T-Mobile Adds 506,000 Fixed Wireless Subs

The company also added 54,000 fiber subscribers, in addition to 755,000 absorbed from Metronet.

Jake Neenan

WASHINGTON, Oct. 23, 2025 – T-Mobile added 506,000 fixed wireless customers in the third quarter of 2025, beating Wall Street expectations.

The company now counts a total of just under 8 million fixed wireless customers, the most of the major mobile carriers. The new additions were up 34 percent from the same time last year.

The results come after AT&T also announced more fixed wireless additions than expected on Wednesday, handily beating analyst estimates. The trend is likely to be seen as a negative for the cable industry, which has been losing broadband subscribers as the carriers’ fixed wireless services continue to gain share.

“Both AT&T and T-Mobile beat substantially on FWA results,” New Street Research analyst David Barden said in an investor note Thursday. “We suspect the market will assume that the FWA beats have come at the expense of Cable, impacting stock trading ahead of their results next week.”

In addition to the 506,000 new fixed wireless subs, another 141,000 additions came from T-Mobile's acquisition of UScellular, which closed in August.

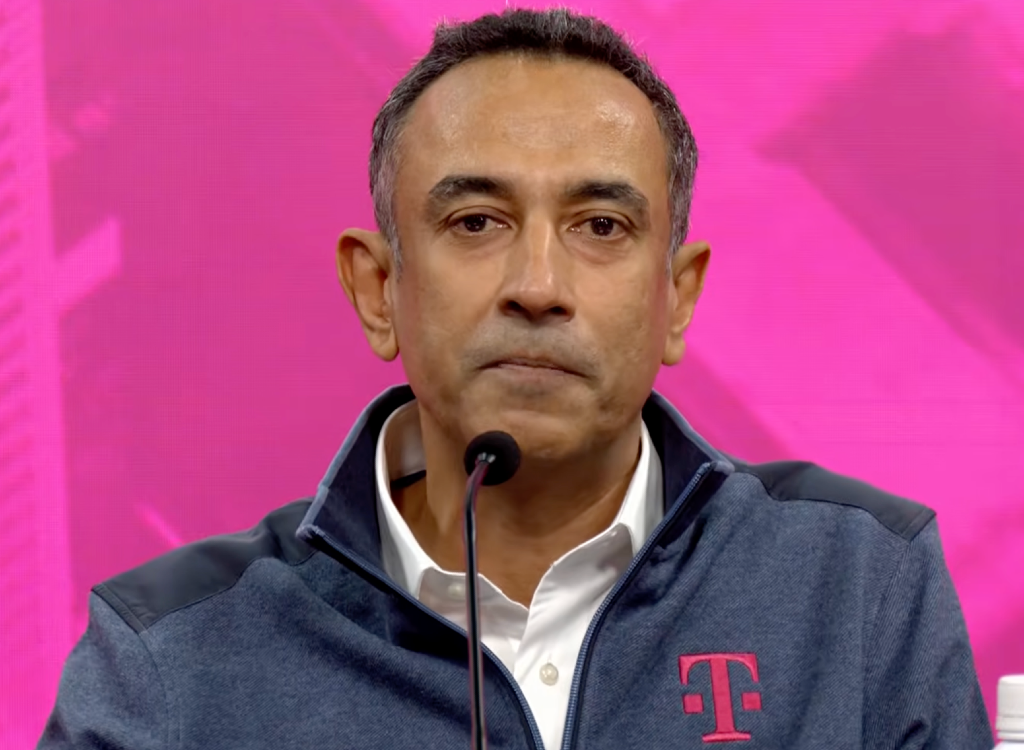

“We see FWA not as a temporary category, but something that’s here to stay as mobile technology gets better and better,” COO and incoming CEO Srini Gopalan said on T-Mobile’s earnings call Thursday. He said it was tapping into frustrations “which a lot of people trapped in old relationships with incumbents are suffering from.”

The company’s long-term fixed wireless subscriber goal is 12 million.

T-Mobile added 1 million postpaid phone lines, which it said was its best third quarter in more than a decade. AT&T’s addition of 405,000 such subscribers Wednesday also beat Wall Street estimates.

Mike Sievert, T-Mobile’s CEO, said competition in the mobile market was not “overheated,” despite some increased churn and recent promotional activity. Analysts have said there’s some uncertainty about how aggressive Verizon’s new CEO Dan Schulman will be in trying to reverse the company’s fortunes.

“The wild card remains Verizon. What will Verizon do if it is indeed bearing the brunt of T-Mobile’s (and Cable’s) share gains?” MoffettNathanson founder Craig Moffett wrote in an investor note. “If Verizon is painted into a corner, with a new CEO bent on change, well… THAT would be bad for everyone.”

Verizon will report its earnings on Oct. 29. New Street analysts have predicted the company will ultimately avoid starting a price war.

Fiber

T-Mobile added 54,000 new fiber subscribers in the third quarter. The company also absorbed 755,000 fiber customers from Metronet, which the carrier acquired via a joint venture with investment firm KKR, for a total of 934,000.

The carrier raised its 2025 guidance on new fiber additions to 130,000, up from 100,000. Excluding subscribers from acquisitions, T-Mobile has added 73,000 fiber subs this year.

The company has plans to hit between 12 million and 15 million fiber passings eventually. Executives didn’t say exactly how many passings they had currently. The mobile carriers are each trying to expand their fiber footprints as quickly as possible in a bid to offer bundles fixed and mobile broadband.

“Cable has a huge advantage here, with the ability to offer a converged solution everywhere,” Moffett wrote. “With only a very small fiber footprint (Lumos and Metronet), T-Mobile’s answer is FWA.”

Member discussion