Q2 Broadband Numbers: Wirelines ISPs Slipped, Fixed Wireless Access Gained

Wireline broadband experienced notable churn in Q2 as subscribers shifted to fiber and fixed wireless technologies.

Jericho Casper

WASHINGTON, August 16, 2024 – In the second quarter, the pattern looked familiar among publicly traded broadband Internet Service Providers: The wireline variety as a group lost subscribers, while fixed wireless access providers posted solid gains.

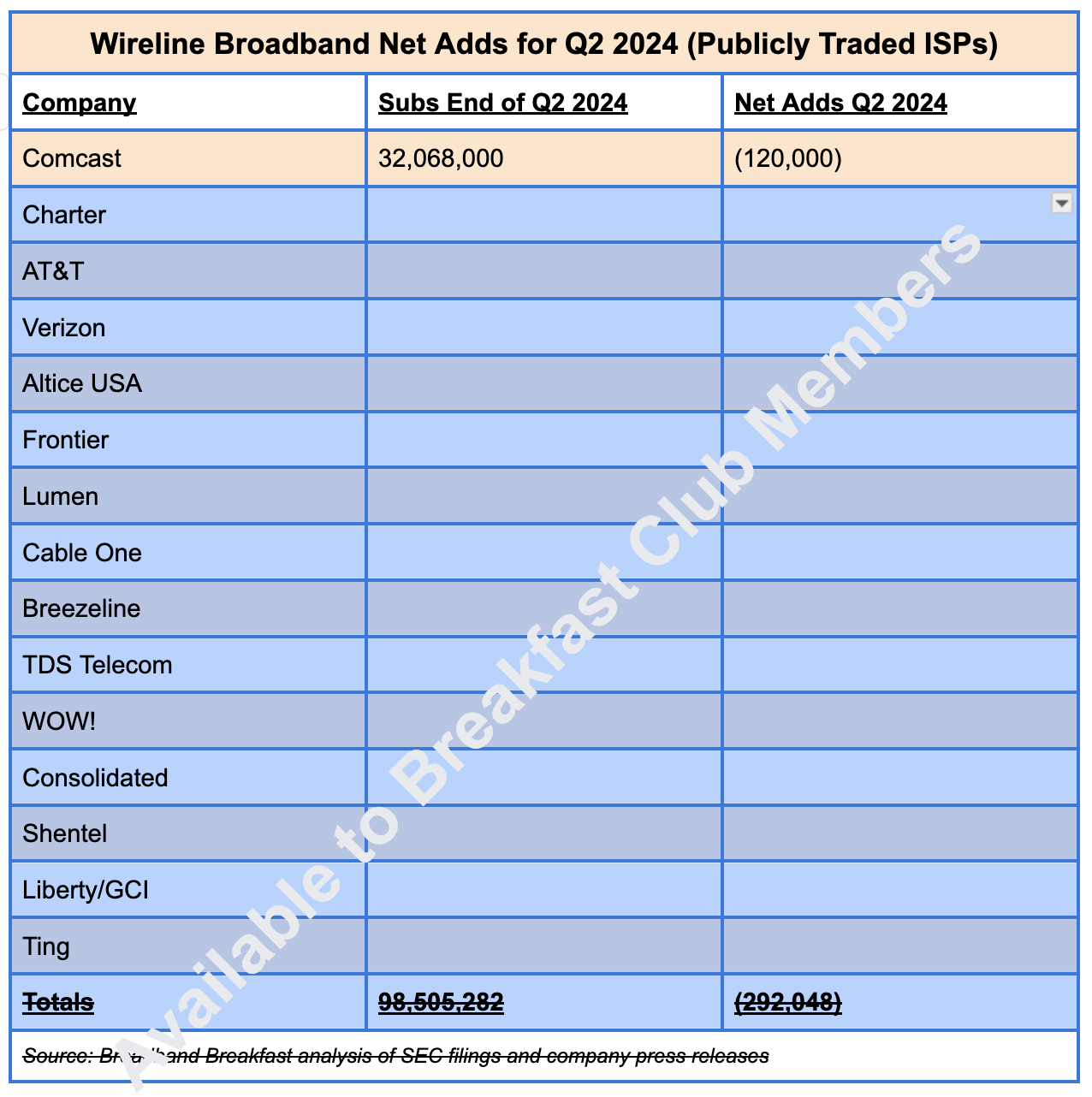

Challenging competitive conditions facing many wireline broadband providers led to a net loss of 292,048 subscribers sequentially as reported by the top fifteen publicly traded ISPs in the sector.

The quarterly performance of wireline providers was closely linked to the technology they utilized. Major providers dependent on hybrid fiber-coaxial (HFC) technology, such as Comcast and Charter, experienced marked subscriber losses. Conversely, regardless of size, companies utilizing fiber-to-the-home (FTTH) solutions, like AT&T, Frontier, and Shentel, achieved modest gains.

In terms of subscriber losses, Comcast and Charter both faced declines, though the figures were slightly better than analysts had predicted. Comcast lost 120,000 subscribers ending the quarter with 32.1 million, while Charter's subscriber base shrank by 149,000, leaving it with 30.4 million subscribers.

Comcast Cable CEO David Watson mentioned in the company’s Q2 earnings call that fiber ISPs were now viewed as the company’s primary competition in the broadband market. He also noted increasing pressure from rapid growth in the fixed wireless sector, which gained 933,000 subscribers in Q2, led by T-Mobile and Verizon.

In line with this shift, the wireline providers that reported positive results for the April-to-June quarter were those focused on expanding their fiber footprint.

For instance, AT&T added 18,000 new wireline subscribers. Similarly, Verizon’s fully fiber-optic FiOS network gained 28,000 subscribers. Frontier Communications, after 6.8 million fiber passings reported in Q1 2024, saw an increase of 36,000 subscribers in Q2. Additionally, Ting Internet, known for its FTTH offerings, netted 2,100 subscribers.

Altice USA and Lumen didn’t fare as well. Despite their efforts to expand fiber infrastructure, both ISPs experienced declines in their subscriber bases, with each losing just over 50,000 wireline customers.

Altice, operating a combination of HFC and FTTP in its Optimum and Suddenlink service areas, attributed the loss in part due to the expiration of the Affordable Connectivity Program.

Meanwhile, Lumen’s decline was primarily due to the continued loss of legacy DSL subscribers. With over 1.8 million DSL customers remaining, Lumen has experienced DSL losses that outpace its fiber additions by 4-5 times each quarter.

Smaller ISPs’ results also varied based on the technology they provision. Shentel, Consolidated Communications, and TDS Telecom, all of which offer FTTH in many areas, added 8,879, 3,670, and 2,100 subscribers, respectively.

However, providers like Cable One, Breezeline, and WOW!, primarily operating hybrid fiber-coaxial networks, recorded losses. Cable One saw a decline of 3,700 subscribers, while Breezeline lost 7,897 and WOW! 4,700 subscribers.

As new entrants in the fiber market intensify wireline broadband competition, consumers are increasingly turning away from cable-based services, for faster and more reliable internet connections provided by fiber technology.

The overall industry net loss of 292,048 subscribers this quarter brought the total wireline broadband customer base to just over 98.5 million. In comparison, fixed wireless, with 9.8 million total subscribers, has been viewed as a technology expected to encounter capacity constraints.

Member discussion