Winfrey Buys $1 Million of Charter Shares

The cable giant's stock took a hit last week after worse than expected broadband subscriber losses.

Jake Neenan

WASHINGTON, August 4, 2025 – There’s an old saying on Wall Street: Investors have a thousand reasons for selling a stock, but only one reason for buying. They think it’s cheap.

Can't see the Earnings Chart? Know you need Breakfast Club? Get access for $590/year.

Charter CEO Chris Winfrey purchased $1 million of the cable operator’s stock on Thursday. The purchase came after the company’s stock price tumbled in the wake of disappointing broadband subscriber losses, and came on the same day that Charter’s shareholders approved the company’s pending acquisition of Cox Communications.

Winfrey bought 3,670 shares Thursday at $273.095 each, for a total price of $1,002,258.65, according to a filing with the Securities and Exchange Commission. He now directly holds 70,243 shares, worth about $19.2 million.

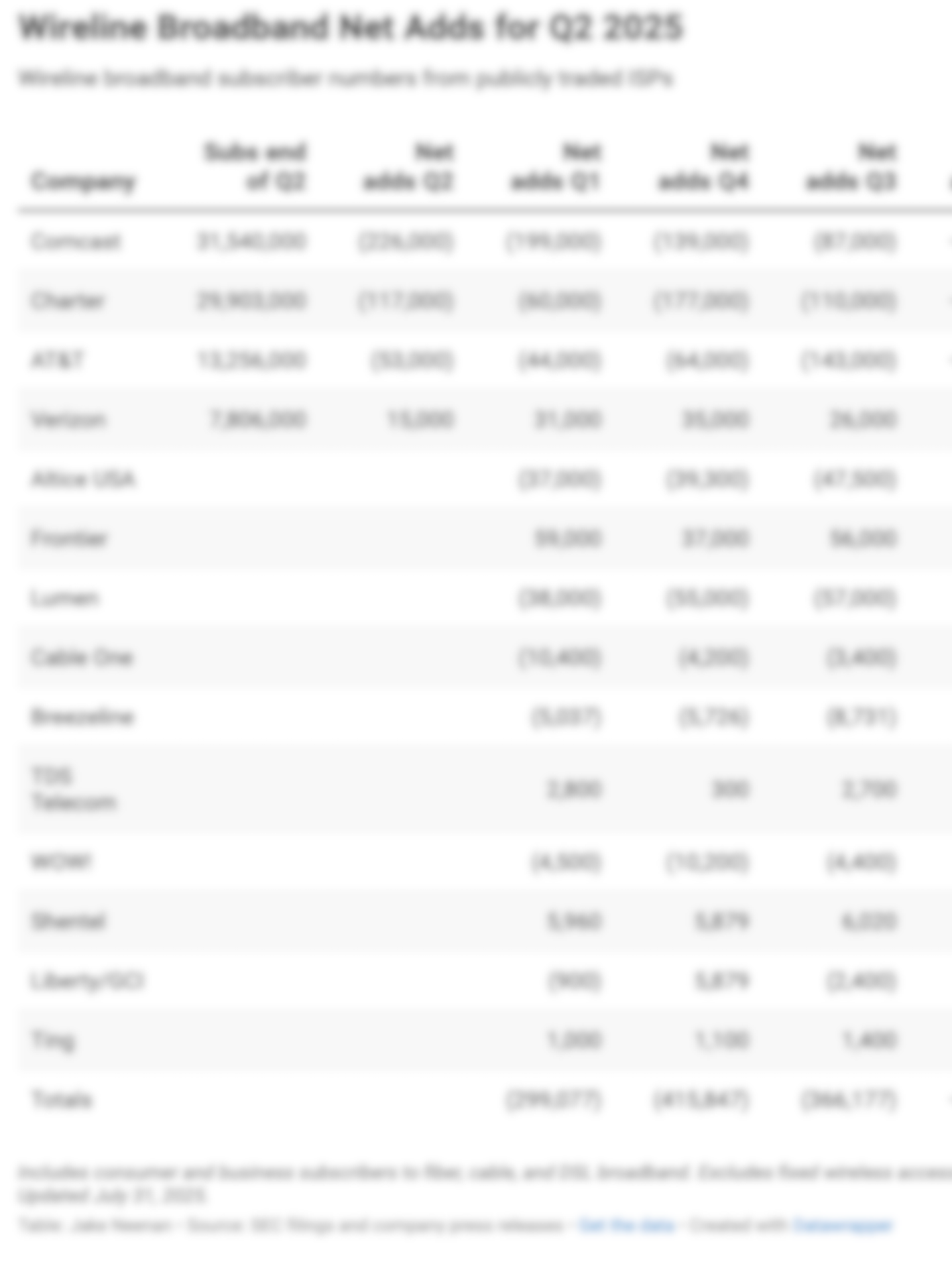

Charter’s stock was down more than 35 percent in the last 30 days, hitting $261.51 on Monday. Much of the drop came after the company reported 117,000 lost broadband subscribers in the second quarter, worse than the 74,000 Wall Street analysts had estimated.

The heavier-than-expected losses rattled investors, as did recently disclosed revenue information about Cox showing the company’s prices were higher than publicly traded ISPs’ – the cable industry has been scrambling to make prices more competitive to stave off losses to fiber and fixed wireless.

Winfrey was apparently still confident, though. Analysts have also been positive about the company’s prospects, if only because free cash flow is expected to increase as Charter’s rural builds and network upgrades finish up.

The company’s mobile service, offered to consumers through a deal with Verizon and now to mid-size businesses through a new deal with T-Mobile, is continuing to grow, though the rate is getting slower. It reached 10.8 million lines last quarter after adding 500,000 new lines.

Expanding that mobile service, which MoffettNathanson Senior Managing Director Craig Moffett called “Charter’s most important growth engine,” into Cox’s 12.3 million-passing footprint will be key both for growing the service and bringing Cox’s revenue per user down through bundles.

Cox offers a mobile service, but it has very few subscribers. Charter and Comcast have been leaning on fixed and mobile broadband bundles, which the major wireless carriers are also pushing, to make their plans more competitive.

“In their quarterly investor presentation, Charter makes its value proposition clear: Charter offers customers (by far) the lowest bundled price (yes, even versus FWA),” Moffett wrote in an investor note after the company’s earnings call. “This is, in a nutshell, the strategy to address Cox’s broadband ARPU problem.”

Charter is the second largest ISP in the country, with 29.9 million subscribers. It would overtake Comcast for the top spot after the merger with Cox, which has about 5.9 million broadband subscribers. The deal is expected to close in mid-2026.

Correction: A precious version of this article said Charter's board, rather than its stockholders, approved the Cox acquisiton on July 31. Charter's board of directors was already in favor of the deal.

Member discussion