Comcast Down 226,000 Broadband Subs

The company posted its highest mobile gains ever with 378,000 new lines.

Jake Neenan

WASHINGTON, July 31, 2025 – Comcast reported 226,000 lost broadband subscribers in the second quarter of 2025, the most the company has seen since subscriber growth turned negative in 2022, but fewer than Wall Street had expected.

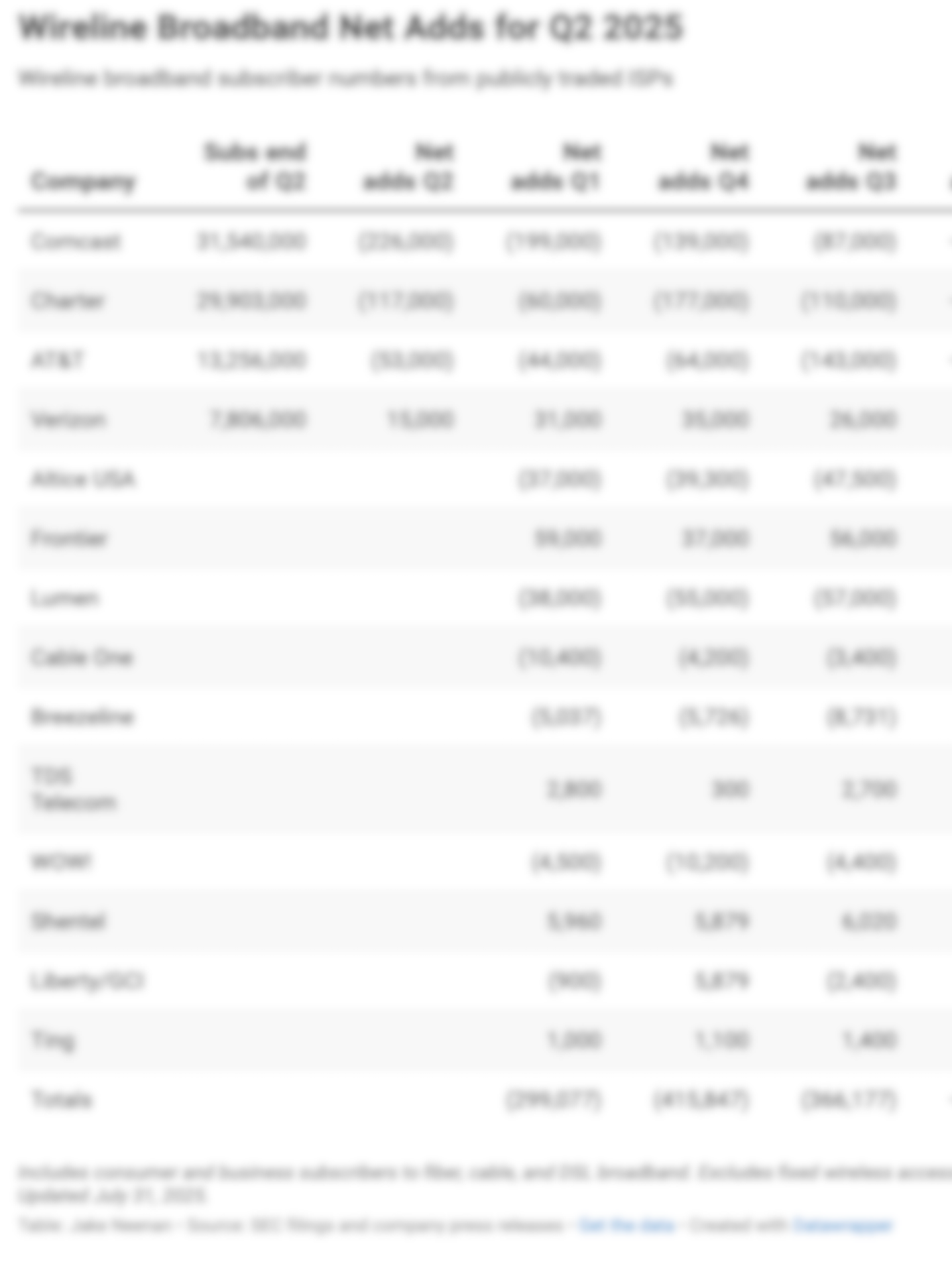

Can't see the Earnings Chart? Know you need Breakfast Club? Get access for $590/year.

The company introduced new pricing packages in the quarter, offering new customers one-year and five-year price locks, no data caps, and a free mobile line for one year. It’s an effort to address customer frustration over pricing and stave off broadband subscriber losses.

Comcast President Mike Cavanagh said on the company’s earnings call that the early reaction to the new pricing structure was encouraging, with half of eligible new customers taking the five-year price lock and a larger share of new customers choosing premium speeds. He added the company was seeing “stabilization” both in voluntary disconnects and in “overall connect activity in broadband.”

Fellow cable giant Charter’s stock tumbled after it reported 117,000 lost broadband subs, but analysts don’t expect Comcast to take a similar hit even after posting a weaker number because expectations were lower. The cable industry has continued to lose subscribers as subscriber additions for fixed wireless and fiber have stayed positive.

Charter executives pointed to non-pay churn – customers being disconnected after failing to pay their bill – as a headwind contributing to worse than expected losses. That owes in large part to the Affordable Connectivity Program running out of cash last year.

Comcast Cable CEO Dave Watson said the company saw a “slight uptick” in non-pay churn in the second quarter, but that it was “not material.”

New Street Research analyst Vikash Harlalka wrote in an investor note Thursday that households reverting to mobile-only broadband subscriptions after losing ACP support was still contributing to a slower overall broadband market. The national mobile-only share of subscribers has nearly bounced back from 7 percent to the pre-pandemic 11 percent, he wrote.

“It seems the subs switching to mobile-only were the same ones on subsidies previously,” he wrote. “The reversion of mobile-only to pre-pandemic levels is weighing on broadband market growth.”

Comcast is the largest ISP in the country, ending the quarter with 31,540,000 residential and business broadband subscribers.

Federal Communications Commission Chairman Brendan Carr, who has repeatedly criticized and investigated national news outlets, opened a probe Tuesday into Comcast NBCUniversal’s contracts with local TV stations. The inquiry did not come up on the call.

Mobile

Comcast posted 378,000 new mobile lines, the company’s best quarter ever and more than the 349,000 that analysts had been expecting. The cable giant now counts 8.5 million total mobile subscribers.

“While the market still cares about almost nothing other than broadband net additions, a strong argument can be made that the most important forward-looking metrics for Comcast’s Cable business are in wireless, not broadband,” MoffettNathanson founder Craig Moffett wrote in an investor note Thursday. “Comcast’s bet is that wireless will help defend broadband. We have no doubt that it eventually will. But wireless will also be a major revenue and profit driver for the company in its own right.”

Cavanagh said 14 percent of Comcast’s residential broadband subscribers were now on the company’s mobile service. Both Charter and Comcast have been leaning into their consumer wireless services, offered through a deal with Verizon, to stave off broadband losses and help entice new customers. Charter has 10.8 million wireless subscribers.

Comcast and Charter recently signed a separate mobile virtual network operator (MVNO) deal with T-Mobile allowing them to offer that service to mid-size businesses – those with fewer than 1,000 customers. The cable companies can only sign on very small companies under the Verizon deal.

Comcast CEO Brian Roberts noted business services makes up a quarter of the company’s connectivity business, generating $10 billion annually. He said the cable operator connects “more small businesses than anyone in the country” and has been seeing “strong traction with larger enterprises.”

“So it was very important for us to be able to use mobile in our relationships in the mid-market to win more share,” he said. “The relationship with T-Mobile allows us to now do that in ways that we haven’t been able to before.”

T-Mobile CEO Mike Sievert said last week the carrier wasn’t looking to compete with Verizon for cable’s consumer MVNO business.

Member discussion