Senate Committee Asks: Is Crypto a Commodity?

Discussion comes as House Republicans stall debate on three major crypto bills

Cameron Marx

WASHINGTON, July 16, 2025 – What is cryptocurrency, and who should regulate it?

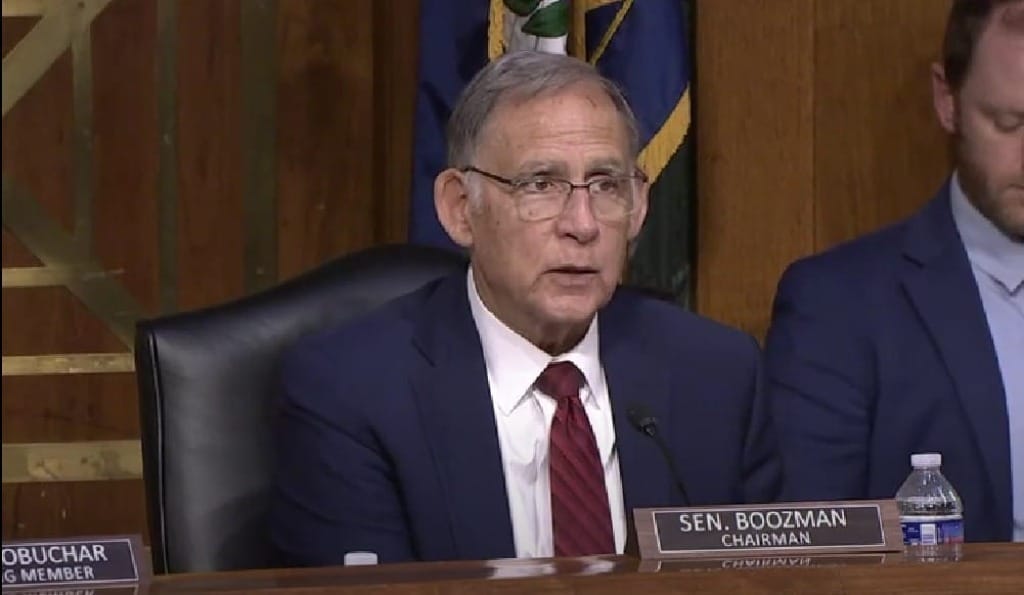

That was the question witnesses and legislators sought to answer at a Wednesday hearing of the Senate Committee on Agriculture, Nutrition, & Forestry.

Though legislators and witnesses were in agreement that regulatory gaps in crypto markets needed to be addressed, and that the Commodity Future Trading Commission should play a major role in filling those gaps, differences emerged over just how large that role should be.

Some, like Walt Lukken, president and CEO of the Futures Industry Association, believed that the CFTC should be the exclusive regulator of these markets.

“My advice to this committee is to give exclusive jurisdiction over digital commodities to the [CFTC] and to give digital securities to the SEC, and to give clearer lines of jurisdiction to both agencies,” Lukken said.

When asked by Sen. John Boozman, R-Ark., why the CFTC, and only the CFTC, was the right regulator for spot digital commodity trading, which involves the buying and selling of cryptocurrencies like Bitcoin or Ethereum, former CFTC Chairman Rostin Behnam agreed.

“It is extremely important the CFTC become the primary regulator of any commodity asset,” Behnam said.

Others, like Timothy Massad, research fellow and director of the Digital Assets Policy Project at Harvard’s Kennedy School of Government, advocated for a joint approach between the CFTC and the Securities and Exchange Commission.

“All of these factors argue for a different approach… one that mandates the SEC and CFTC work together not just on a few rules but overall, because both agencies have significant stakes and expertise in these matters,” he said.

The differences emerged from what witnesses believed digital assets. Many of the witnesses argued that crypto is a commodity, similar to wheat or corn. Regulation of commodities has traditionally fallen under the CFTC’s purview, whereas the SEC has focused on securities regulation.

“A significant portion of the digital asset ecosystem… function like commodities rather than traditional securities,” Ji Kim, CEO of Crypto Council for Innovation said. “These assets are not issued by centralized entities to raise capital and lack profit-sharing rights… participants treat these assets as stores of value, not as equity stakes. Recognizing the commodity-like nature of these assets is essential to crafting a regulatory framework.”

Massad disagreed.

“This is a technology. It is not an asset class,” he said. “It will be used in many ways, and the most viable use cases may be tokenizing securities… we cannot define whether something in digital form is a security, a commodity, or neither with a few paragraphs in a statute.”

Though party affiliation seemed to play less of a role in this debate than in many Congressional hearings, it appeared that Republicans were more supportive of the view that the CFTC should have exclusive jurisdiction over regulating cryptocurrency, while Democrats leaned towards a joint approach between the CFTC and the SEC.

At least one issue was raised where party affiliation played a major role. Democrats on the panel blasted President Donald Trump’s creation of his $TRUMP meme coin, and argued that his promise that its top holders would receive exclusive access to him was a form of blatant corruption.

“To literally sell seats to a dinner at the White House… to me this amounts to a level of galling corruption never ever before imagined,” Sen. Cory Booker, D-N.J., said. “It is corrupt, it is dangerous, it is an attack on our democracy, it’s a violation of the Emoluments clause, and it is undermining this industry as a whole.”

No Republican on the panel brought up the President’s meme coin.

The hearing came on the same day that the Digital Asset Market Clarity Act, which sought to categorize digital assets as either commodities or securities and assign regulatory authority over those assets, hit a roadblock in the House from GOP holdouts.

Twelve House Republicans, primarily Freedom Caucus members, initially blocked a procedural vote Tuesday that would have allowed debate on digital asset bills to commence, including the GENIUS Act and the CLARITY Act.

On Wednesday, Trump announced that he had flipped some of the holdout votes, and that the legislation would move forward.

Member discussion