Jostling in the Airwaves Resumes After Passage of Trump’s Budget Bill

Trump’s budget law mandated a ‘spectrum pipeline’ to sell off 800 megahertz of spectrum. Coupled with FCC pressure, the law is quickly re-arranging the commercial airwaves

Jake Neenan

WASHINGTON, August 26, 2025 – After more than two years, the Federal Communications Commission’s authority to auction off spectrum was restored by Congress in July.

Broadband BreakfastJake Neenan

Broadband BreakfastJake Neenan

And the agency is eager to help remake spectrum utilization in the airwaves. In what EchoStar said was a step toward resolving FCC concerns that the company hasn’t put its airwaves to good use, the company said Tuesday it had reached a deal to sell a big chunk of licenses to AT&T for $23 billion.

EchoStar would be letting go of its 3.5 GigaHertz (GHz) and 600 MegaHertz (MHz) holdings, with its Boost Mobile brand becoming a hybrid mobile network operator primarily using AT&T’s infrastructure.

Broadband BreakfastJake Neenan

Broadband BreakfastJake Neenan

EchoStar CEO Hamid Akhavan suggested in a statement that more spectrum sales were coming. The company was continuing to “evaluate strategic opportunities for our remaining spectrum portfolio in partnership with the U.S. government and wireless industry participants,” he said.

“We appreciate the productive and ongoing discussions with the EchoStar team,” an FCC spokesperson said after the deal was announced. “The FCC will continue to focus on ensuring the beneficial use of scarce spectrum resources.”

The deal is expected to close in mid-2026, although AT&T is looking to lease the airwaves and put them to use before then – particularly the 3.45 GHz licenses, as the carrier already uses the band – if the FCC approves.

AT&T CEO John Stankey told analysts Tuesday that his sense from talking with regulators was that they wanted spectrum lit up as soon as possible. The Department of Justice, though, has said that it’s concerned about increasing consolidation in the wireless industry.

The players in the current ‘Spectrum Wars’ before the FCC

The budget reconciliation law was a major victory for the wireless carriers. It tasked the FCC with selling off 800 megahertz of spectrum, with 500 megahertz coming from the federal government and 300 megahertz coming from elsewhere. FCC Chairman Brendan Carr has been looking to get more spectrum in the hands of both the carriers and the satellite industry, citing both economic and national security concerns.

This feature article provides an overview of many spectrum battles, some of which date back to March 2023, when the FCC’s auction authority lapsed.

Even without auction authority, the FCC had taken steps to get more spectrum to the marketplace. But to some extent, the market for radiofrequencies was frozen for nearly two-and-a-half years.

Some of the biggest fights chronicled in this feature article concern Charlie Ergen’s Dish Network, the company he founded. Dish has been wholly owned by EchoStar, another Ergen-founded company, since January 2024. And Carr has been putting lots of pressure on Dish/EchoStar.

Role of SpaceX’s Elon Musk

A potential beneficiary of Carr’s desire to open up EchoStar’s spectrum is former Trump advisor Elon Musk, CEO of SpaceX and the world’s richest man.

Although SpaceX’s Starlink low-Earth orbit internet service is unaffected by Tuesday’s deal between EchoStar and AT&T, Musk has been pushing for EchoStar to open up some of its spectrum elsewhere.

The 2 GHz spectrum band profiled below is for mobile-satellite service, similar to the service offered by T-Mobile and Starlinkusing T-Mobile’s airwaves. Only EchoStar is in 2 GHz now – and SpaceX is pushing the agency to allow other satellite operators like itself to share the airwaves..

The FCC is also considering ditching international power level limits on low-Earth orbit satellites in some bands and opening up others to satellite companies for the first time. Both of those would be a boon to SpaceX’s LEO broadband service, which has been competing for funding under the Broadband Equity, Access, and Deployment program.

Was Dish ever a viable 4th competitor?

Dish was supposed to be a fourth national wireless carrier after T-Mobile bought Sprint in 2020. T-Mobile purchased Sprint’s prepaid business and some spectrum licenses as part of a settlement agreement with the Justice Department’s antitrust division.

When approving T-Mobile’s purchase of UScellular, the current antitrust division chief said she was concerned that the big three carriers (AT&T, Verizon and T-Mobile) were grabbing up licenses and impeding the path of a real fourth competitor.

But Carr said at the agency’s July meeting that he didn’t share that concern.

“There’s not a particular magic number,” he said. “It’s a dynamic situation right now where mobile wireless is not just competing with mobile wireless. The companies that are taking the largest amount of market share in mobile wireless are cable companies.”

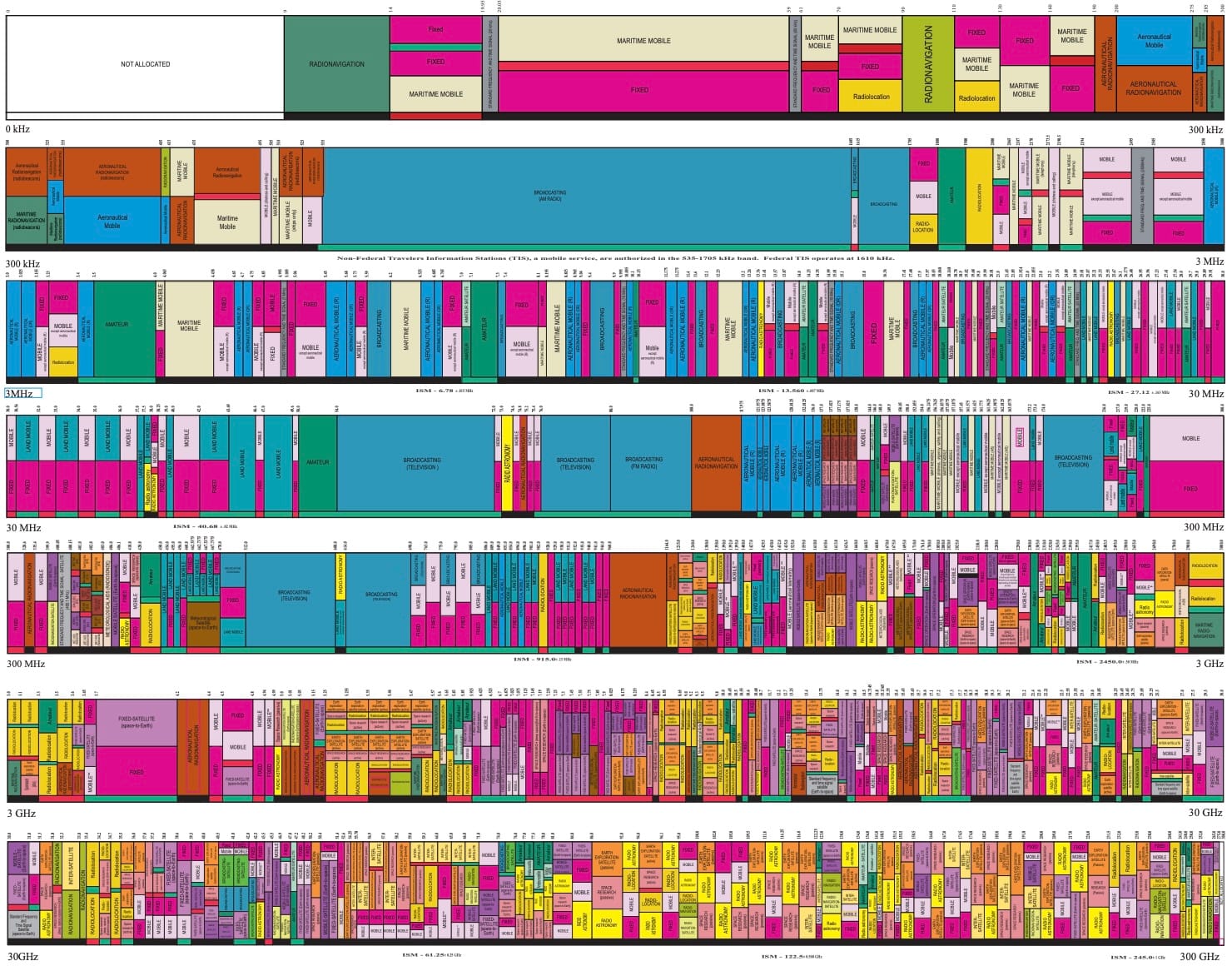

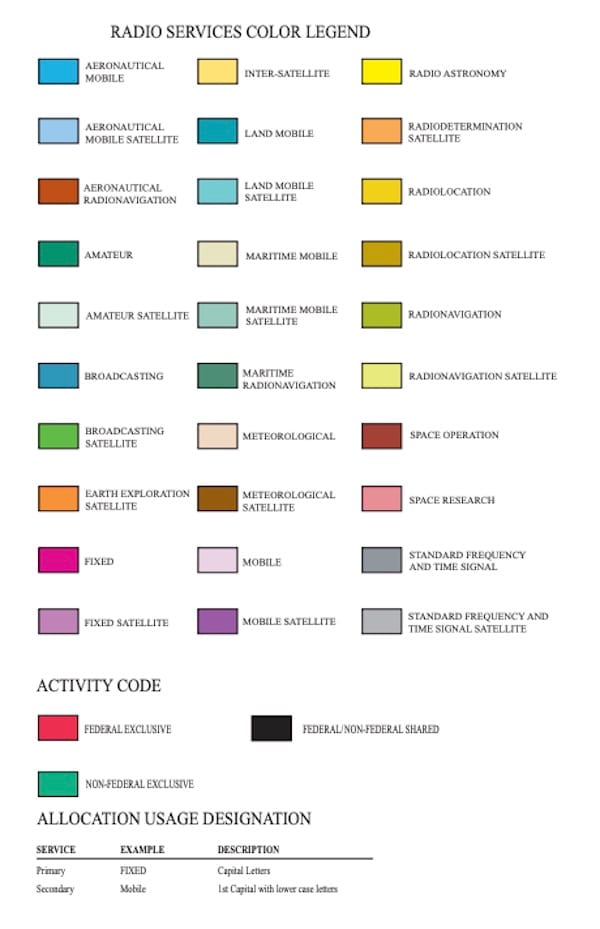

Here Broadband Breakfast reviews the spectrum controversies, band-by-band:

Spectrum Wars

UScellular sales to AT&T and Verizon between 700 MegaHertz (MHz) and 3.45 GigaHertz (GHz)

T-Mobile sale to Grain Management at 800 MHz

AWS-3 (1695-1710, 1755-1780, and 2155-2180 MHz)

2 GHz MSS/AWS-4 (2000-2020 MHz and 2180-2200 MHz)

Lower 3 GHz (3.1-3.45 GHz) and 7/8 GHz (7125-8100 MHz)

CBRS (3.55-3.7 GHz)

Upper C-band (3.98-4.2 GHz)

4.9 GHz (4940-4990 MHz)

6 GHz (5.925-7.125 GHz)

Satellite spectrum at 10.7 GHz and beyond

UScellular sales to AT&T and Verizon between 700 MegaHertz (MHz) and 3.45 GigaHertz (GHz)

UScellular, whose wireless operations were recently acquired by T-Mobile, along with about a third of its spectrum, is looking to sell more airwaves to Verizon in the 850 MHz, PCS, AWS-1, and AWS-3 bands, and to AT&T in the 700 MHz and 3.45 GigaHertz (GHz) bands, for use in their wireless networks. Verizon and AT&T are set to pay about $1 billion each.

Rural carriers have also opposed those deals, as have consumer advocates. They’ve argued the three dominant carriers are effectively carving up their second largest competitor and further edging out smaller providers. They’ve repeatedly called the FCC to review the deals as a single transaction when evaluating its competitive effects, which the agency declined to do before approving the T-Mobile purchase.

The Department of Justice said that it was concerned about consolidation in the wireless industry when it cleared the T-Mobile deal, but despite those reservations said it would not block the pending Verizon and AT&T spectrum purchases either.

T-Mobile sale to Grain Management at 800 MHz

T-Mobile is looking to sell its licenses in the 800 MegaHertz (MHz) band, which encompasses 806-824 and 851-869 MHz, to Grain Management in exchange for the firm’s 600 MHz holdings and $2.9 billion in cash.

Grain is looking to market the spectrum to utility companies for private networks to help monitor and operate their infrastructure. Rural carriers oppose the deal, saying Grain could end up warehousing the airwaves. Utilities are generally in favor.

The deal would require the FCC to waive some rules, including buildout timelines associated with the licenses.

T-Mobile was supposed to sell the 800 MHz spectrum to Dish as part of its merger with Sprint, but Dish couldn’t come up with the required $3.59 billion. T-Mobile then moved to auction its 800 MHz licenses last year, also a requirement of the deal, but again nobody bid up to the target price and the company was able to keep the airwaves.

AWS-3 (1695-1710, 1755-1780, and 2155-2180 MHz)

AWS-3 (which stands for “Advanced Wireless Service”) is a small amount of spectrum: 65 megahertz, with 15 megahertz at each of 1695 MegaHertz (MHz), 25 megahertz at 1755 MHz, and 25 megahertz at 2155 MHz. It is used by wireless carriers. The FCC is moving to re-auction 200 licenses in the band in the near future, with a mandate to start bidding by June 23, 2026.

Congress authorized the re-auction late last year, before the agency’s blanket authority to sell off spectrum was renewed. Proceeds are set to fund the Rip and Replace program, an effort to reimburse small providers for swapping blacklisted Chinese gear out of their networks that has been hobbled by a $3 billion shortfall.

Tribal organizations had asked the agency to allow tribes and Tribal ISPs to apply for free licenses covering Tribal lands before holding the auction, similar to what the agency did for its 2.5 GHz auction in 2020, but the FCC declined. The agency said it agreed with the major wireless carrier trade group that a Tribal window would hold up the auction, and that the law authorizing the sale required moving as quickly as possible.

The agency is taking comment on Tribal windows in future auctions, something consumer advocates and tribes want and that carriers oppose.

Dish had in 2015 won the vast majority of the licenses being auctioned, but the FCC found the company improperly received the spectrum at a discount through its control of smaller entities that actually did the bidding. The company returned the licenses and tried unsuccessfully to get them back for years.

2 GHz MSS/AWS-4 (2000-2020 MHz and 2180-2200 MHz)

2 GigaHertz (GHz) is another way of saying 2000 MHz. It is the same spot on the radio frequency dial. And the 2 GHz mobile-satellite service (MSS) is a band set aside for connectivity between satellites and devices like smartphones. The same airwaves comprise the AWS-4 band, which is used for mobile broadband on terrestrial networks.

EchoStar controls these airwaves for both purposes, but FCC Chairman Carr has made it clear he’s not pleased with that. The agency is probing whether the company is meeting requirements to use the band for either purpose, which EchoStar says is jeopardizing its business. The inquiries are seen as a means to push EchoStar to sell or open up its airwaves.

The company did so on Tuesday, reaching a deal to sell $23 billion worth of licenses to AT&T. Those are in the 3.5 Ghz and 600 MHz bands, which AT&T is aiming to use to expand both its fixed wireless broadband service and its mobile coverage.

The deal will need regulatory approval and is expected to close in mid-2026. While Carr likely views the deal favorably, the Department of Justice has said it’s concerned about increasing consolidation in the wireless industry.

On the MSS front, the FCC has asked whether the company is effectively using the spectrum, while the agency is also evaluating whether EchoStar met buildout deadlines associated with the AWS-4 licenses and whether to rescind extensions granted last year.

SpaceX and other satellite companies have been pushing for access to the band for MSS purposes, which EchoStar argues would lead to unworkable interference. The company says the band can only be used for both MSS and terrestrial mobile service by one entity because the interference can’t be dealt with otherwise.

EchoStar recently announced plans to launch a low-earth-orbit satellite service in the band, a bid to show intent to put the airwaves to work. The company doesn’t have a U.S.-based MSS service in the band, but has said its two satellites meet FCC requirements. EchoStar also has a nationwide mobile network, and serves more than 1.3 million of its 7.36 million subscribers with its own infrastructure and spectrum.

Dish was tapped to become a fourth national wireless carrier when T-Mobile bought Sprint in 2020. The company purchased Sprint’s prepaid business and some spectrum licenses so the Department of Justice would approve the deal.

Carr has implied he doesn’t think that’s going to pan out.

“What’s clear to me is that the status quo itself is just not acceptable,” Carr said of the company in August. “We’re pushing hard to free up spectrum, and you have Dish effectively, over the years, sitting on a tremendous amount of spectrum that simply isn’t loaded.”

If the company were to sell some of its spectrum, the dominant wireless carriers would be likely buyers.

Lower 3 GHz (3.1-3.45 GHz) and 7/8 GHz (7125-8100 MHz)

These are key military bands used by the Defense Department. The wireless industry has eyed them, especially the lower 3 GHz because of its favorable characteristics for 5G networks.

These bands were mostly exempted from FCC auction authority in the budget reconciliation bill. This means that the agency couldn’t sell them off if it wanted to, except for the 7.125-7.4 GHz portion of the 7/8 GHz band. The protections were key for securing the support of some Senate Republicans on the Armed Services Committee.

The lower 3 GHz band was studied for potential repurposing previously proposed by the Defense Department. Defense found in 2023 it couldn’t easily let commercial entities into the band. Another Biden-era initiative, expected to continue in the Trump administration, called for studying the band again, along with 7/8 GHz.

In December the NTIA said it had secured funding for those studies. A final report was planned for October 2026.

CBRS (3.55-3.7 GHz)

CBRS, the Citizens Broadband Radio Service, uses a shared band for home broadband and private networks, among other things. It uses a tiered licensing system, with coastal Navy radars getting protection from companies that purchased priority access licenses (PALs) and both military and PAL users getting protected from those accessing the spectrum for free on a general access basis.

Users pay fees to spectrum access managers like Federated Wireless and Google to avoid interference. The FCC approved those managers and auctioned off PAL licenses in 2020.

Users and proponents, including wireless ISPs and the cable industry, had hoped to secure language in the budget bill that would exempt CBRS spectrum from FCC auction authority. The law directs the agency to sell off 300 megahertz of non-federal spectrum. It’s not clear where 200 megahertz of that is going to come from. The fear is the FCC could look at CBRS airwaves, which is sandwiched by bands already used by wireless carriers, to meet the goal.

AT&T and the Defense Department have separately floated the idea as a means of satisfying the carriers’ hunger for spectrum without uprooting critical military systems – though it isn’t clear the FCC itself is eager to relocate current license holders, which could be arduous. The 5G carriers oppose sharing models generally, preferring the high-power, exclusive-use licenses that their wireless networks rely on.

The FCC took comment last year on updating CBRS rules, and power levels were a sticking point. WISPs said their equipment could become unusable from the extra interference, while the carriers generally said higher power would make the band more useful.

Upper C-band (3.98-4.2 GHz)

The FCC is looking at putting the upper C-band to more intensive use, likely by selling it to wireless carriers and/or allowing satellite providers to use the airwaves. It’s currently occupied by satellite TV distributors that moved their systems there to accommodate the agency’s adjacent C-band auction in 2021.

The budget bill required the FCC to sell at least 100 megahertz of the band.

The carriers are eager to scoop up the spectrum, but Musk’s SpaceX and other satellite companies have also chimed in, saying they could use a slice of the band. When announcing the inquiry into the band, FCC Chairman Carr said “nothing is off the table.”

As the budget bill was working its way through Congress, Sen. Maria Cantwell, D-Wash., strongly criticized the legislation over fears that airline altimeters, which operate in the 4.2-4.4 GHz range, couldn’t handle proximity to high-power mobile users. Altimeters measure the height of aircraft and are essential for pilots and air traffic controllers.

The Trump administration told the FCC it thinks up to 150 megahertz of the band could ultimately be sold off to the carriers, plus “potentially even more for other commercial uses.” It shared concerns about altimeters, though, saying it’s likely thousands of aircraft with current generation devices would need to be retrofitted after new standards for altimeters are released in 2027.

Adel Al-Saleh, CEO of SES, which recently closed its acquisition of Intelsat and thus controls that majority of the band, has said it should be possible to quickly clear 100 megahertz and preserve current service quality. Broadcasters have said they’re a bit uneasy about one entity controlling the program distribution service they still depend on.

4.9 GHz (4940-4990 MHz)

The 4.9 GHz band is set aside for local public safety users. The FCC began the process in October of allowing FirstNet, the nationwide first responder network operated by AT&T, to access unassigned parts of the band.

While bipartisan at the FCC – Commissioner Anna Gomez recused herself but the remaining four commissioners voted in favor – the decision was controversial. The other major carriers said it amounted to a multibillion-dollar giveaway to AT&T, which can use inactive FirstNet spectrum for its commercial wireless service as part of its contract.

Opponents, including a group representing the carriers, sued, arguing the agency wasn’t legally able to assign spectrum to FirstNet. The pro-FirstNet group that had proposed the idea also sued the FCC for not moving fast enough to get spectrum in the hands of FirstNet.

The lawsuits have been combined. The agency submitted a brief on August 14 defending its decision.

6 GHz (5.925-7.125 GHz)

The 6 GHz band is unlicensed spectrum used for Wi-Fi and by WISPs for fixed broadband. It was also opened in 2020, and greatly expanded the airwaves available for Wi-Fi.

It’s another band that cable, WISPs, and consumer advocates failed to protect from auction in the big budget law . The House passed a version that would have shielded the band from FCC auctions authority, but the Senate’s version, which was ultimately signed into law on July 4 by President Trump, did not.

It’s again not clear the FCC has the will to claw the airwaves back, but it’s easier to do with unlicensed spectrum than licensed. Sharing proponents are also uneasy about the fact that protections were specifically removed as the bill was being crafted.

CTIA, the wireless industry trade group, has repeatedly suggested the upper portion of the band (6.425-7.125 GHz) could be a candidate for mobile networks, and said in 2020 the FCC should only have opened the lower half for unlicensed use.

The cable industry generally supports shared spectrum regimes over exclusive licenses. Cable companies offload the large majority of their mobile traffic over Wi-Fi, thus paying lower fees to the wireless carriers, and own some CBRS licenses, but have been slow to deploy them.

More licenses spectrum for the wireless carriers also means more headroom for their fixed wireless broadband service, which has been gaining share as cable continues to lose subscribers.

Satellite spectrum at 10.7 GHz and beyond

The FCC is taking input on making more spectrum available to satellite operators, and on ditching international power level limits in certain bands that the industry say are hobbling satellite broadband.

In the 10.7-12.7, 17.3-18.6, and 19.7-20.2 GHz bands, the agency is seeking comment on moving away from power limits on non-geostationary satellite operators like SpaceX and Kuiper. Those operators share the band with geostationary satellites that sit locked above a specific point on the earth’s surface, and have to observe power limits to avoid interference.

Those limits are based on international standards that SpaceX and Kuiper want the FCC to move the American market away from. They say doing so would vastly improve their satellite broadband services. Consumer advocates agree.

AT&T was wary about the LEO systems upping their power, as the company’s terrestrial mobile networks use the same airwaves.

The agency is also taking input on opening up the 12.7-13.25 GHz band for satellite downlink, and opening to satellites for the first time the 42-42.5 GHz, 51.4-52.4 GHz, 92.0-94.0 GHz, 94.1-100 GHz, and 102.0-109.5 GHz bands.

Some scientists were nervous about the higher frequencies, as some of the airwaves and adjacent bands are used for weather forecasting and astronomy.

Member discussion