Verizon’s Fixed Wireless Adds Miss Expectations

The carrier's 278,000 fixed wireless additions were its lowest since 2022.

Jake Neenan

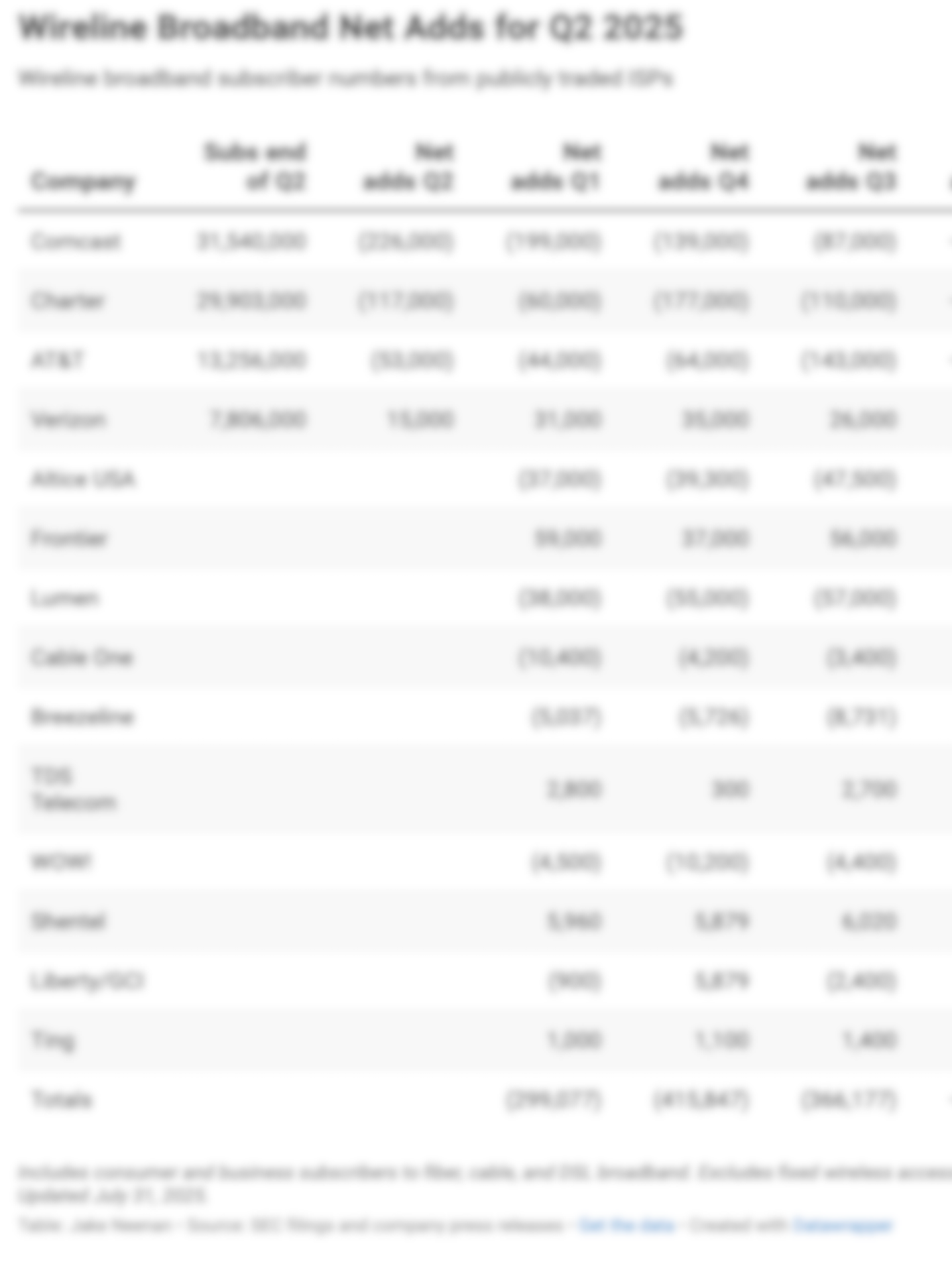

WASHINGTON, July 21, 2025 – Verizon added fewer fixed wireless and fiber subscribers than analysts expected in the second quarter of 2025, the carrier announced Monday. The company’s stock still jumped more than 4 percent as financial results beat expectations and management raised earnings guidance for the year.

Can't see the Earnings Chart? Know you need Breakfast Club? Get access for $590/year.

“While we always see opportunities to improve, I’m confident in the future of our business,” Verizon CEO Hans Vestberg said. “Our fixed wireless base has surpassed 5 million subscribers, and our fiber build is tracking ahead of its plan.”

Verizon added 278,000 consumer and business fixed wireless subscribers, down from 378,000 in the same quarter last year and 24,000 fewer than Wall Street had expected.

The carrier also added 32,000 fiber customers, missing analyst predictions of 44,000. Last year in the second quarter, Verizon added 28,000 fiber subscribers.

“The weaker broadband trends, and particularly the weaker FWA trends, will be encouraging for cable,” New Street Research analyst Jonathan Chaplin said in a Monday investor note. “However, this also suggests slower market growth, which isn’t great for cable.”

Chaplin said in the note, published before Verizon’s earnings call Monday morning, that if executives became less confident than they have previously been in a bounce back later this year, that would be good for cable. Vestberg was still positive.

“I’m pretty certain we will do better on broadband in the second half of this year than we did in the first,” he said.

The carrier now counts 5.1 million fixed wireless subscribers and 7.6 million fiber subscribers. Vestberg said the company was “firmly on track to achieve” its goal of 8 million to 9 million FWA subscribers by 2028.

MoffettNathanson Senior Managing Director Craig Moffett noted Monday's fixed wireless result was the seventh straight quarter of lower year-over-year net additions, and the lowest result since shortly after the service launched.

That’s “reason for concern,” he said in an investor note, as the wireless carriers’ nationwide convergence plans will depend on fixed wireless allowing them to offer home broadband outside their fiber footprints. The company said it was still on track to reach 650,000 new fiber passings in 2025.

Vestberg also said Verizon’s acquisition of Frontier – aimed at boosting Verizon’s fiber network and helping it reach its eventual goal of 35 million to 40 million passings – was still expected to close in the first quarter of 2026. The deal – which has federal approval – still needs OK from the California Public Utilities Commission. The CPUC has generated some friction over the carrier’s commitment to ax diversity initiatives in exchange for FCC approval.

Mobile

The carrier lost 51,000 consumer postpaid phone lines and added 50,000 prepaid lines excluding its SafeLink brand, both slightly worse than analysts expected.

Competition for mobile subscribers has been heating up in 2025, with the wireless carriers and cable giants offering increasingly competitive price locks and free phone line deals to attract new customers. Verizon began doing so in April.

Vestberg said the company should deploy 80 to 90 percent of its C-band spectrum this year, which he noted helps offer fixed wireless in more places but is primarily aimed at boosting mobile capacity.

Financial projections

The carrier raised its annual free cash flow projections to between $19.5 billion and $20.5 billion and said it now expected adjusted earnings per share to increase by 1 percent to 3 percent. The company said that was partly attributable to the Republicans’ budget bill recently signed into law, which continued and expanded the 2017 tax cuts.

Vestberg said stock buybacks would be a main priority for the extra cash, in addition to paying down debt.

Member discussion