BEAD Plans Released for Washington, Kansas, Maine and Wisconsin

Six of the 10 states releasing draft BEAD proposals plan on more than 70% fiber

Jake Neenan

WASHINGTON, August 25, 2025 – More states have published drafts of their final spending plans under the $42.45 Broadband Equity, Access, and Deployment program: Maine, Wisconsin, Kansas, and Washington.

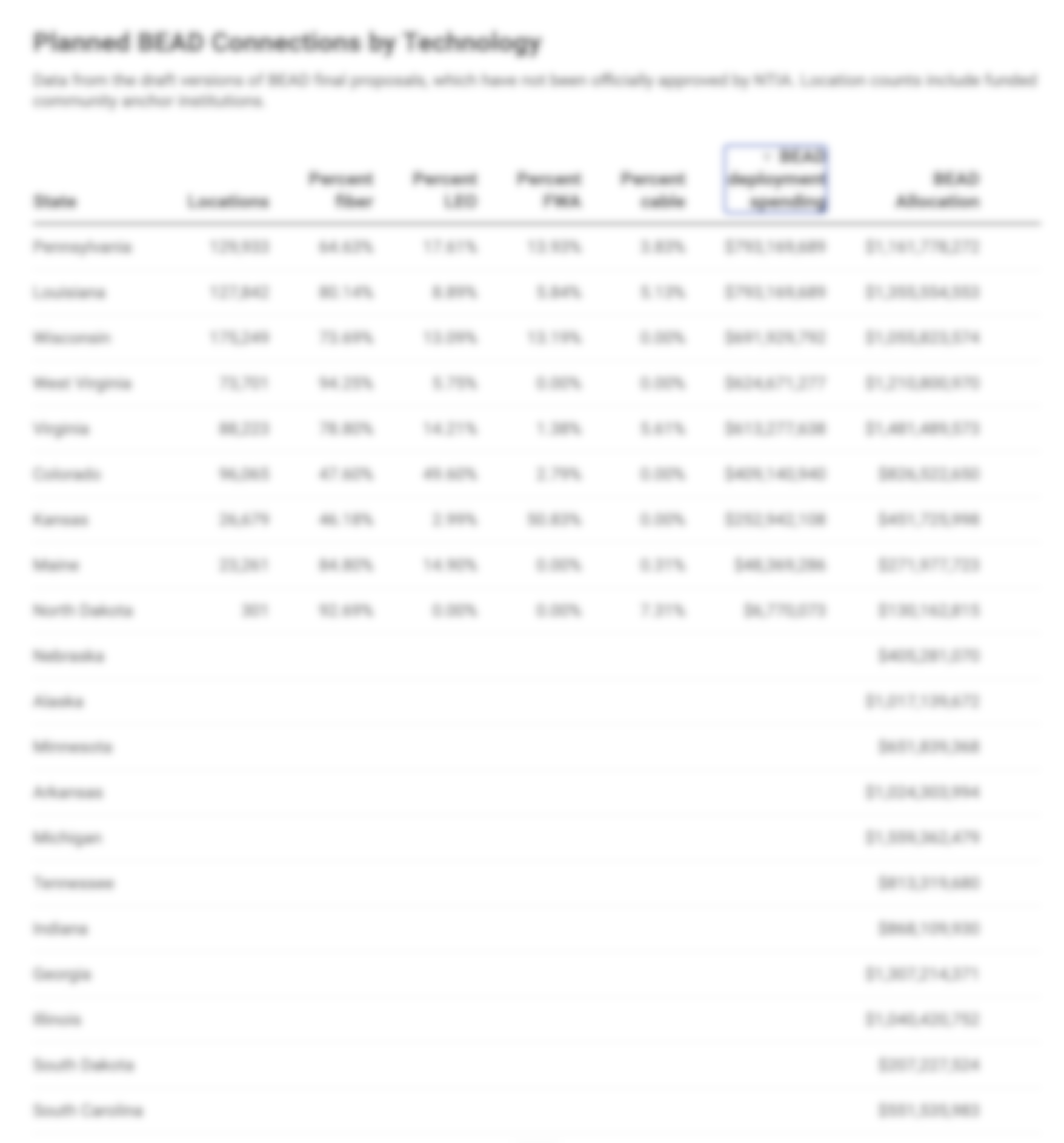

Broadband Breakfast is tracking the planned BEAD Connections by Technology in every state and territory.

That makes at least 10 states that have reached the milestone. They’ll accept public input for one week each before submitting finalized versions to the National Telecommunications and Information Administration for approval, the final step before states can begin funding projects under the program. States have until Sept. 4, 2025 to submit their plans, aside from Texas and California, which were granted extensions.

Maine and Wisconsin are aiming to get fiber to most of their eligible homes and businesses, at about 84 percent and 74 percent respectively. Kansas and Washington are looking at about 46 percent and 36 percent fiber coverage respectively.

Kansas and Washington have more fixed wireless and satellite in the mix: Kansas is looking to serve most of its non-fiber locations with fixed wireless, and Washington is planning on about 26 percent of its eligible locations getting satellite service and about 38 percent getting fixed wireless.

The four states said they would secure coverage for all of their eligible homes and businesses.

The Trump administration issued new rules for the program in June, rescinding federal approval of three states’ spending plans and mandating a new round of bidding. The new policy eliminated an explicit preference for fiber and made it easier for other technologies like satellite to compete on the basis of deployment cost, where fiber is at a disadvantage.

6 of the 10 states releasing draft BEAD proposals plan on more than 70% fiber

Of the states that have released draft plans so far, many are still leaning on fiber. Six of the 10 are planning on more than 70 percent of their eligible location ultimately being served with fiber.

Exactly how much BEAD money gets shifted from fiber to satellite depends on how states classify priority broadband projects.

That determination, which gets applicants first dibs on a given area, was limited to fiber under the Biden administration, as officials determined only fiber met the statutory requirement to easily scale for future technology needs. The Trump administration asked states to make the call on an application-by-application basis, opening the door for fixed wireless and satellite projects to request the designation and, if they received it, compete on the basis of cost with fiber projects.

Washington in its final proposal said that when evaluating satellite and wireless applications it considered the topology and tree cover of an area, which can affect signal strength. It said scalability being “dependent on yet unproven emerging technologies” would cut against an applicant.

Elon Musk’s SpaceX has taken issue with draft BEAD spending plans posted by Virginia and Louisiana, urging the NTIA to reject them on the grounds that SpaceX should have been deemed priority in more places.

Satellite expected in western states

It was not a surprise that the western states have lower proportions of their location being served by fiber, according to New Street Research policy advisor Blair Levin.

“We think there will be a big difference between states in the eastern US (particularly in the Southeast) and the states in the western US (particularly in the mountain west.),” he wrote in an investor note Thursday.

That’s both because of the western states’ more sparse populations and the NTIA’s focus on lowering deployment costs. The agency hasn’t instituted a formal cap on per-location spending, but Levin noted states have so far tended to select projects under $10,000 per location.

“As a result, the mountain states will simply have to rely more on satellites, even if they had a sufficient budget for wireline in more places,” he wrote.

Even if they’re losing locations, fiber providers are still taking home the lion’s share of BEAD funding so far.

Some eastern states that have released plans to get fiber to most of their eligible locations, like West Virginia and Louisiana, have Republican governors, which Levin said makes it unlikely the NTIA will entirely block them and others from going that route, even though SpaceX has asked them to.

States also have frequent contact with NTIA throughout the project selection process, and are required to meet with the agency before posting drafts of their final proposals for public comment. Levin said if NTIA were opposed to any of the published plans, it would have stepped in earlier in the process.

Member discussion