FCC Seeks Comment on TDS-RiverStreet Deal

The first round of public comments is due on July 17 .

Ted Hearn

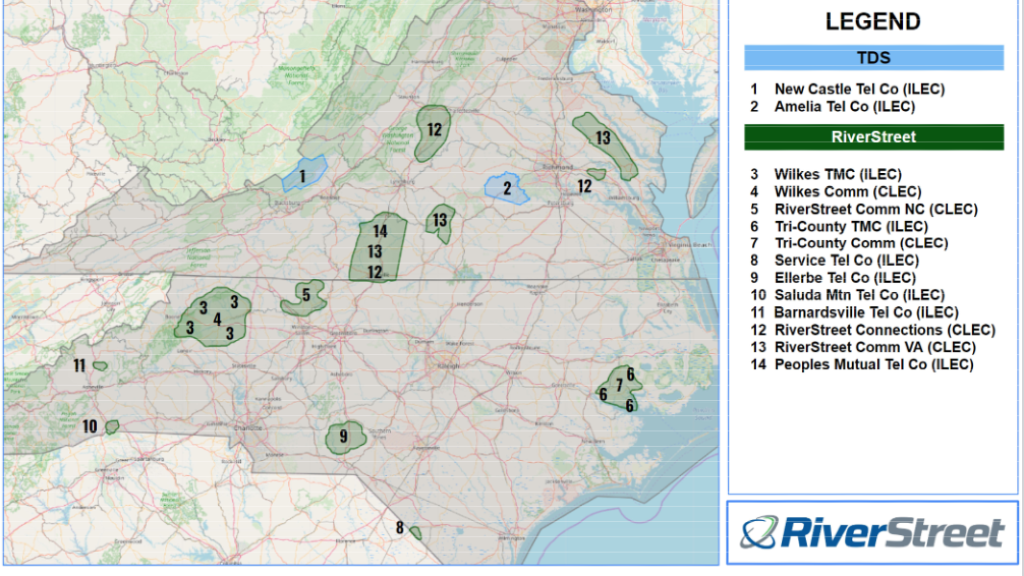

WASHINGTON, July 5, 2024 – Federal regulators are seeking public comment on the sale of two central Virginia communications networks from TDS Telecommunications to RiverStreet Management Services.

TDS has proposed selling Amelia Telephone Corp. and New Castle Telephone Co. to RiverStreet pursuant to a stock purchase agreement reached on May 31.

In a July 3 public notice, the FCC said public comments were due on July 17 and reply comments on July 24. The transaction was submitted to the agency on June 21.

In their application for approval, TDS and RiverStreet did not disclose the number of subscribers involved or the communications services provided by Amelia and New Castle. They did say that the transaction would not reduce competition.

In the public notice, the FCC said Amelia Telephone was an incumbent local exchange carrier and designated Eligible Telecommunications Carrier, and New Castle Telephone was an incumbent LEC and designated ETC.

“Both Licensees receive Universal Service Fund high-cost support in the form of Enhanced Alternative Connect America Cost Model and Connect America Fund Intercarrier Compensation support,” the FCC said. “Licensees also participate in the Lifeline program.”

The FCC cited TDS and RiverStreet as committing to remain in the Lifeline program following consummation of their transaction.

The Lifeline program provides a $9.25 discount on monthly internet bills for eligible low-income households. In 2023, the Lifeline program spent $869.9 million assisting 7.3 million subscribers, according to the Universal Service Administrative Co.’s annual report.

TDS Telecom is a wholly-owned subsidiary of Telephone and Data Systems. RiverStreet is a holding company organized as a North Carolina corporation and a subsidiary of Wilkes Telephone Membership Corp.

Member discussion