Did Rosenworcel Make Changes to the Net Neutrality Draft Rules?

FCC Chairwoman Rosenworcel spent the last three weeks fielding various entreaties.

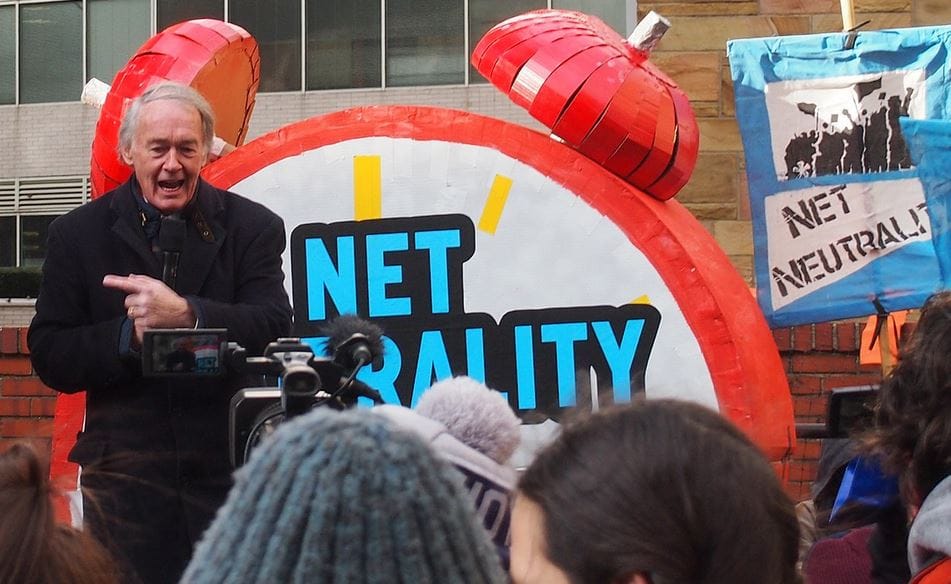

Ted Hearn

WASHINGTON, April 24, 2024 – How flexible was Federal Communications Commission Chairwoman Jessica Rosenworcel?

That’s a big question on the minds of just about everyone active in the D.C. telecom sector on the eve of the FCC’s toweringly important vote to apply utility-style regulation to the country’s Internet Service Providers, regardless of size, for the second time in nine years.

Rosenworcel issued her Net Neutrality draft rules on April 4 – a massive, 435-page document with 2,642 footnotes that triggered a lobbying frenzy designed to get the agency to modify the document in ways that could result in billions of dollars shifting from one segment of the industry to another

During the past three weeks, the FCC has been lobbied by industry, consumer groups, state regulators, academics, and technologists who pushed for new language in the draft or the removal of passages viewed as problematic.

Insiders close to top officials at the FCC likely already know whether Rosenworcel has made any accommodations. Everyone else will need to await the arrival of the final rules, which the agency will release not long after its open meeting Thursday in Washington.

Below is a recap of some of the hottest issues that surfaced and were brought to the attention of FCC Commissioners and their top aides for consideration:

USF: INCOMPAS, CCIA and NTCA voiced concern because the FCC’s Net Neutrality draft rules state that broadband ISPs won’t have to contribute to the $8.1 billion Universal Service Fund (USF), which supports rural broadband as well as Internet for schools and libraries across the country. The trade groups want the FCC to launch a rulemaking in lieu of forbearance to decide whether broadband ISPs ought to contribute at some point. Backed by Free Press, Rosenworcel fears rate shock if broadband ISPs start adding USF fees to monthly bills.

State USF: Cable ISPs like Comcast, Charter and Cox are seeking “language expressly preempting states … from requiring broadband providers to contribute to state universal service fund mechanisms,” consistent with the FCC’s approach at the federal level. The concern arises from the view that states might interpret the FCC’s decision not to interfere with state Net Neutrality rules as a signal for them to seek USF payments. USTelecom said the FCC’s 2015 Net Neutrality rules made clear the agency would preempt any state from imposing new state USF contributions on broadband.” The trade group asked the FCC “to be similarly explicit in its forthcoming order.”

Network Slicing: Wireless 5G players like T-Mobile and Verizon want the FCC to exempt network slicing from the Net Neutrality rules. “Network slicing is a promising technology that will help drive exciting network innovation and enable new capabilities and services for the benefit of consumers in ways that previously were only possible over wireline networks,” Verizon said. The FCC’s draft rules took a wait-and-see approach, saying it would not “categorize network slicing or the services delivered through network slicing as inherently either [broadband] or non-broadband data services, or to opine on whether any particular use of network slicing or the services delivered through network slicing would be considered a reasonable network management practice …” Michael Calabrese, Director, Wireless Future, at New America’s Open Technology Institute, said 5G service providers should not be allowed to define specialized services like network slicing so broadly that they escape open Internet protections, such as the ban on paid prioritization. Calabrese has referred to network slicing as “the equivalent of an HOV lane” designed to sell priority treatment “to mostly deep-pocketed edge providers.”

Preemption: The FCC has said two things on this, including that it would preempt “any state or local measures that interfere or are incompatible with th+e federal regulatory framework …” It also ruled out preemption without a “specific determination that such regulation interferes with our exercise of federal regulatory authority.” For example, the FCC is refusing to interfere with California’s 2018 Net Neutrality law because it “appears largely to mirror or parallel our federal rules.” ISPs are worried that if the FCC isn’t firm, the states will develop a patchwork of rules that will be difficult and expensive to follow and will be incompatible with an inherently interstate service like broadband. By contrast, the Electronic Frontier Foundation wants the California law to serve as a “floor to build on, and that further state protections are not inconsistent simply because they may go further than the FCC chooses to.”

CDNs: Caching and CDN company Akamai Technologies wants assurances that its business ties to ISPs won’t be considered paid prioritization, which is banned under the Net Neutrality rules. Akamai wants new language from the FCC that says "the ban on paid prioritization does not restrict the ability of a broadband provider to enter into an agreement with a CDN to store content locally within the broadband provider’s network.” This language, Akamai said, would accord with the FCC’s 2015 Net Neutrality rules. Although the FCC has said that CDNs fall “outside the scope of broadband Internet access service,’ Akamai wants the FCC to confirm that the 2015 rules are still valid. “There have been no changes to CDN technology or the marketplace since 2015 that would warrant a different approach,” said Akamai Counsel Paul Caritj.

Exemptions: WISPA has asked for an immediate but temporary Net Neutrality exemption for all ISPs with 250,000 subscribers of fewer to give them time to absorb the weight of the rules and the FCC space to launch a rulemaking to decide whether to make the ban permanent. WISPA’s threshold would cover every ISP except for a handful of industry giants. The 2015 Net Neutrality rules did not carve out an exemption for small ISPs.

Other issues considered largely settled could see a tweak or two, including: Section 214 approval to enter or exit broadband markets, rate regulation within the context of state-required, low-cost broadband plans, usage-based billing restrictions, and guidance related to permissible zero-rating plans.

Member discussion