House Bill to Make Broadband Grants Non-Taxable Introduced

Sen. Mark Warner said last month he is working to pass a companion bill by year’s end.

David B. McGarry

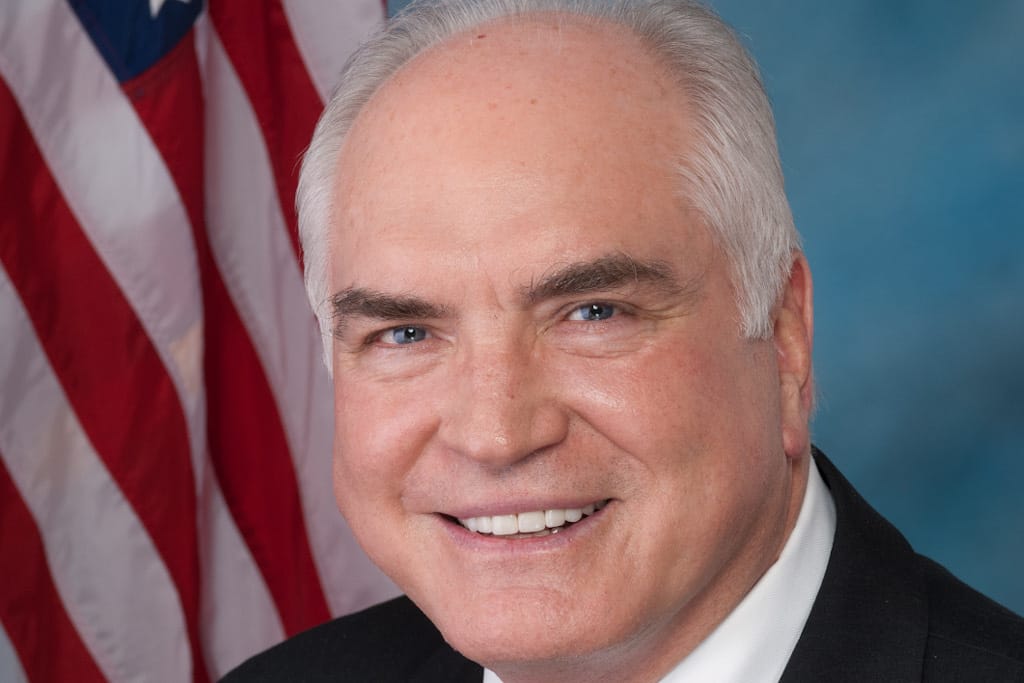

WASHINGTON, December 7, 2022 – Reps. Mike Kelly, R-Penn., and Jimmy Panetta, D-Ca., on Wednesday introduced the Broadband Grant Tax Treatment Act, the companion of a Senate bill of the same name, which would make non-taxable broadband funding from the Infrastructure Investment and Jobs Act and the American Rescue Plan Act.

The bill’s supporters say it will increase the impact of Washington’s broadband-funding initiatives, the largest of which is the IIJA’s $42.45 billion Broadband Equity, Access, and Deployment program. The IIJA allocated a total of $65 billion toward broadband-related projects.

Kelly said the proposal “ensures federal grant dollars, especially those made available to local governments through pandemic relief funding, will give constituents the best return on their investment.”

“This legislation allows for existing grant funding to be spent as effectively as possible,” Kelly added.

Sen. Mark Warner, D-Va., sponsored Senate’s version of the bill in September and said last month he is working to push it through by year’s end.

“Representative Panetta’s and Kelly’s bill to eliminate the counter-productive tax on broadband grants is right on the money,” said Jonathan Spalter, president and CEO of trade group US Telecom. “Closing the digital divide in America – especially in our hardest-to-reach rural communities – will require every cent of the $65 billion Congress has dedicated for that critical purpose.”

Member discussion