Pressed by House Committee on Buy-Side Restrictions, Robinhood CEO Says, ‘Look, I’m Sorry!’

February 21, 2021 – “Look, I’m sorry.” That’s what Robinhood CEO Vladimir Tenev said to those who lost money in the stock frenzy surrounding GameStop that began in late January. The virtual hearing got off to a tense start. House Financial Services Committee Chairman Maxine Waters, D-Calif., grille

Derek Shumway

February 21, 2021 – “Look, I’m sorry.”

That’s what Robinhood CEO Vladimir Tenev said to those who lost money in the stock frenzy surrounding GameStop that began in late January. The virtual hearing got off to a tense start.

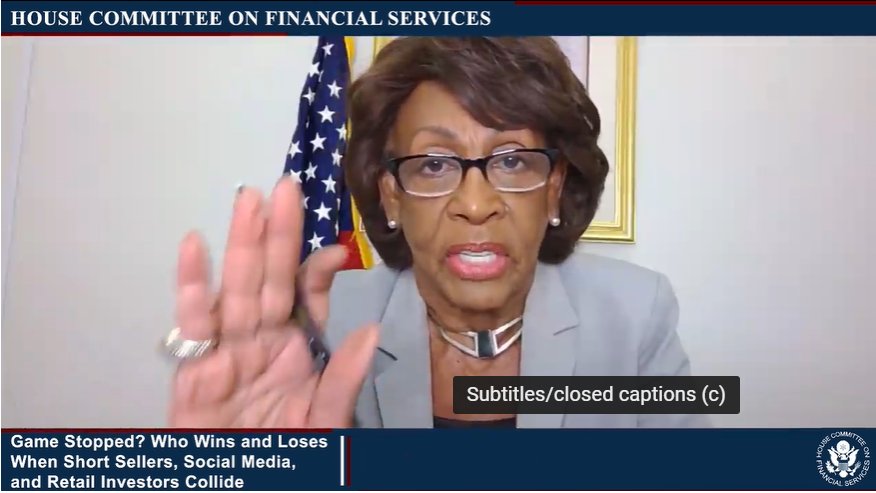

House Financial Services Committee Chairman Maxine Waters, D-Calif., grilled Tenev and other chief executives involved in stock spectacle.

Both Democrats and Republicans on the committee pressed Tenev to explain why he authorized Robinhood to prevent its users from buying into GameStop stock and other popular meme stocks.

The actions, causing outrage for allegedly protecting large hedge funds against small investors, were probed throughout the hearing titled “Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide.”

Robinhood’s explanation

Rep. Patrick McHenry, R-N.C., asked Robinhood why it restricted the buying but not the selling of GameStop. Further, he said, why did traders get locked out of the buy side only?

Tenev replied that restricting GameStop and other securities was driven purely by depositing collateral requirements imposed by its clearing houses.

Tenev said there was no other choice but to impose restrictions. He said he sympathized with investors who lost money after GameStop stock fell from its record highs once the buying frenzy ended.

He warned that it would have been “significantly worse” if Robinhood equally prevented its users from selling the stock as well after a frenzy that began on the social media site Reddit.

Rep. Carolyn Maloney

Rep. Carolyn Maloney, D-N.Y., said that Robinhood’s actions to halt buying of certain stocks didn’t just cause confusion and anger, but undermined investor confidence in fundamental fairness.

She asked if Robinhood owed users more disclosure and transparency, and if Robinhood’s “lack of candor” with its customers may have led to wild speculation In reply, Tenev said, ”Look, I’m sorry for what happened.”

While Robinhood did not do everything perfect, it commits to improve and learn from this to prevent similar mistakes in the future, said Tenev.

In particular, she targeted Robinhood’s customer agreement, noting the vague wording regarding when the company can restrict trades.

She said that there was no language whatsoever that mentions clearing house deposit requirements Robinhood is allegedly obligated to meet, other than “volatility” being mentioned.

Citadel

Citadel CEO Kenneth Griffin, said that his company had no role in Robinhood’s decision to limit trading in GameStop or any other stock. He only became aware of Robinhood’s trading restrictions the same time the public was made aware, he said.

Citadel bet GameStop shares would fall but suffered when the shares rose because millions of small investors began buying up the stock. Citadel’s losses were not nearly as badly as another hedge fund, Melvin Capital, which took a $2 billion investment from Citadel and some of its employees to shore up its finances.

Melvin Capital

Echoing Citadel, Melvin Capital also pleaded innocence from placing pressure on Robinhood to restrict trades. Melvin Capital Management CEO Gabriel Plotkin, said he was “humbled by these unprecedented events,” and expressed regret for those who lost money.

He also said that Melvin Capital played no role in these trading decisions! Melvin closed out its positions in GameStop days before the trading restrictions went into effect.

There was no evidence of market manipulation in this specific case surrounding GameStop, said Reddit CEO Steve Huffman. He defended Reddit moderators, who are not paid employees.

He said Reddit had an “anti-evil” team composed of engineers, data scientists, and other specialists whose focus is to ensure site integrity and protect against manipulation and spam, among other things.

Huffman did say that the popular thread called WallStreetBets, responsible for fueling the GameStop frenzy, was indeed a real community of users that supports its members who lose money as fast as it congratulates them for their successes in the stock market.

Roaring Kitty relishes the attention

Keith Gill, one of the most influential voices that pushed GameStop on the WallStreetBets Reddit forum, also testified and said he was happy to talk about his GameStop stock purchases. He is believed to have made millions as a result of his investment in GameStop which has enraged others who believe he deceptively manipulated the market in his favor with GameStop via Reddit.

Gill clarified that he was first and foremost “not a cat, not an institutional investor, and not a hedge fund.” He maintained he has no clients and does not provide any personalized investment advice for fees or commissions.

“I’m just an individual whose investment in GameStop and post on social media were based upon my own research and analysis,” he said. He worked for Mass Mutual in the past.

Stocks often trade higher or lower, said Cato Institute

Stocks often trade at higher or lower levels than what formal analysis or fundamentals may claim is best, said Jennifer Schulp, director of financial regulation studies at the Cato Institute. Even as GameStop might still be trading at a higher than fair valuation, it is no cause for concern as “markets are no strangers to bubbles.”

“I cannot opine on whether any regulatory changes are warranted on this incomplete record,” she said. “By no means, though, should these events lead to restrictions on retail investors’ access to the markets.”

Member discussion