and fixed broadband to more businesses was attractive in the same way converged services are for residential customers.

The cable giants have been leaning into those bundles amid continued subscriber losses, as they appear to keep customers around longer and have better margins.

“We expect Charter 2Q results to be viewed as disappointing, and would expect a negative reaction in the stock today,” KeyBanc analyst Brandon Nispel wrote in an investor note before the call. “Residential internet net adds came in below consensus, and the y/y trend was quite a bit worse than last year, adjusted for ACP impact. Residential mobile net adds also came in softer than expected.”

The company’s stock was down to $314 Friday morning, a more than 17 percent drop.

Tax reform

Charter CFO Jessica Fischer said the company expects tax reforms in the Republicans’ recently passed budget bill to generate “several billion” in free cash flow for the company over the next 5 years.

Member discussion