Small ISPs Face Economic, Incumbent Bundling Headwinds: CoBank Economist

CoBank also mentions that Space X and T-Mobile will begin testing a satellite service by the end of 2023.

WASHINGTON, November 29, 2022 — An economist at a bank that provides loans for rural infrastructure projects said this month on a Broadband Breakfast Live Online event that smaller internet service providers are likely to face challenges on two fronts in the near future: getting financing for fiber projects in a down economy and from the service-bundling prowess of the larger national players.

With economic weakness forecast in the next 12 to18 months, banks will become more hesitant to lend, said Jeff Johnston, lead economist at CoBank, a $170 million cooperative bank that provides lending and private equity services for rural infrastructure projects by smaller providers. That’s despite an unprecedented amount of federal funding, including $42.5 billion from the Infrastructure, Investment and Jobs Act still to come.

Johnston also warned about larger providers taking up market share in certain regions from the smaller providers because they can bundle services. In a fourth quarter financial report in October 2022, Johnston warned local broadband fixed-wireless providers that incumbents like Verizon and T-Mobile are ramping up smartphone bundle deals with wireless services as a strategy to pry consumers away from smaller providers.

Drew Clark, CoBank’s Jeff Johnston, Capital Partners’ Angelo Lacroix and Andrew Semenak of Pinpoint Capital Management

“Broadband operators located in smaller and/or rural cities could face competitive threats if the national operators decide to target these markets,” the report said. “Their fixed wireless market strategy is largely a function of where they have excess capacity in their networks. We do not see standalone fixed wireless operators as much of a threat to fixed line broadband operators as they don’t have a smartphone bundle to offer, which dilutes their value proposition in markets where fixed line broadband already exists.”

Angelo Lacroix, investment director at Capital Partners, added that “we’re not so concerned about customers falling away because they cannot pay the bills; it’s more about losing customers to competitors.”

Our Broadband Breakfast Live Online events take place on Wednesday at 12 Noon ET. Watch the event on Broadband Breakfast, or REGISTER HERE to join the conversation.

Wednesday, November 16, 2022, 12 Noon ET – How to Value Your Fiber Company

The United States is currently in the midst of what can only be described as a fiber boom. Wireless and 5G technologies aren’t going away, but stringing fiber deeper into neighborhoods is necessary. And because of this understanding, fiber businesses can become very valuable. In this special session of Broadband Breakfast Live Online, we’ll explore the important question of how to value your fiber business.

Panelists:

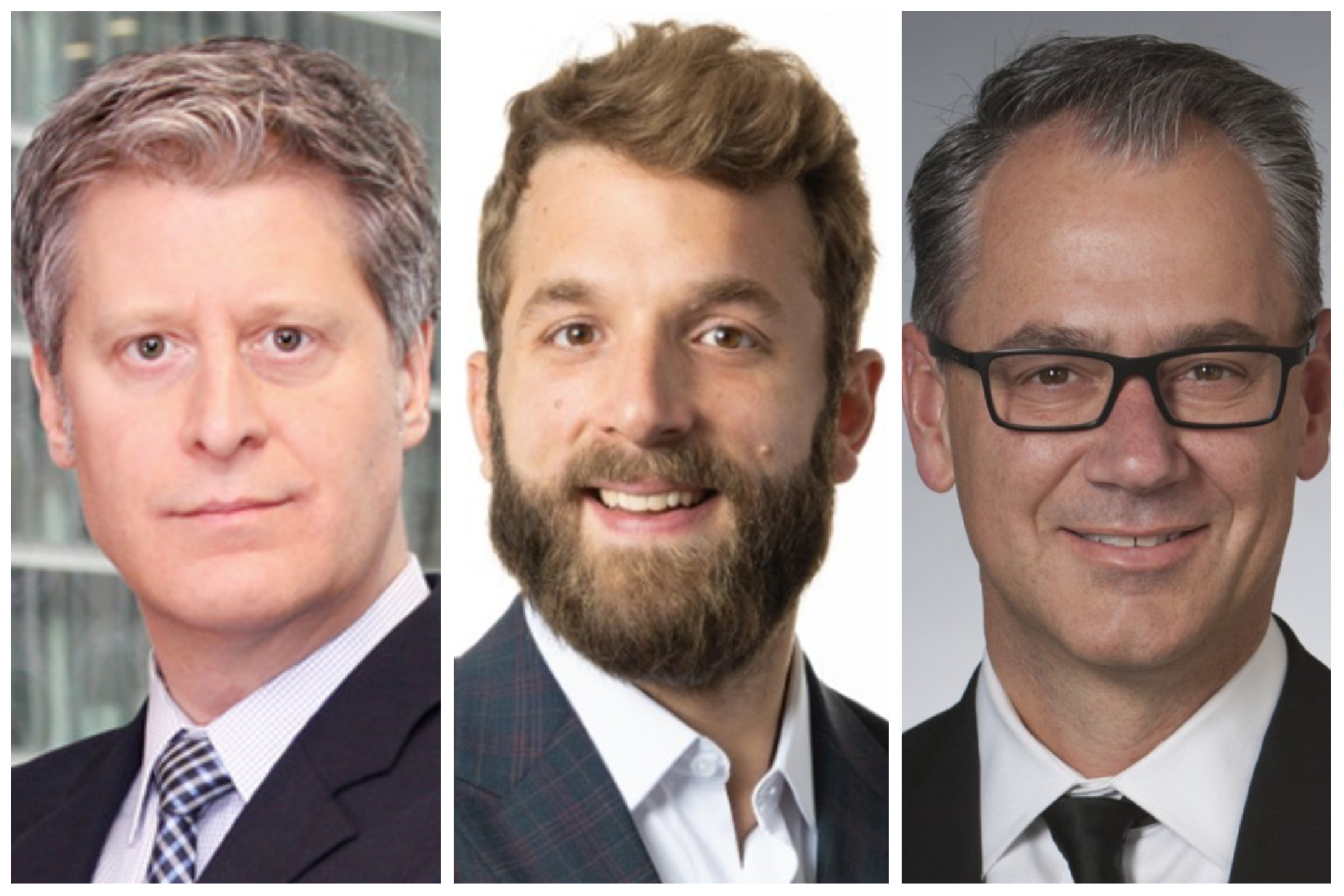

- Andrew Semenak, Managing Director, Pinpoint Capital Advisors

- Angelo Lacroix, Investment Director, DIF Capital Partners

- Jeff Johnston, Lead Communications Economist, CoBank

- Drew Clark (moderator), Editor and Publisher, Broadband Breakfast

Andrew Semenak has over 20 years experience in corporate finance and investment banking with large global firms. He is the founding partner of Pinpoint Capital Advisors and has advised on numerous domestic and international capital raisings and mergers and acquisition transactions. Andrew’s relationships span leading small and mid market companies, private equity and infrastructure funds, pension plans, sovereign wealth funds, family offices, endowments and insurance companies.

Angelo Lacroix is an Investment Director covering core plus and value add infrastructure investments in North America for DIF Capital Partners with a strong emphasis on digital investments like fiber and data centers. DIF Capital Partners is a leading midmarket private equity infrastructure investor with over 14bn of assets under management. Angelo is a CFA Charterholder with over a decade of transaction experience and has previous global work experience at KPMG Corporate Finance as well as Macquarie Capital.

Jeff Johnston has over 25 years of telecom experience that includes 11 years as a Wall Street analyst covering tech media and telecom, and 13 years of product management and business development experience for telecom operators. He is currently a lead communications economist in the Knowledge Exchange research division for CoBank, a $160 billion commercial bank that finances rural infrastructure (communications, power and energy) and agriculture.

Drew Clark (moderator) is CEO of Breakfast Media LLC, the Editor and Publisher of BroadbandBreakfast.com and a nationally-respected telecommunications attorney. Under the American Recovery and Reinvestment Act of 2009, he served as head of the State Broadband Initiative in Illinois. Now, in light of the 2021 Infrastructure Investment and Jobs Act, attorney Clark helps fiber-based and wireless clients secure funding, identify markets, broker infrastructure and operate in the public right of way.

WATCH HERE, or on YouTube, Twitter and Facebook.

As with all Broadband Breakfast Live Online events, the FREE webcasts will take place at 12 Noon ET on Wednesday.

SUBSCRIBE to the Broadband Breakfast YouTube channel. That way, you will be notified when events go live. Watch on YouTube, Twitter and Facebook.

See a complete list of upcoming and past Broadband Breakfast Live Online events.