T-Mobile Up 454,000 Fixed Wireless Subs

CEO Mike Sievert said the carrier wasn't interested in a consumer MVNO deal with the cable giants.

Jake Neenan

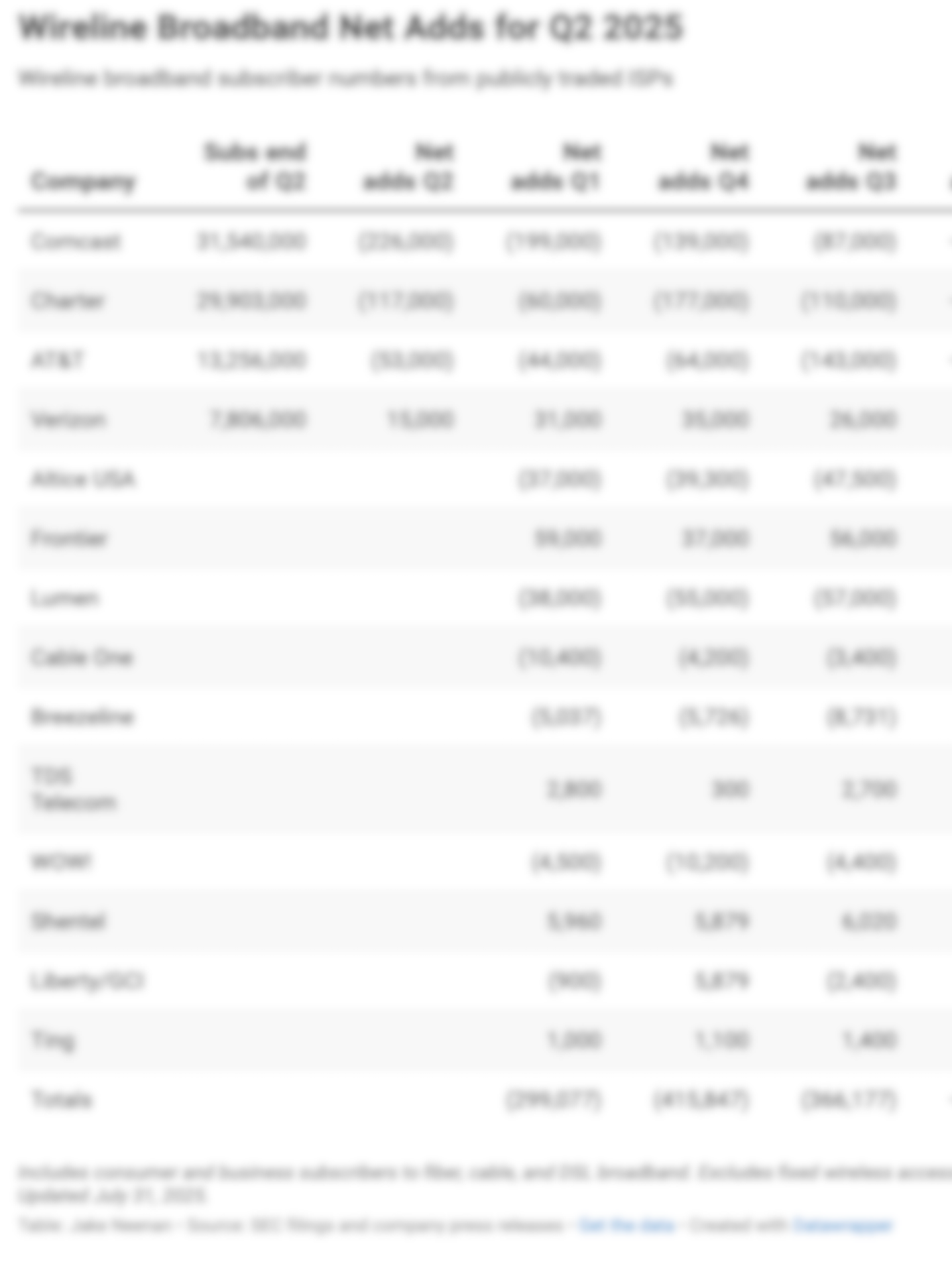

WASHINGTON, July 23, 2025 – T-Mobile added 454,000 fixed wireless broadband customers in the second quarter of 2025, bringing its total to 7.3 million.

Can't see the Earnings Chart? Know you need Breakfast Club? Get access for $590/year.

That brings the three major wireless carriers to 935,000 new fixed wireless customers in the quarter. AT&T reported 203,000 and Verizon saw 278,000 net additions.

Through its joint-venture acquisition of Lumos, which closed in April, the company said it gained 97,000 fiber subscribers. T-Mobile said it was aiming to add more than 100,000 fiber subscribers by the end of the year.

The carrier is ultimately looking to pass 12 million to 15 million locations with fiber, aided by the Lumos and Metronet joint ventures. Executives said the company would provide a more detailed update after the Metronet deal closed, which they said was expected Thursday.

T-Mobile also added 830,000 postpaid phone customers, for a total of 80.3 million.

Cable MVNO

T-Mobile announced Tuesday evening it had struck a mobile virtual network operator deal with cable giants Comcast and Charter, allowing them to provide mobile service to business customers with the carrier’s wireless network.

Enterprise customers above 1,000 lines are excluded from that deal, T-Mobile CEO Mike Sievert said on the call. The deal is designed for cable to offer mobile service to mid-size businesses, where T-Mobile doesn’t compete as heavily.

“We’re way down in very small businesses where we already compete with cable, and we tend to be growing way up in enterprise,” he said. “We don’t have a lot of market share, nor win share, in between.”

Sievert also implied T-Mobile was not interested in competing for Verizon’s existing contract with the cable giants, through which the companies offer mobile service to consumers and very small businesses.

“People are asking us, ‘Does this mean you’re stepping into consumer, or something like that?’ And no, we’re not interested in that,” he said of the deal. “It’s great for what it is, it’ll grow over time, I think it will be really productive. But it’s not the start of something that will open up new segments after that.”

That is likely good news for all three wireless carriers, New Street Research analyst Jonathan Chaplin wrote in an investor note before the call. If Verizon had to compete to keep the MVNO deal, which is an essential source of cash, that would mean better terms for cable, enabling fiercer competition for mobile customers when competition is already intense.

The cable giants have increasingly been competing with the mobile carriers, counting more than 18 million subscribers. Charter and Comcast are leaning on the service to slow down losses through bundled fixed and mobile broadband offers. They have a sprawling wireline footprint to offer those in, with more than 30 million customers each.

Other deals

Executives said the purchase of UScellular’s wireless business will close on Aug. 1.

T-Mobile is acquiring UScellular’s 4.4 million rural customers and about a third of its spectrum. That should give T-Mobile at least 50 percent more capacity in the combined footprint, Sievert said.

Peter Osvaldik, T-Mobile’s CFO, said Grain Management would be paying $2.9 billion for the carrier’s 800 MegaHertz (MHz) licenses, in addition to the investment firm’s 600 MHz holdings and a portion of the proceeds if Grain sells or leases the 800 MHz licenses. The cash terms of the deal hadn’t been disclosed before.

Tax reform

Executives also said they expect a $1.5 billion tax windfall in 2026 as a result of the tax reform Republicans instituted in the recently passed budget bill. The impact this year was expected to be minimal.

Executives said it was too early to say exactly how the extra cash would be used.

Member discussion