Weiss Ratings Says Banks Spreading 'Misleading' Information

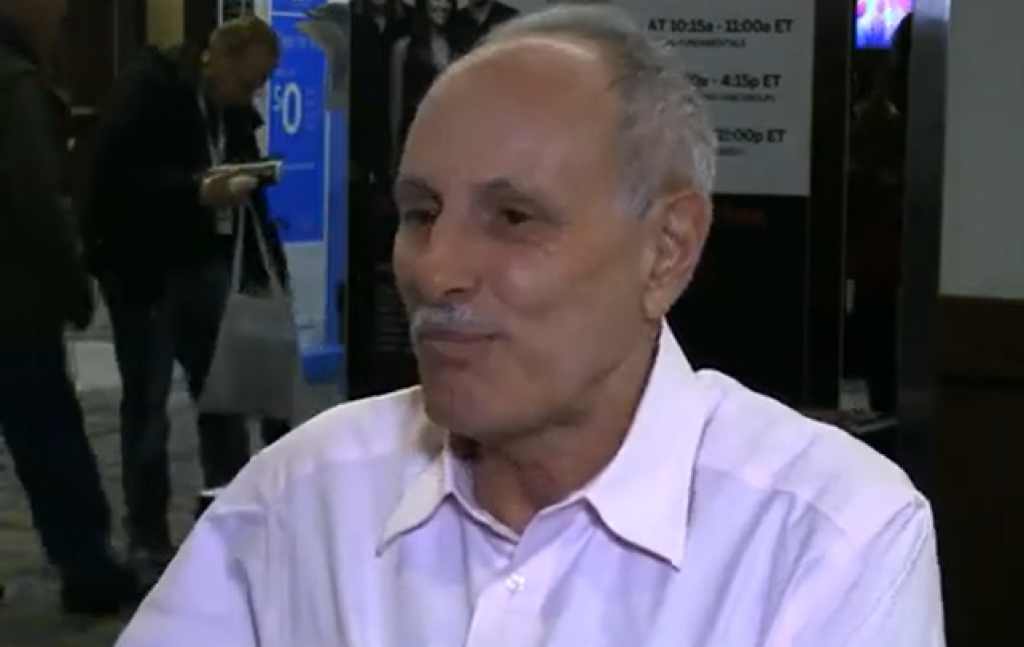

Weiss Ratings has been rating banks for 53 years, according to founder Martin Weiss.

Ted Hearn

WASHINGTON, Aug 18, 2024 – A bank ratings organization at the center of a federal broadband funding dispute claimed its reputation has been attacked by banking groups circulating "untruthful or misleading" information about the accuracy and reliability of its work.

In a filing Friday with the Federal Communications Commission, Weiss Ratings said its bank appraisals can be trusted in part because of its long experience in the field and its freedom from the influence of Wall Street business conflicts that helped fuel the 2008 financial crisis.

"It’s largely thanks to the independence and objectivity of its ratings that Weiss has consistently warned the public of nearly all failures well in advance, while also accurately identifying the truly safe institutions that did not subsequently suffer financial difficulties," Weiss Ratings said in the filing sent Saturday to Broadband Breakfast that has not appeared on the FCC's website.

Weiss Ratings also responded especially to one of its strongest critics – the Bank Policy Institute, a Washington trade associate for big banks like Wells Fargo and Bank of America, that complained that Weiss Ratings had "reliability" issues and an "opaque" methodology.

"It is unfortunate that, in their effort to persuade the FCC to cease using the Weiss Bank Safety Ratings, the BPI and others refer to information and opinion about Weiss that is untruthful or misleading," Weiss Ratings said.

Based in Palm Beach Gardens, Fl., Weiss Ratings has been rating banks for 53 years, according to founder Martin D. Weiss, Ph.D. The firm's competitors include Standard & Poor’s, Moody's, Fitch Group, and other Nationally Recognized Statistical Ratings Organizations.

The FCC is mulling whether to retain Weiss Ratings, which grades banks for safety and soundness on a scale from A plus to F. Broadband Internet Service Providers deploying network infrastructure can see their federal financial support cut off in one program if they are connected to a bank with a subpar rating from Weiss.

Under FCC rules, a broadband ISP receiving funds from the Rural Digital Opportunity Fund must maintain a letter of credit with a bank with at least a B minus rating from Weiss.

In addition to the BPI, state banking associations have called on the FCC to abandon Weiss Ratings because of the upheaval caused after a downgrade to a level below B minus.

The Wisconsin Bankers Association told the FCC that last year Weiss downgraded many "financially sound" state banks, causing broadband ISPs to scramble to find a bank with at least a B minus rating.

"Inexplicably, there are currently 108 out of 179 Wisconsin banks with a Weiss safety rating lower than [B minus].” WBA CEO Rose Oswald Poels told the FCC in May.

Nationally, 1,600 banks from February 2022 and March 2024 lost their B minus Weiss rating, a plunge that convinced the FCC to allow RDOF participants to maintain their letters of credit with downgraded banks, though new letters had to be obtained from banks with a B minus or better rating from Weiss.

Member discussion