Fixed Wireless Subscriber Growth Solid in Q2

Some companies expressed concerns that the mass transition to fixed wireless could lead to future spectrum limitations.

Jericho Casper

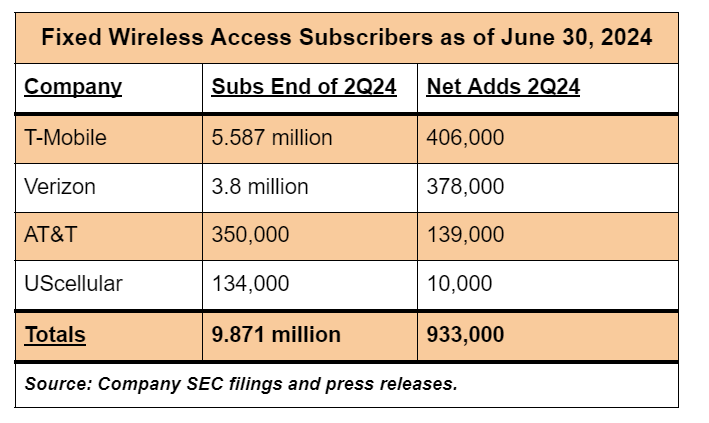

WASHINGTON, August 5, 2024 – Providers of fixed wireless access service experienced notable new subscriber growth in the April-to-June quarter, with 933,000 customers across the United States embracing the fast-growing service.

In all, the four most closely watched fixed wireless providers combined added 54,000 subscribers sequentially.

T-Mobile led the sector, adding 406,000 new FWA subscribers in Q2. This brought the company’s total fixed wireless subscriber base to 5.587 million, solidifying its position as the overall subscriber leader in the fixed wireless market.

“Our customers love this product,” T-Mobile CEO Mike Sievert told investors last week.

Verizon was not far behind, adding 378,000 fixed wireless subscribers in Q2, marking the business segment’s best quarterly result to date. Verizon ranked as the second-largest fixed wireless provider, with a total of 3.8 million subscribers.

Showing steady growth, AT&T announced it gained 139,000 new fixed wireless subscribers in Q2, bringing its total fixed wireless customer base to 350,000 subscribers. Meanwhile, UScellular added 10,000 fixed wireless customers during the same period, to bring its total subscriber count to 134,000.

The rapid expansion of fixed wireless service contrasted with the struggles of major cable broadband providers, with some announcing record quarterly losses in the second quarter.

Some cable companies suggested that the mass transition to fixed wireless would lead to spectrum limitations, which may cause wireline broadband to gain increased popularity in the future.

On a July 26 earnings call with Wall Street analysts, Charter Communications CEO Christopher Winfrey continued to belittle fixed wireless technology, calling it "cell phone Internet" destined to fall by the wayside.

A recent report by MoffettNathanson indicated that the C-Band – the spectrum band Verizon and AT&T rely on to deliver 5G fixed wireless service – was experiencing propagation issues, raising concerns about the band's effectiveness.

Although the C-Band was initially praised for its favorable propagation characteristics for fixed wireless service, the band may not perform as expected based on the new findings

When Verizon CEO Hans Vestberg was asked two weeks ago if the company had enough capacity to keep pace with demand for its fixed wireless broadband service provided with excess 5G capacity, he responded “around 50 percent of all our traffic is now on C-band, so we have a ways to go.”

Member discussion