Comcast’s Broadband Subscribers Dip, While Revenue Climbs in Q3

Comcast execs prepare for fiber competition with network upgrades and expansion.

Jericho Casper

WASHINGTON, Oct. 31, 2024 – Comcast reported a mixed third quarter in its broadband segment, citing challenges from the end of the government’s Affordable Connectivity Program and increased competition.

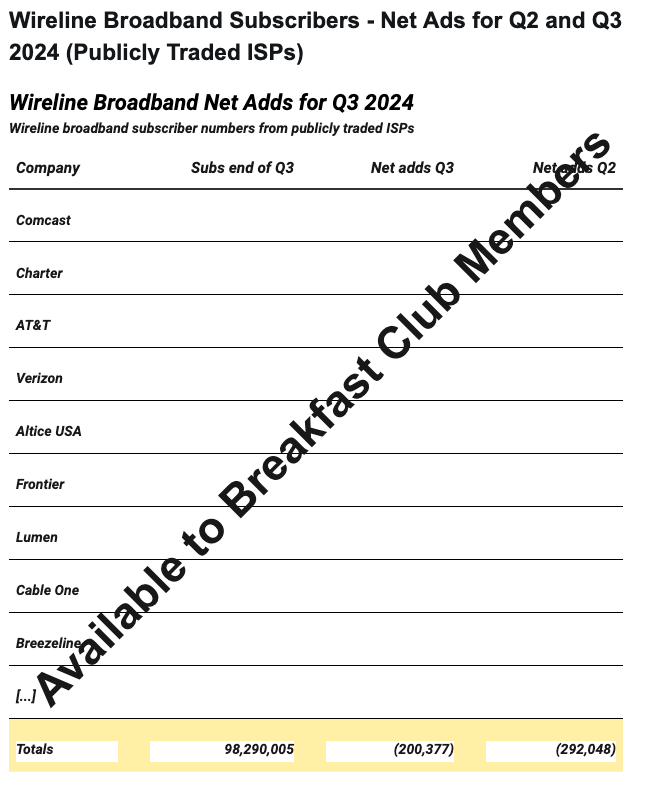

For the quarter ending Sept. 30, Comcast reported a net loss of 87,000 broadband customers — an improvement from the 120,000 lost in Q2 but much more than the 18,000 decline during the same period last year.

Executives estimated during Thursday’s earnings call that, without the expiration of the ACP in May, Comcast would have recorded a net increase of 9,000 broadband customers.

Despite the dip in customer numbers, Comcast’s broadband revenue rose by 2.7% year-over-year to $6.54 billion, driven by increased spending among its existing customer base. Average revenue per user in the broadband segment grew 3.6%, underscoring resilient consumer demand even as new subscriber additions slowed.

“We’re on a path, over the next few years, to being able to deliver multi-gigabit, symmetrical speeds, which will be competitive with any technology out there,” said Comcast Corp. President Michael Cavanagh, emphasizing the company’s commitment to advancing its broadband capabilities.

He added that Comcast’s network is capable of handling significant increases in data usage, which currently averages around 700 Gigabytes per month for broadband-only customers.

Comcast also highlighted its efforts to expand its network footprint to increase its competitiveness in the face of rising fiber deployments. The company has increased its annual new home and business pass rate from 800,000 to 1.2 million this year, a pace it intends to maintain.

“We expect to see competition across the majority of our footprint,” said David Watson, president & CEO of Comcast Cable. “We’re seasoned in competing against fiber. If you go back and look at some of the early fiber markets and tenured markets where we've had a chance to see the competitive progression, you see relatively even share between us and fiber."

While broadband faced challenges, Comcast’s wireless business provided a bright spot in the quarter. Xfinity Mobile added 319,000 new customers, bringing its total wireless lines to around 7.5 million.

"Our six major growth drivers, including broadband, wireless, business services, connectivity, theme parks, streaming, and premium content, generated nearly $18 billion in revenue, growing 9% this quarter,” said CFO Jason Armstrong.

Comcast’s overall financial performance was robust in the third quarter, with total revenue rising 6.5% year-over-year to $32.1 billion.

Although company net income fell by 10% to $3.63 billion, or 94 cents per share, and adjusted EBITDA declined slightly by 2% to $9.7 billion, Comcast generated solid free cash flow of $3.4 billion.

Comcast returned $3.2 billion to shareholders through a mix of $2 billion in share repurchases and $1.2 billion in dividends.

Member discussion