AT&T Adds Over 200K Internet Air Customers in Q2

Fiber base also grows by 243K as company ramps up investments

Cameron Marx

WASHINGTON, July 23, 2025 – For the first time in company history, AT&T added over 200K customers in a single quarter to its Internet Air Fixed Wireless Service and now has over one million net air subscribers.

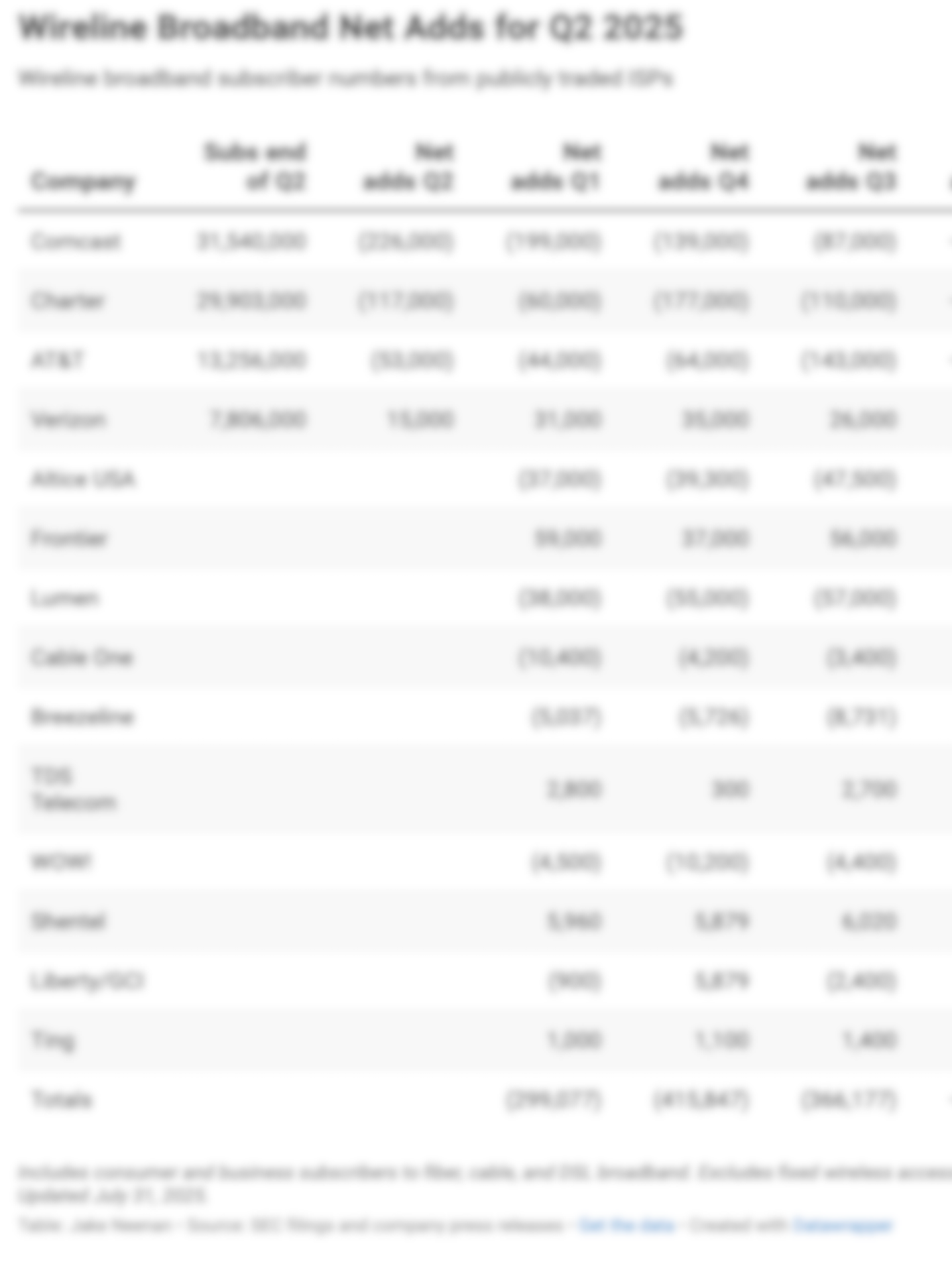

Can't see the Earnings Chart? Know you need Breakfast Club? Get access for $590/year.

That addition of 203K Internet Air customers headlined a relatively strong quarter for the telecommunications company. Overall revenue rose from $30.6 billion in Q1 to $30.8 billion in Q2 and surpassed the Zacks Consensus Estimate by 1.02 percent. Adjusted earnings per share, excluding DIRECTV, rose from $0.51 in Q1 to $0.54 in Q2, and beat the Zacks Consensus Estimate by $0.03 a share.

Though AT&T added an additional 401K postpaid phone users in Q2, up significantly from the 324K it added in Q1, and cracked $57 average revenue per user for postpaid customers, its churn rate also rose from 0.83 percent to 0.87 percent. That had some investors worried, though company executives attempted to mollify those concerns on the company’s Wednesday morning earnings call.

Fiber deployment was relatively strong in Q2, with the company adding an additional 243K fiber customers. Fiber revenue grew 18.9 percent year-over-year, similar to the 19 percent growth seen in Q1.

AT&T execs said the company was updating its fiber deployment projections in light of the passage of the recent reconciliation package. AT&T’s CFO Pascal Desroches explained that the company expects to realize $6.5 to $8 billion in cash tax savings from 2025-2027, much of which will be spent on additional fiber deployment.

The company told investors that it would spend an additional $500 million in capital investment in 2025 and an additional $3 billion in 2026 and 2027 combined. These investments were expected to yield a run rate of an additional 4 million new fiber locations per year by the end of 2026.

AT&T also said they would be contributing $1.5 billion more to their employee pension fund by the end of 2026 as a result of its tax cuts.

AT&T Chairman and CEO John Stankey was optimistic about the company’s future.

“Investment and policy tailwinds are as strong as I can remember since maybe the Telecommunications Act of 1996,” he told investors Wednesday morning.

Net debt increased slightly, from $119.1 billion in Q1 to $120.3 billion in Q2. AT&T attributed this debt increase to the weakening of the U.S. dollar. The company also reported $1 billion in share repurchases in Q2.

AT&T continues to phase-out copper lines, and informed investors that it had filed a petition with the Federal Communications Commission to discontinue service for 10 percent of its remaining wire centers in 17 states. It also reported $4.5 billion in Business Wireline revenue, flat compared to Q1, but down 9.1 percent year-over-year, as the company continues its transition from legacy systems to next generation technology.

The company’s revenue growth projections remained relatively unchanged from Q1. It now expects to grow its mobility service returns 3 percent or more, up from the higher end of the 2-3 percent range. It also expects its consumer fiber broadband revenues to increase by an amount in the mid-teens, down from the mid-to-high-teens projection in Q1. Adjusted EBITDA Growth remained at 3 percent or better.

AT&T’s overperformance relative to expectations stands in stark contrast with Verizon, which reported on Monday that it had lost 51,000 consumer postpaid phone lines and added only 32,000 fiber customers in Q2. Though AT&T’s stock initially dipped upon the release of its report, by 11:00 AM ET it had fully recovered and was trading slightly above its previous close.

Member discussion