Nuclear Power a Distant Solution to Data Center Needs

Experts say nuclear power's potential to meet surging AI data center energy demand remains years away, held back by high costs and lengthy regulatory hurdles.

Broadband Breakfast

WASHINGTON, Feb. 19, 2026 — As artificial intelligence drives explosive growth in data center energy consumption, nuclear power has emerged as a promising solution, experts said Wednesday during a panel discussion hosted by Broadband Breakfast.

The United States leads the world in nuclear generating capacity, but its fleet carries a mean age of roughly 45 years, Frank Wolak, director of the program on Energy and Sustainability Development at Stanford University, noted. Despite limited new construction, operational improvements have driven fleet-wide capacity factors from around 50 percent in the mid-1970s to above 90 percent today, meaning existing plants are generating nearly twice the electricity from the same capacity.

"Nuclear power is the second most important success story in U.S. energy, besides the shale gas revolution," Wolak said, citing declining unplanned reactor shutdowns and a strong safety record as indicators of the fleet's improved reliability.

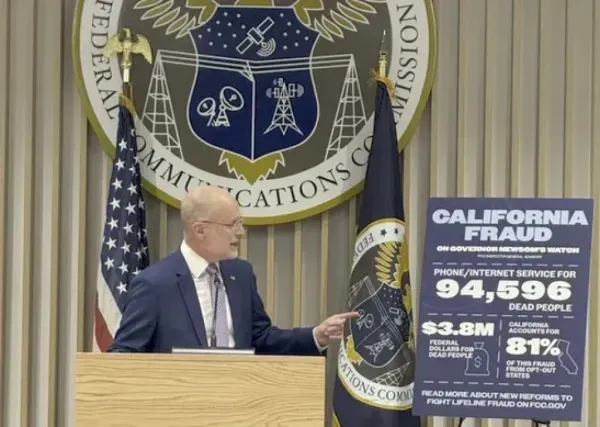

Broadband BreakfastFrank Wolak

Broadband BreakfastFrank Wolak

Rob Gramlich, founder and president of consulting firm Grid Strategies, outlined the central appeal of nuclear for data center operators: Its status as firm, always-on, carbon-free power. Tech hyperscalers such as Google, Amazon Web Services and Microsoft have made high-profile nuclear investments in recent years, including Microsoft's restart of Three Mile Island.

"I've never seen a shift in the general public's view over a generation resource change so fast," Gramlich said, noting that environmental groups once opposed to nuclear are increasingly supportive given climate concerns. "We kind of need it all."

But significant challenges remain. Gramlich said he does not expect meaningful new nuclear capacity to come online before roughly 2033, creating a disconnect with the technology industry's urgent demand for power.

"All the debate within the tech firms and the power sector right now is 'speed to power,'" Gramlich said. "The utility wants to take four years to connect a new data center, and the tech company wants to do it in four days instead of four years."

Small modular reactors, or SMRs, have attracted attention as a potential solution — smaller, factory-built units that could be sited closer to load centers. But Steve Haro, founder and managing partner at consultant Haro Solutions, cautioned that SMRs have not yet been permitted or deployed in a practical commercial scenario in the United States.

"We are far, far away from that reality," Haro said. "I believe we will get there, but the time horizon on that is candidly longer than a five to ten year horizon."

Haro also raised nuclear waste disposal as an underappreciated obstacle. "We still have not dealt with the waste problem from a policy perspective," he said, arguing it compounds cost and timing barriers to new reactor development.

In the near term, panelists agreed natural gas will serve as the primary bridge fuel. Gramlich described gas as "the new source to beat right now," particularly for data centers struggling to connect to the grid. Haro called gas "your primary bridge to nuclear," while acknowledging it remains a finite resource.

The panelists agreed the broader energy mix, including wind, solar, geothermal and demand response, will continue supplying data centers alongside whatever nuclear capacity can be deployed.

"We cannot think that nuclear is going to be the sole savior for data centers," Haro said. "We have to be generation agnostic."

Member discussion