Lumen Reports Over $900M in Q2 Losses

Some investors panic even as most losses come from special items.

Cameron Marx

WASHINGTON, July 31, 2025 – For anyone wondering if it was possible for a company to lose nearly $1 billion in three months, Lumen has an answer for you.

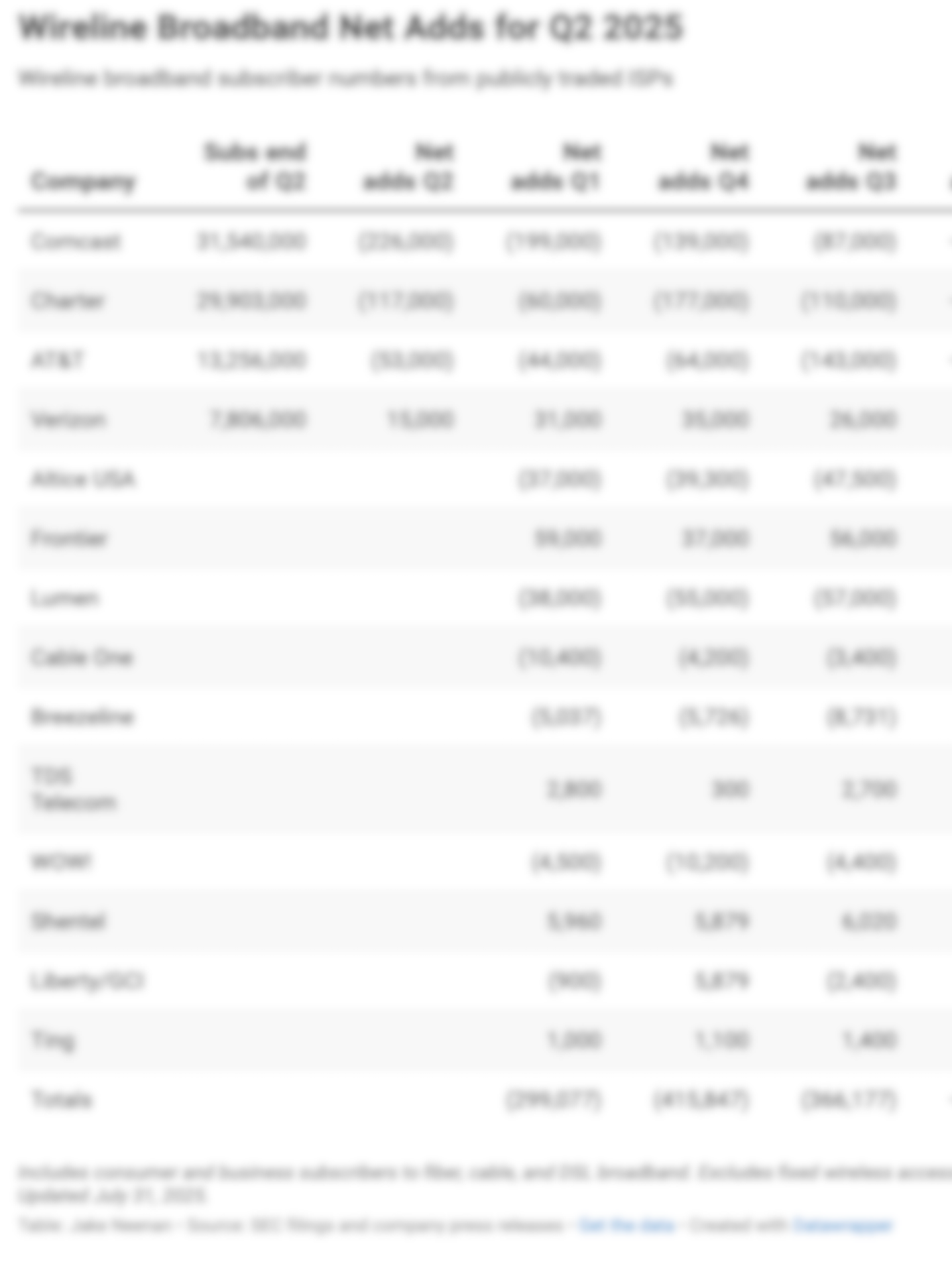

Can't see the Earnings Chart? Know you need Breakfast Club? Get access for $590/year.

The internet-service provider announced Thursday afternoon that it had sustained losses totalling $915 million in Q2. That prompted its stock to take a nosedive after markets closed, dropping nearly 7.5 percent before recovering slightly to $4.25 a share as of 5:30 PM ET, $0.20 lower than at closing. The diluted loss per share was $0.92 in the quarter, compared to a loss of $0.05 per share in Q2 2024.

Most of the company’s losses came from accounting changes tied to the sale of its fiber-to-the-home business to AT&T for $5.75 billion – not from money actually spent.

The company wrote down $628 million in value after selling approximately 95% of its home internet division, Quantum Fiber. An additional loss of $236 million resulted from the company restructuring its debt, and it was also forced to return $46 million in funds from the Rural Digital Opportunity Fund.

Excluding these and other special items, the company suffered a net loss of only $29 million, significantly better than the $124 million net loss it suffered a year ago when excluding special items.

Lumen’s adjusted EBITDA, or core earnings before debt, taxes, etc., was only $725 million, noticeably less than the $875 million EBIDTA it posted in Q2 2024.

Revenue was down slightly, from 3.268 billion in Q2 2024 to 3.092 billion today, $20 million short of expectations. Still, the company posted an adjusted loss of just 3 cents per share, beating investor expectations by $0.24.

Kate Johnson, president and CEO of Lumen, framed the Q2 results as part of the company’s larger strategic shifts.

“Our second quarter results underscore the momentum of our transformation strategy and the discipline of our execution,” Johnson said. “We are delivering on our financial milestones and building a stronger, more modern company. With the sale of our consumer fiber business, successful debt refinancing, and continued modernization gains, we’re laying our foundation for future revenue growth – we are playing to win.”

The company successfully completed a $2 billion bond offering in Q2, extending maturities to 2033 and reducing its annual interest expenses by roughly $50 million. It adjusted its Free Cash Flow outlook from $700-$900 million to $1.2-$1.4 billion, while keeping its outlook for its Adjusted EBITDA, Net Cash Interest, and Capital Expenditures the same.

Member discussion