Cable Unlikely to Grow Subscribers This Decade: New Street

On the FWA front, MoffettNathanson estimates the service accounts for more than half the traffic on Verizon, T-Mobile networks.

Jake Neenan

WASHINGTON, Dec. 4, 2025 – The cable industry isn’t likely to return to broadband subscriber growth this decade, according to a new report from New Street Research.

“While we expect cable losses to improve over time, we never have cable adds in aggregate turning positive,” New Street analysts David Barden and Vikash Harlalka wrote in a Tuesday report. “We think most investors agree with us and are not modeling positive subscriber growth for any of the large cable operators over the next 5 years.”

Wireless broadband net adds over time, including future estimates

The group forecast the cable companies would eventually stabilize at a penetration of just over 40 percent across their footprints, down from about 62 percent currently.

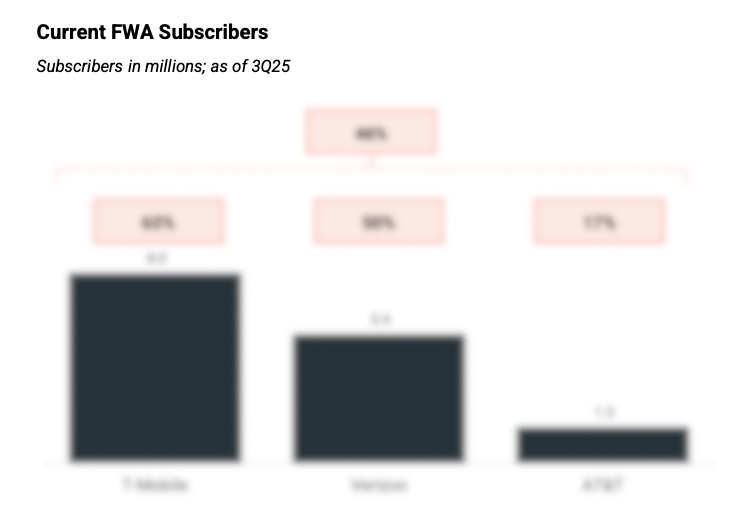

Fixed wireless subscribers by career in millions.

Analysts from KeyBanc, and UBS have also made negative predictions about cable’s near-term future. KeyBanc’s Brandon Nispel said in a recent investor note that cable could be “permanently impaired” by competition from fiber and fixed wireless, also putting cable’s terminal penetration somewhere between 30 and 40 percent.

Moffett forecast improvements in subscriber losses until 2028

MoffettNathanson’s Craig Moffett in September put out an investor note with a slightly more optimistic take, forecasting improvement in subscriber losses until 2028, when losses in Moffett’s model would be very small. He put cable’s terminal penetration at 47 percent across its footprint.

While that would be a percentage decline, he noted new household formation and rural network expansion would mitigate the trend from a subscriber perspective, meaning penetration could fall without the companies losing too many subscribers.

Cable operators have been losing broadband subscribers for the last three years. The end of the Affordable Connectivity Program, which subsidized internet plans for low-income households, and competition from fiber and fixed wireless ISPs has been making it tough for cable companies to retain subscribers.

Cable giants Comcast and Charter are making moves to address longstanding consumer frustration over pricing and leaning into their mobile services, which are growing.

They also, as Moffett has noted, have a much larger wireline footprints to market those mobile services to. But the turnaround won’t be overnight.

“Cable needs industry growth to improve and FWA adds to slow down to return to growth,” New Street wrote.

The group said it expects the broadband industry (not including satellite) to add about 1.6 million subscribers in 2025, up from last year, and to further improve in 2026. But that growth has been driven in large part by fixed wireless gains, and the mobile carriers still have headroom to expand the service.

Fixed wireless

New Street estimated AT&T, Verizon, and T-Mobile have the spectrum capacity to support about 32.4 million fixed wireless subscribers. That includes new spectrum AT&T is buying from EchoStar, but not upper C-band spectrum soon to be auctioned by the Federal Communications Commission.

The companies currently have about 14.9 million fixed wireless subscribers between them, meaning they have capacity to more than double that number.

T-Mobile has nearly 8 million, Verizon has 5.4 million, and AT&T has 1.5 million. Verizon’s fixed wireless additions have slowed down in recent quarters while AT&T’s has recently heated up.

In a separate report from Nov. 19, Moffett estimated that fixed wireless already accounts for a huge share of the carriers’ network usage, roughly 51 percent at Verizon and 68 percent at T-Mobile.

That’s compared to relatively small portions of the companies’ revenue, 3.4 percent at Verizon and an estimated 6 percent at T-Mobile.

“Importantly, these are but estimates. Which is to say, they are almost certainly wrong,” he wrote. “But our estimates are almost certainly directionally correct. The conclusion that Verizon and T-Mobile's networks are now mostly used to service FWA is clear.”

That isn’t necessarily a bad thing, or an indication the service is unsustainable, according to Moffett, but it did raise some questions for him.

“The carriers would argue that FWA only uses fallow capacity, so one could argue that even the tradeoff of 50-70% of nationwide network traffic (today) for 3-6% service revenue still makes sense,” he wrote. But “what happens if mobile traffic demands, whether due to AI or wearables or autonomous vehicles, start to accelerate?”

The upcoming upper C-Band auction, New Street estimated, could provide enough capacity for nearly another 4 million fixed wireless subscribers in total

New Street predicted fixed wireless adds would hit 3.8 million in total in 2025, and tick down to 3.6 million in 2026. Bardan and Harlalka wrote that T-Mobile and Verizon would probably slow down while AT&T’s additions would remain steady.

Member discussion