Pew: Bad Data a Barrier to Shoring up Broadband Workforce

The $42.45 billion BEAD program is expected to create a large jump in demand.

The $42.45 billion BEAD program is expected to create a large jump in demand.

WASHINGTON, Nov. 3, 2025 – The national broadband workforce is widely expected to be strained by an influx of projects funded by the $42.45 billion Broadband Equity, Access, and Deployment program. Faulty data is a major barrier to the industry adequately meeting that demand, according to a new report from the Pew Charitable Trusts’ broadband access initiative.

Pew said it found 41 states that identified workforce shortages as a risk factor in their planning documents for BEAD or Digital Equity Act programs. A Fiber Broadband Association report last year estimated nearly 120,000 additional workers would be needed over the next 10 years just to replace people who retire or change industries, plus another nearly 60,000 to meet BEAD-induced demand.

The FBA study was conducted before the Trump administration changed BEAD’s rules in June and made it easier for satellite providers to win funding, but the program is still tentatively slated to fund fiber to more than 2 million locations nationwide.

City says affordability remains primary barrier to internet adoption

The CPUC’s claim that increased broadband competition could save Californians $1 billion is facing pushback.

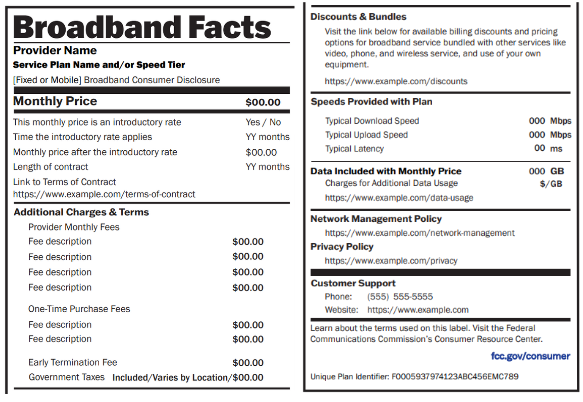

Consumer Reports found 30 percent of shoppers recalled seeing the labels since they went into effect.

A new report argues fiber is central to the next phase of U.S. data center expansion.

Member discussion