Fiber Still in Line for Two-thirds of BEAD Locations

Experts noted NTIA could still change states’ draft spending plans.

Jake Neenan

WASHINGTON, Sept. 2, 2025 – At least two more states reported their tentative grant winners under the Broadband Equity, Access, and Deployment program, bringing the total to at least 32.

Kentucky posted a draft of its final spending plan on Thursday, and Wyoming had posted its plan on Aug. 22. States have to accept public comments on the plans for at least one week before submitting them to the National Telecommunications and Information Administration for approval.

The deadline for that submission is Sept. 4, and NTIA told states to post plans “no later than” Thursday to meet that deadline. At least five have been given extensions and specified their new deadlines: California (Oct. 2), Texas (Oct. 27), Idaho (Sept. 25), Oregon (Sept. 18), and Illinois (Sept. 30).

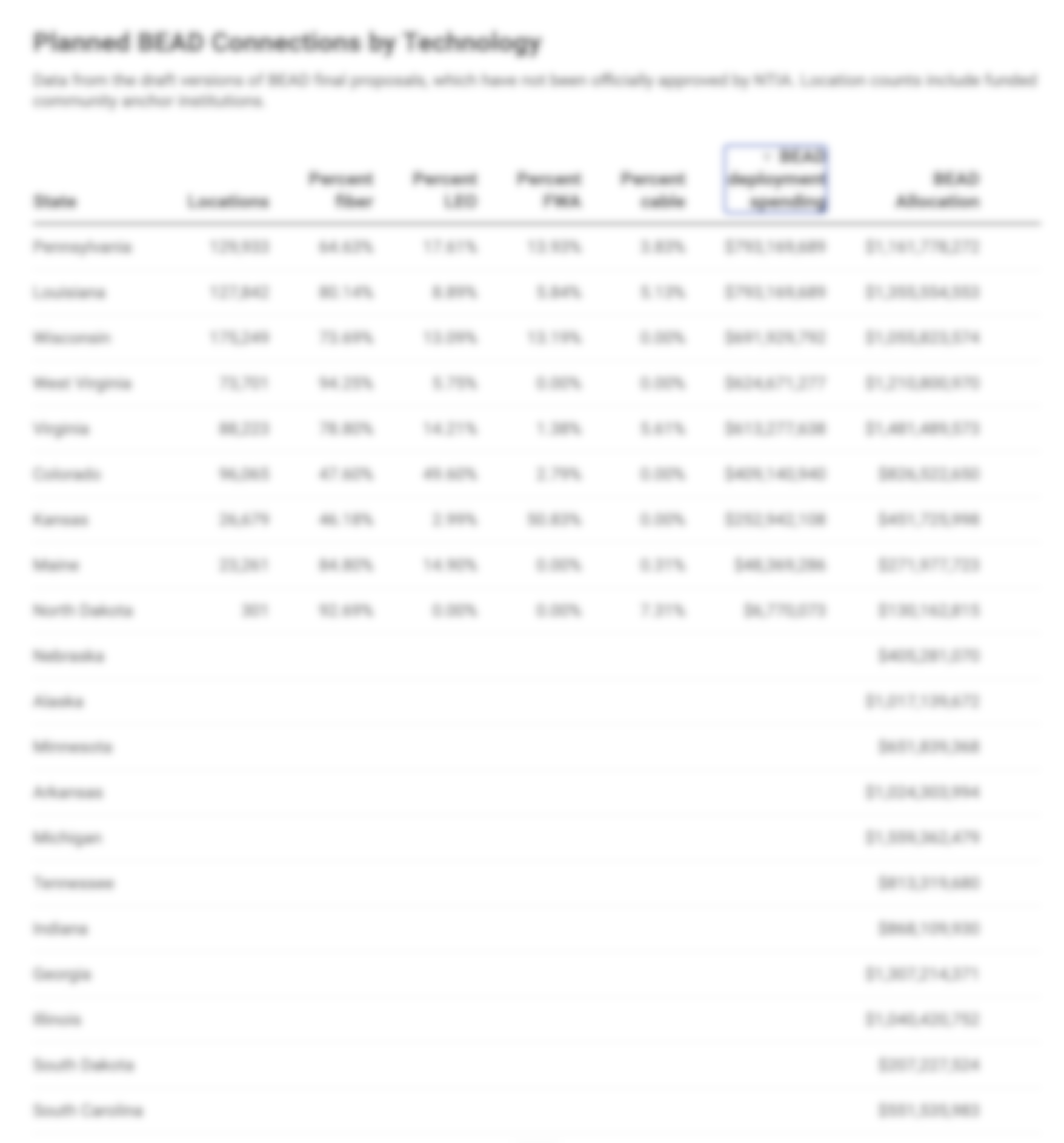

In an analysis of 25 of the states that have reported, New Street Research found most eligible locations were still going to fiber, 68 percent by their latest count, with satellite still at 18 percent and fixed wireless at 12 percent.

“Unless the remaining states over index on satellite or FWA, we don’t see the share of fiber changing dramatically from here,” New Street analyst Vikash Harlalka wrote in a research note Tuesday.

The Trump administration issued new rules for the program in June axing an explicit preference for fiber and making it easier for wireless ISPs to compete for BEAD grants on the basis of deployment cost, where fiber is at a disadvantage. States have still generally been determining that fiber is preferable for many of their locations and not prioritizing wireless applications.

Still, in the few states that had posted draft spending plans under the Biden administration, fiber’s share has diminished under the new rules while satellite’s has increased.

In Wyoming, most of the state’s nearly 39,000 eligible BEAD locations are slated for wireless service from BEAD. About 40 percent would get satellite, and more than 26 percent would get fixed wireless. More than 33 percent would get fiber.

In Kentucky, about 68 percent of the 86,000 BEAD-eligible locations are in line for fiber. Satellite companies would take another 25 percent, with fixed wireless taking much of the remaining 7 percent.

In terms of major national ISPs, Comcast was still in the lead with more than $745 million in total awards, with AT&T beginning to catch up at $514 million. Frontier was slated for $291 million, Verizon for $183 million, and Charter, a major RDOF participant, had tentatively won $160 million

“The biggest surprise in that list is AT&T,” telecom consultant Doug Dawson wrote in a Tuesday blog post. “Just a year ago, the company said it was still thinking about participating in BEAD.”

The satellite operators, Elon Musk’s Starlink and Amazon’s nascent Project Kuiper, were respectively in line for $227 million and $94 million.

“Both SpaceX and Amazon Kuiper have won more locations than any wired operator at 166k and 154k locations, respectively,” Harlalka wrote. “Their share of funding remains substantially lower.”

Awards not set in stone

Although states have to review their bidding results with NTIA before posting their plans to the public, those awards are still tentative until the agency gives its formal approval. The agency is aiming to approve those plans within 90 days of the Sept. 4 submission deadline.

“NTIA has allowed most states to go out to public comment and has stopped only those whose results it considered below some unstated line. But we don’t believe NTIA is done requiring more changes,” New Street policy adviser Blair Levin wrote in a Tuesday note. “Investors should keep in mind that the public comment draft is just the starting point of what will effectively be negotiations between NTIA and the states in the fall.”

It’s not clear whether Commerce Secretary Howard Lutnick will be satisfied with the cost savings states have so far delivered – states are reporting saving hundreds of millions on deployment due to fewer fiber projects and their eligible location counts decreasing – or call for more substantial revisions.

“NTIA could go along with State recommendations or could force States to award more money to ISPs with the lowest bids for funding, like the satellite companies,” Dawson wrote. “That’s something that we may not know for months.”

One of the satellite companies, SpaceX, has already asked NTIA to reject plans from at least Louisiana and Virginia, where the company says it should have won even more locations under the Trump administration’s new framework.

In those cases, Levin has said NTIA would likely have already stepped in if it agreed that SpaceX should have won nearly every location in the two states.

It’s also not clear what will happen to the money states are saving. The Biden administration allocated BEAD money on a state-by-state basis in 2023, and New Street found states planning to spend 44 percent of their collective allocations so far.

NTIA rescinded approval for any non-deployment activities in June and said that more guidance on that front would be forthcoming. The agency doesn’t appear eager to fund many of those.

“This is a deployment program. It’s not a non-deployment program,” NTIA Chief of Staff Brooke Donilon said at the Mountain Connect conference in August. “We’re going to deliver on the benefit of the bargain, and we will figure out how much we have for non-deployment. Until we know how much money we’re talking, it’s hard to talk about the policy.”

Member discussion