Sen. Moran Wants to Shield BEAD Grants from Taxation

Kansas senator hinted at tying broadband tax exemption to reconciliation bill.

Jericho Casper

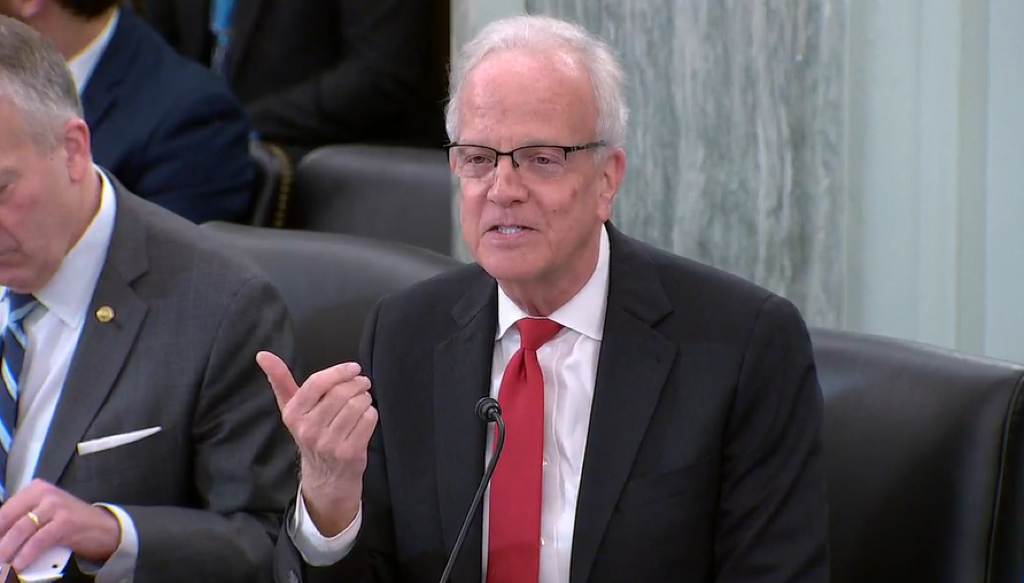

WASHINGTON, Feb. 3, 2025 – Sen. Jerry Moran, R-Kan., wants to stretch the broadband dollar as far as possible.

Moran – likely with bipartisan support in the Senate and House – was renewing his effort to pass a bill to ensure that broadband grants from the Infrastructure Investment and Jobs Act and the American Rescue Plan will not be subject to federal taxation.

Moran and Mark Warner, D-Va., alongside Reps. Jimmy Panetta, D-Calif., and Mike Kelly, R-Penn., last Congress introduced the Broadband Grant Tax Treatment Act, legislation that would amend the Internal Revenue Code to exempt broadband deployment grants from the 21% federal corporate income tax.

Moran pressed the issue during a Senate Commerce Committee hearing Wednesday on the nomination of Howard Lutnick to be Commerce Secretary, warning that taxing broadband grants reduces their effectiveness and discourages investment in underserved areas.

“Let me tell you that the BEAD grant dollars are subject to taxes. So the company that receives the grant to put broadband into rural and underserved areas has to pay taxes on the money received,” Moran said of the $42.5 billion Broadband, Equity, Access, and Deployment program.

He argued that reducing the amount of available BEAD funds by taxing them contradicts the program’s goal of expanding broadband access.

“And it seems to me that if you want the BEAD grant program to work and actually get the dollars to the people across the country, including Kansas, who need broadband services, reducing the amount of money that's available by taxing the grant makes no sense. Am I missing something here?” Moran asked.

Lutnick appeared to support the idea, responding that the tax exemption “sounds entirely sensible.”

Moran also hinted that lawmakers may try to attach the broadband tax break to a broader reconciliation bill, telling Lutnick, “We're working to solve that problem, but your input and support at a point in time may be helpful to us.”

Industry groups and state governments have also pushed to make broadband grants tax-free since the bill was first introduced in September 2022.

Broadband industry groups, including INCOMPAS, WISPA, and NTCA, wrote to the Senate Finance Committee and House Ways and Means Committee in January 2024 urging Congress to pass the legislation and include it in any upcoming tax legislation.

While Congress continues to debate the Broadband Grant Tax Treatment Act, some states have attempted to exempt broadband grants from state taxation — without success.

In Georgia, the House passed HB 814 in February 2024 with overwhelming bipartisan support (162-1), aiming to exempt federal broadband grants from state income taxes. However, the bill failed to advance in the Senate and did not become law.

In Wisconsin, the House Committee on Ways and Means advanced a similar measure, Assembly Bill 272 in March 2024, recommending an amendment to exempt BEAD and other broadband expansion grants from state and corporate franchise taxes. Despite early momentum, the proposal failed to pass in the legislature.

Member discussion